The overall crypto market is on the path to full recovery following the most dramatic short-term disruption in network history. Earlier, the on-chain analytics provider Glassnode reported that Bitcoin hash rate v veliki meri okreval despite the FUD(s). Ergo, hinting at a mood-booster for the investors within the crypto space.

Here are some statistics to back it up

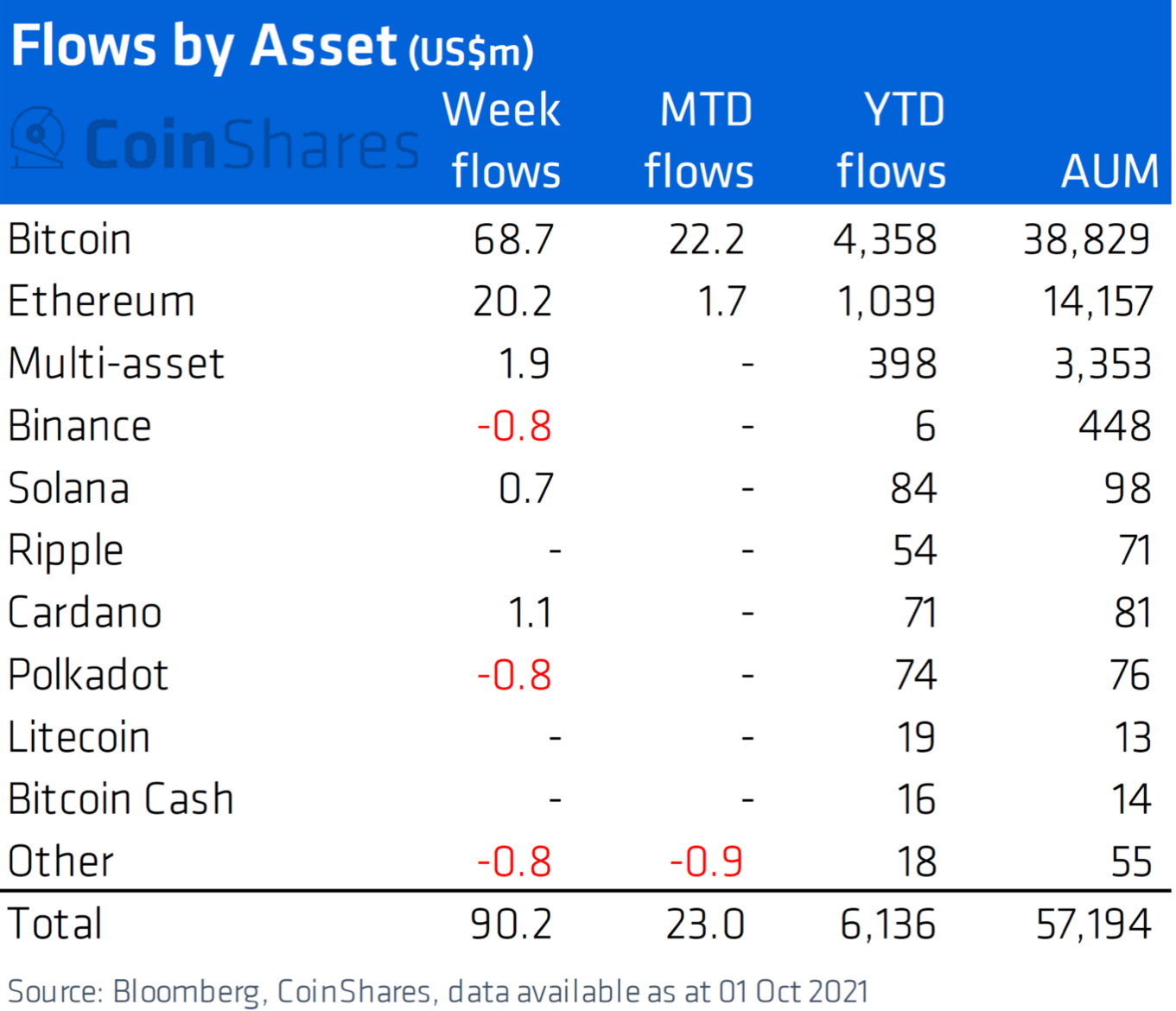

Upravitelj digitalnih sredstev CoinShares objavljeno their weekly “Digital Asset Fund Flows” report. It tracked inflows from institutional investors as capital poured into crypto tokens, especially Bitcoin. The introductory line read as “Growing investor confidence in digital assets with inflows of US$90m.” The graph below highlights the same.

vir: CoinShares

Vpogled

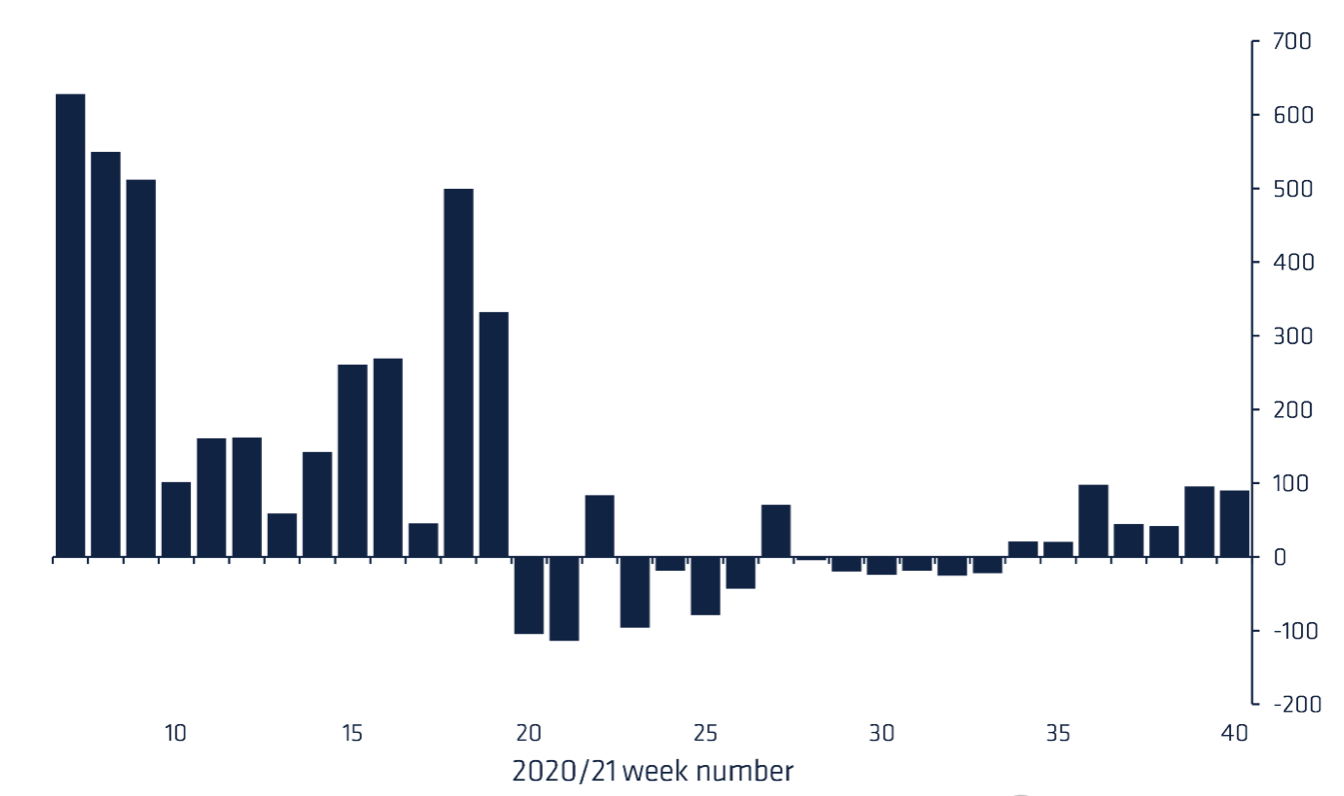

Digital asset investment products saw inflows of US$90m last week, marking the 7th consecutive week of inflows totalling US$411m. Bitcoin in particular enjoyed the sunshine post its damp phase. Here’s the significance. The largest crypto token

“…saw inflows of US$48m last week. Having suffered the longest run of outflows on record, Bitcoin has now seen its 3rd week of inflows totaling US$115m.”

The report highlighted a possible reason as well. “We believe this decisive turnaround in sentiment is due to growing confidence in the asset class amongst investors.” This coupled with a more accommodative statement(s) from the US Securities Exchange Commission and the Federal Reserve certainly aided this surge.

Consider the aforementioned figures, while BTC produced some massive figures, altcoins- in general, had a mixed play. Ethereum, the largest altcoin, despite another week of inflows, lost some market share.

“Ethereum saw another week of inflows totaling US$20m, although it has conceded market share to Bitcoin in recent weeks, having fallen from a peak of 28% to 25%,” the report noted.

Other alt coins such as Polkadot, Tezos and Binance witnessed an outflow totalling US$0.8m each. However, Cardano and Solana painted a slightly different picture. The said tokens saw minor inflows totalling US$1.1m and US$0.7m respectively. Nevertheless, volumes remain low at US$2.4bn last week, compared to US$8.4bn in May 2021.

More on Bitcoin

Of late, CoinShares chief strategy officer Meltem Demirors tudi shared her bullish narrative v intervjuju.

“I think most importantly, honestly, is there’s a lot of cash sitting on the sidelines, and a lot of investors are now seriously contemplating an allocation to Bitcoin in their portfolios.”

In addition to this, the flagship token officially became the best performing asset of 2021- according to the data mentioned below.

Po močni uspešnosti v tretjem četrtletju #Bitcoin is now up +49.1% year-to-date. The best performing asset class of 2021. 👍 pic.twitter.com/BMTAMWhQvB

- Bitcoin (@Bitcoin) Oktober 4, 2021

Kam vlagati?

Naročite se na naše e-novice

- 7

- 9

- dodelitev

- Altcoin

- analitika

- sredstvo

- Sredstva

- BEST

- binance

- Bitcoin

- blockchain

- BTC

- Bikovski

- Kapital

- Cardano

- Denar

- šef

- Kovanci

- CoinShares

- Komisija

- zaupanje

- Posoda

- kripto

- Kripto tržnica

- datum

- digitalni

- Digitalna sredstva

- Motnje

- ethereum

- Izmenjava

- Zvezna

- zvezne rezerve

- polno

- Sklad

- splošno

- stekleno vozlišče

- Pridelovanje

- Hashrate

- Poudarjeno

- zgodovina

- HTTPS

- Institucionalna

- institucionalni vlagatelji

- Intervju

- naložbe

- Investitor

- Vlagatelji

- IT

- vrstica

- Tržna

- mešano

- mreža

- Častnik

- performance

- slika

- polkadot

- Proizvedeno

- Izdelki

- okrevanje

- poročilo

- Run

- Vrednostni papirji

- sentiment

- Delite s prijatelji, znanci, družino in partnerji :-)

- deli

- Solana

- Vesolje

- Statistika

- Strategija

- sonce

- prenapetost

- Tezos

- žeton

- Boni

- us

- teden

- Tedenski

- v

- youtube