Bitcoin cena is making its best attempt yet to climb back above $40,000 since the big crash in May. Thus far, the phrase “sell in May and go away” has worked like a charm, and it could take longer before buying coins back again is a profitable strategy.

That’s because the top cryptocurrency is struggling to hold above the middle-Bollinger Band, and if it can’t hold, it could result in another retest of the bottom of the band. Another retest could finally push the price per " Preberi več

” href=”https://www.newsbtc.com/dictionary/coin/” data-wpel-link=”internal”>coin below support, making a clean sweep before a reversal.

Deja Vu: Zakaj bi bil zgodovinski premik lahko na obzorju

Za vsakogar, ki je bil med kripto trgom v letu 2019, se zdi kot deja vu. Pri vrednosti nad 10,000 USD ni bilo nenavadno, da so trgovci trdili, da je naslednja postaja 100,000 USD ali več. Motili so se in Bitcoin je strmoglavil.

When it did, and sentiment shifted bearish, the cryptocurrency reversed with the third most profitable day on record. Anyone familiar with the October 2019 “Kitajska črpalka” knows that things can turn around fast, even when they seem at their worst.

Sorodno branje | Čas za pozornost: Bitcoin kazalnik vedenje posnema zgodovinski rally

Indicators are primed na enak način and so is sentiment, and the latest rally following a morning star reversal and dragonfly doji serve up plenty of bullish signals.

Zakaj potem pasovi Bollinger opozarjajo na še en potencialni propad - ujemanje kitajske črpalke veliko bolj kot trenutno cenovno dogajanje.

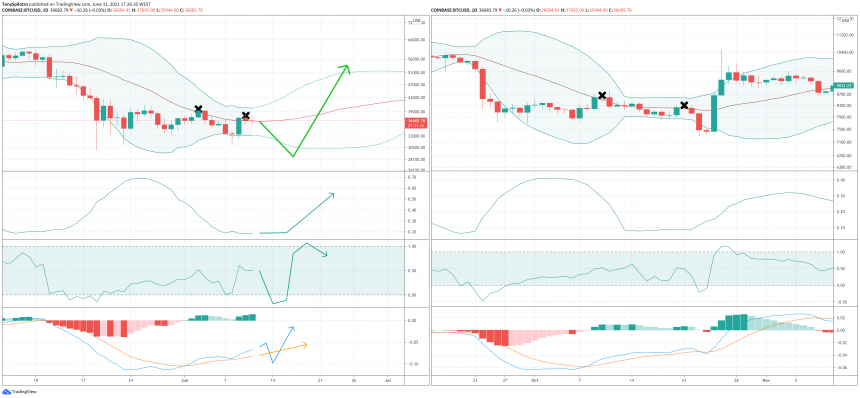

Could Bitcoin sweep lows one more time? | Source: BTCUSD na spletnem mestu TradingView.com

Cena bitcoina bi se lahko prag znižala, preden bi se vrnila na najvišjo raven

The Bollinger Bands created by John Bollinger are a versatile technical analysis tool that measures volatility, highlights support and resistance, and much more. When the bands tighten or squeeze, it is a sign a massive move is coming ahead, and so far the tool is signaling something shocking should soon happen. But when?

Sorodno branje | Bitcoin Daily Dragonfly Doji daje bikom upanje o ostrem preobratu

Še ne, če se srednji Bollingerjev pas - preprosto drseče povprečje - izgubi kot podpora. Med uvodom v zgodovinsko kitajsko črpalko se srednji BB ni izgubil niti enkrat, ampak dvakrat.

Indicators also match the last time Bitcoin got so confusing | Source: BTCUSD na spletnem mestu TradingView.com

Bollinger Band Width is at similar lows, but should hang there a while long. BB% could sweep the current low like it did in 2019 before slingshotting back upward.

Finally, the LMACD is also exhibiting a very similar pattern and if another bearish crossover happens, it could be a massive trap like the last time around. But for now, beware of one more sweep of lows before a reversal.

Prikazana slika iz Depozit fotografije, Grafikoni iz TradingView.com

- 000

- 2019

- Ukrep

- Analiza

- okoli

- Medvjedast

- BEST

- Bitcoin

- Bikovski

- Biki

- Nakup

- Charts

- Kitajska

- Coin

- Kovanci

- prihajajo

- Crash

- kripto

- Kripto tržnica

- cryptocurrencies

- cryptocurrency

- Trenutna

- dan

- DID

- digitalni

- FAST

- končno

- sledi

- držite

- HTTPS

- slika

- IT

- Zadnji

- Long

- Izdelava

- Tržna

- Stave

- Momentum

- premikanje

- Ostalo

- Vzorec

- Plačajte

- Veliko

- Cena

- rally

- reading

- sentiment

- Enostavno

- So

- Software

- Strategija

- podpora

- Sweep

- tehnični

- Tehnična analiza

- Tehnologija

- čas

- Boni

- vrh

- trgovci

- vrednost

- Volatilnost

- WHO