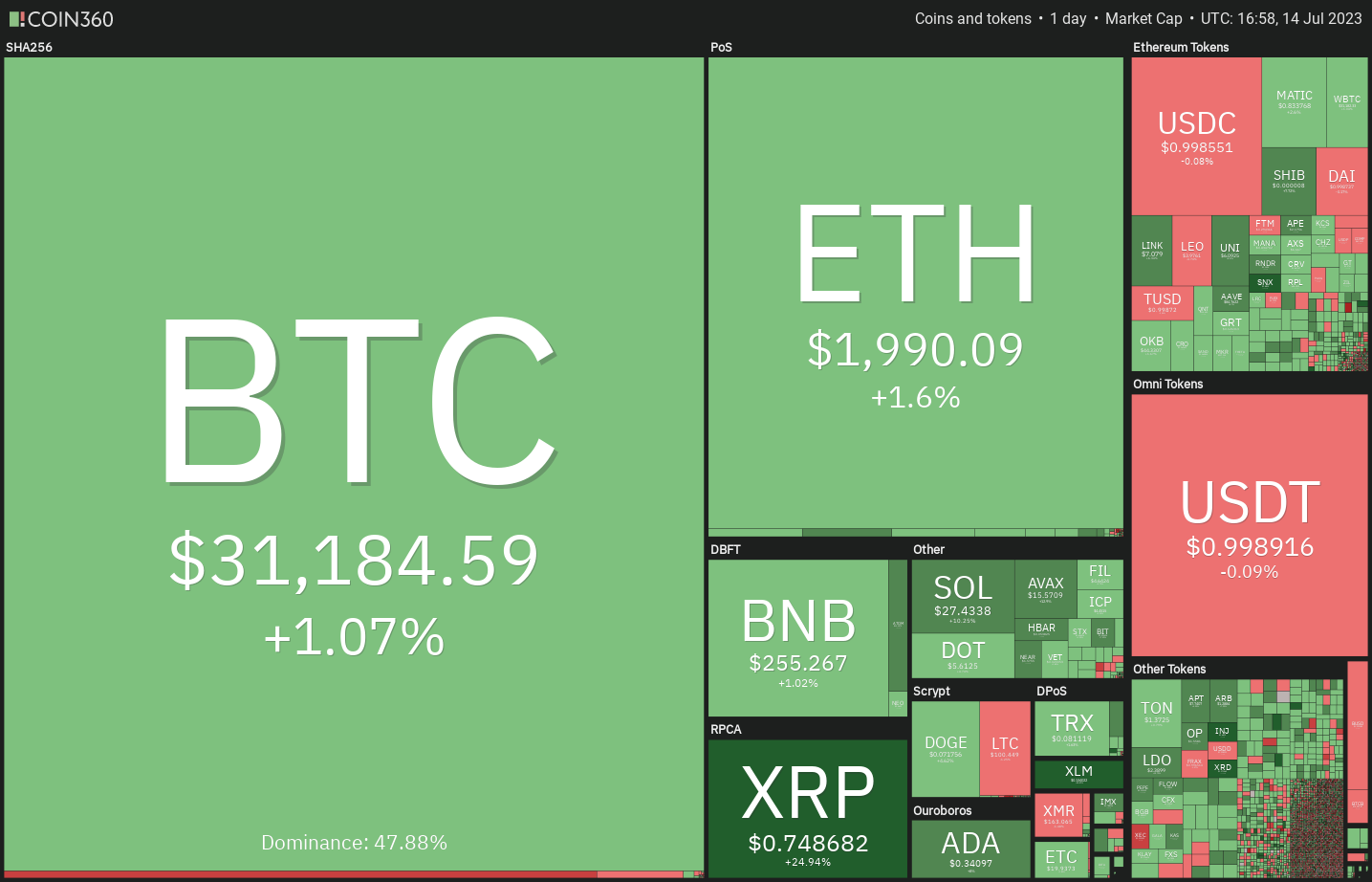

Ripple Labs’ victory in the case against the United States Securities and Exchange Commission gives a significant boost to the crypto industry. In addition to benefitting Ripple and XRP (XRP), analysts believe that the ruling will weaken the regulator’s case against Binance and Coinbase.

In another positive event for the crypto space, the U.S. dollar index (DXY) completed a bearish head and shoulders pattern on July 12 and followed that up with a drop below the psychological level of 100 on July 13. The DXY typically moves in inverse correlation with Bitcoin (BTC), hence its weakness is a positive sign for the crypto bulls.

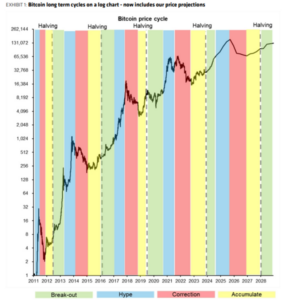

LookIntoBitcoin creator Philip Swift said that increased on-chain spending volume shows that Bitcoin is in the first stage of a bull market.

Ostra rast XRP in več drugih altcoinov po zmagi Rippla je znak, da se kripto biki vračajo.

What are the important resistance levels that need to be crossed for Bitcoin and the altcoins to start the next leg of the up-move? Let’s study the charts of the top-10 cryptocurrencies to find out.

Analiza cen Bitcoinov

Bitcoin broke and closed above the $31,000 resistance on July 13 but the bulls are struggling to build upon this strength. This suggests that the bears have not yet given up and they continue to sell at higher levels.

Although the upsloping moving averages indicate advantage to buyers, the relative strength index (RSI) is forming a bearish divergence, signaling that the bullish momentum may be weakening.

The bears will try to pull the price back below the breakout level of $31,000. If they do that, the BTC/USDT pair could drop to the 20-day exponential moving average ($30,244). This remains the key level to keep an eye on. A bounce off it will suggest that the sentiment remains bullish and traders are buying on dips. A rally above $32,400 could clear the path for a potential rise to $40,000.

Po drugi strani pa bi lahko preboj in zapiranje pod 20-dnevno EMA ceno dvignilo na 29,500 $. Medvedi bodo morali prekiniti to podporo, da bodo v bližnji prihodnosti prevzeli premoč.

Analiza cene etra

The failure of the bears to sink Ether (ETH) below the 50-day SMA in the past few days may have attracted strong buying by the bulls. That pushed the price to the overhead resistance of $2,000 on July 13.

The bulls and the bears may witness a tough battle near $2,000 but the rising 20-day EMA ($1,895) and the RSI in the positive zone indicate that bulls have a slight edge. If buyers clear the hurdle at $2,000, the ETH/USDT pair may retest the overhead resistance zone between $2,142 and $2,200.

Druga možnost je, da se cena obrne navzdol in pade na 20-dnevno EMA. Če se cena odbije od te ravni, bodo biki znova poskušali premagati oviro nad glavo.

Medvedi bodo morali potegniti ceno pod 50-dnevno SMA (1,850 $), da oslabijo bikovski zagon.

Analiza cen BNB

BNB (BNB) turned up from the 20-day EMA ($245) on July 13 and broke above the resistance line of the symmetrical triangle pattern.

The bulls continued the up-move on July 14 and pushed the price above the 50-day SMA ($257) but the bears are posing a formidable challenge near the overhead resistance at $265. If the price turns down and re-enters the triangle, it will suggest that the recent breakout may have been a bull trap. The pair may then plummet to the 20-day EMA.

Nasprotno, če se cena odbije od črte upora, bo to pomenilo, da so biki raven obrnili v podporo. To bo povečalo možnosti dviga nad 265 $. Par lahko nato začne svoj pohod proti severu do 280 $ in kasneje do 300 $.

Analiza cen XRP

XRP (XRP) skyrocketed above the overhead resistance of $0.56 on July 13. This meant the $0.30 to $0.56 range resolved in favor of the bulls. The pattern target of this breakout is $0.82 but the price overshot this level.

Par XRP/USDT se sooča z knjiženjem dobička blizu 0.94 USD. Na splošno močnemu dvigu sledi silovita korekcija in nekajdnevna konsolidacija. Biki bodo poskušali zaustaviti kakršen koli umik v območju med 38.2-odstotno ravnjo Fibonaccijevega odmika 0.75 $ in 50-odstotno ravnjo odmika 0.70 $.

Če cena ostane nad to ravnjo, lahko par ponovno preizkusi upor nad glavo pri 0.94 $. Nasprotno pa bi lahko preboj pod 0.70 USD potopil par na 61.8-odstotno raven povratka 0.64 USD. Tako globok padec lahko odloži začetek naslednjega koraka naraščajočega trenda.

Cardano analiza cen

kardan (ADA) witnessed aggressive buying by the bulls on July 13, which drove the price above the immediate resistance of $0.30 and the 50-day SMA ($0.31).

That may have hit the stops on several bearish trades, triggering short covering. The price soared toward the target objective of $0.38 on July 14 but the long wick on the candlestick shows profit-booking by the bulls. The first support on the downside is at the 50% Fibonacci retracement level of $0.33.

If the price rebounds off this level, the bulls will once again try to overcome the hurdle at $0.38. If they succeed, the ADA/USDT pair may rally to $0.42. Contrarily, a break below the 61.8% retracement level of $0.32 could indicate a weakening momentum.

Analiza cen Solane

After trading near the $22.30 resistance for a few days, Solana (SOL) made a solid move on July 13. That pushed the price to the strong overhead resistance at $27.12.

Biki so z nakupom nadaljevali 14. julija in dvignili ceno nad 27.12 USD. To je RSI potisnilo v močno prekupljeno območje, kar nakazuje, da se bo dvig lahko v kratkem podaljšal. To lahko povzroči kratkoročni popravek ali konsolidacijo.

Pomembna raven, ki jo je treba opazovati na spodnji strani, je raven preboja 27.12 $. Če biki to raven obrnejo v podporo, bi lahko par SOL/USDT začel močno naraščati na 39 $. Druga možnost je, da če se medvedi potopijo in ohranijo ceno pod 27.12 $, bi lahko par padel na 22.30 $.

Analiza cen dogecoinov

Dogecoins (DOGE) staged a strong turnaround on July 13 and surged above the moving averages. This shows that the bulls are attempting a comeback.

The bulls are trying to sustain the price above the overhead resistance of $0.07. If they manage to do that, the DOGE/USDT pair could start a new up-move. The pair may then rise to $0.08 where the bears will again try to stall the rally.

V nasprotju s to predpostavko bi lahko, če se cena obrne navzdol in pade pod 0.07 USD, ujela več agresivnih bikov. Par lahko nato strmoglavi do drsečih povprečij. Takšna poteza bo nakazovala, da bo par morda ostal vezan na razpon še nekaj dni.

Povezano: Zakaj se cena Cardana danes dvigne?

Analiza cen Litecoin

The bulls successfully held the 20-day EMA ($96) on July 12, indicating that the sentiment has turned positive in Litecoin (LTC) and traders are buying on dips.

The rally has reached near $106 where the bulls are likely to face a solid resistance. If buyers do not give up much ground from the current levels, it will increase the likelihood of a break above $106. The LTC/USDT pair could then retest the important resistance of $115. If this level is scaled, the pair may rally to $134.

Ta pozitiven pogled bo v bližnji prihodnosti neveljaven, če se cena obrne navzdol in zapre pod 20-dnevno EMA. Par lahko nato pade na 50-dnevni SMA (90 USD).

Analiza poligonskih cen

The bears tried to pull Polygon (MATIC) back below the breakout level of $0.72 on July 12 but the bulls held their ground.

That attracted huge buying on July 13, which propelled the price to $0.89, just shy of the pattern target of $0.94. The moving averages are on the verge of a bullish crossover and the RSI is near the overbought zone, indicating that bulls are in control. The up-move could reach the psychological level of $1 where the bears are expected to mount a stiff resistance.

Pomembna podpora, ki jo je treba opazovati na spodnji strani, je 20-dnevna EMA (0.72 USD). Preboj in zapiranje pod njim bosta nakazovala, da bikovski zagon slabi.

Analiza cene Polkadot

polkadot (DOT) rebounded off the moving averages on July 13 and reached the overhead resistance at $5.64 on July 14.

The 20-day EMA ($5.20) has turned up slightly and the RSI has jumped into positive territory, indicating that bulls have the upper hand. The DOT/USDT pair will complete a bullish inverse H&S pattern on a break and close above $5.64. That could start a new up-move, which has a pattern target of $7.06.

Če želijo medvedi preprečiti dvig, bodo morali ceno povleči in vzdrževati nazaj pod 5.64 $. To lahko nekaj časa ohrani razpon para med 50-dnevnim SMA (5.05 USD) in 5.64 USD.

Ta članek ne vsebuje investicijskih nasvetov ali priporočil. Vsaka investicijska in trgovinska poteza vključuje tveganje, bralci pa bi morali pri odločanju opraviti lastne raziskave.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://cointelegraph.com/news/price-analysis-7-14-btc-eth-bnb-xrp-ada-sol-doge-ltc-matic-dot

- :ima

- : je

- :ne

- :kje

- $GOR

- 000

- 12

- 13

- 14

- 2%

- 20

- 200

- 30

- 31

- 32

- 33

- 500

- 70

- 72

- 75

- a

- nad

- ADA

- Poleg tega

- Prednost

- nasveti

- spet

- proti

- agresivni

- Altcoins

- an

- Analiza

- Analitiki

- in

- Še ena

- kaj

- SE

- aretirati

- članek

- predpostavka

- At

- poskus

- privlači

- povprečno

- nazaj

- Bitka

- BE

- Medvjedast

- razhajanje medvedov

- Medvedi

- bilo

- Verjemite

- spodaj

- koristi

- med

- binance

- Bitcoin

- bnb

- Rezervacija

- povečanje

- Bounce

- Break

- zlom

- odmori

- broke

- BTC

- izgradnjo

- bull

- past za bike

- Bikovski

- Biki

- vendar

- kupci

- Nakup

- by

- Cardano

- cena kartice

- primeru

- izziv

- Graf

- Charts

- jasno

- Zapri

- zaprto

- Zapre se

- coinbase

- Cointelegraph

- povratek

- Komisija

- dokončanje

- Končana

- Ravnanje

- konsolidacijo

- vsebujejo

- naprej

- naprej

- nasprotno

- nadzor

- Korelacija

- bi

- kritje

- kreator

- Crossed

- kripto

- kripto prostor

- cryptocurrencies

- cryptocurrency

- trg kripto valute

- Trenutna

- vsak dan

- Dnevi

- Odločitev

- globoko

- zamuda

- navzdol

- Razhajanja

- do

- ne

- Doge

- Dollar

- indeks dolar

- DOT

- navzdol

- slaba stran

- Drop

- Kapljice

- Dxy

- Edge

- EMA

- okrepi

- ETH

- Eter

- Event

- Tudi vsak

- Izmenjava

- Pričakuje

- eksponentna

- eksponentno drseče povprečje

- oči

- Obraz

- s katerimi se sooča

- Napaka

- Padec

- prednost

- Nekaj

- Fibonaccijevo

- Najdi

- prva

- Flip

- sledili

- po

- za

- čudovito

- iz

- Gain

- splošno

- Daj

- dana

- daje

- Igrišče

- strani

- Imajo

- Glava

- Hero

- zato

- več

- hit

- HTTPS

- velika

- if

- Takojšen

- Pomembno

- in

- Povečajte

- povečal

- Indeks

- Navedite

- v

- naložbe

- IT

- ITS

- julij

- Skočil

- samo

- Imejte

- Ključne

- pozneje

- Stopnja

- ravni

- verjetnost

- Verjeten

- vrstica

- Litecoin

- Long

- LTC

- je

- Izdelava

- upravljanje

- marec

- Tržna

- tržne uspešnosti

- Matic

- Maj ..

- pomenilo

- Momentum

- več

- Gora

- premikanje

- premika

- premikanje

- drseče povprečje

- drseče povprečje

- veliko

- Blizu

- Nimate

- Novo

- Naslednja

- Cilj

- ovira

- of

- off

- on

- Na verigi

- enkrat

- or

- Ostalo

- ven

- Premagajte

- lastne

- par

- preteklosti

- pot

- Vzorec

- performance

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Plummet

- poligon

- pozitiven

- možnost

- potencial

- preprečiti

- Cena

- Analiza cen

- cena gor

- Dobiček

- poganja

- možnosti

- pullback

- nakup

- potisnilo

- rally

- območje

- dosežejo

- dosegel

- bralci

- nedavno

- Priporočila

- relativna

- indeks relativne trdnosti

- ostajajo

- ostanki

- Raziskave

- Odpornost

- rešiti

- povzroči

- . \ t

- Ripple

- Ripple in XRP

- Rise

- narašča

- Tveganje

- RSI

- Odločitev

- s

- Je dejal

- Vrednostni papirji

- Securities and Exchange Commission

- prodaja

- sentiment

- več

- oster

- Kratke Hlače

- kratkoročno

- shouldnt

- Razstave

- sramežljiva

- podpisati

- Padec

- GURS

- zvišali

- SOL

- Solana

- trdna

- nekaj

- vir

- Vesolje

- Poraba

- Stage

- Začetek

- Države

- Postanki

- moč

- močna

- Boriti se

- študija

- uspeh

- Uspešno

- taka

- predlagajte

- Predlaga

- podpora

- povečal

- SWIFT

- Simetrični trikotnik

- ciljna

- Izraz

- Ozemlje

- da

- O

- njihove

- POTEM

- jih

- ta

- potisk

- čas

- do

- danes

- težko

- proti

- trgovci

- Trgovanja z dobičkom

- Trgovanje

- Poskušal

- sproži

- poskusite

- Obrnjen

- zavoji

- tipično

- nas

- ameriški dolar

- Indeks ameriških dolarjev (DXY)

- Velika

- Združene države Amerike

- Komisija za vrednostne papirje in borze ZDA

- naprej

- navzgor

- bankinah

- zmaga

- Poglej

- Obseg

- želeli

- Watch

- šibkost

- kdaj

- ki

- bo

- z

- priča

- priča

- xrp

- še

- zefirnet