Over the past couple of years, institutional involvement with major assets such as Bitcoin, Ethereum has been a common affair. However, it has been a difficult task to identify all sources of investments. In late 2020, Grayscale’s Bitcoin accumulation was considered the most influential institutional interest. However, it slowed down in 2021.

Kljub temu je kapital še naprej pritekal od pooblaščenih trgovcev.

V tem članku bomo izpostavili vsak sklad, ki hrani Bitcoin in Ethereum, in kako je njihova dejavnost ustvarila vpliv v daljšem časovnem obdobju.

Dolg seznam občudovalcev Bitcoina in Ethereuma

As previously mentioned, the difficulty of identifying every fund involved with BTC, ETH has been a major dilemma. Hence, we will be seznam out every trust currently invested in both digital assets at the end of this article.

Zdaj se je po podatkih podjetja Bytetree količina bitcoinov, ki jih imajo skladi od začetka leta 2020, skoraj potrojila do danes. Dejansko se je BTC v 316,615-dnevnem obdobju povečal s 834,156 na 670.

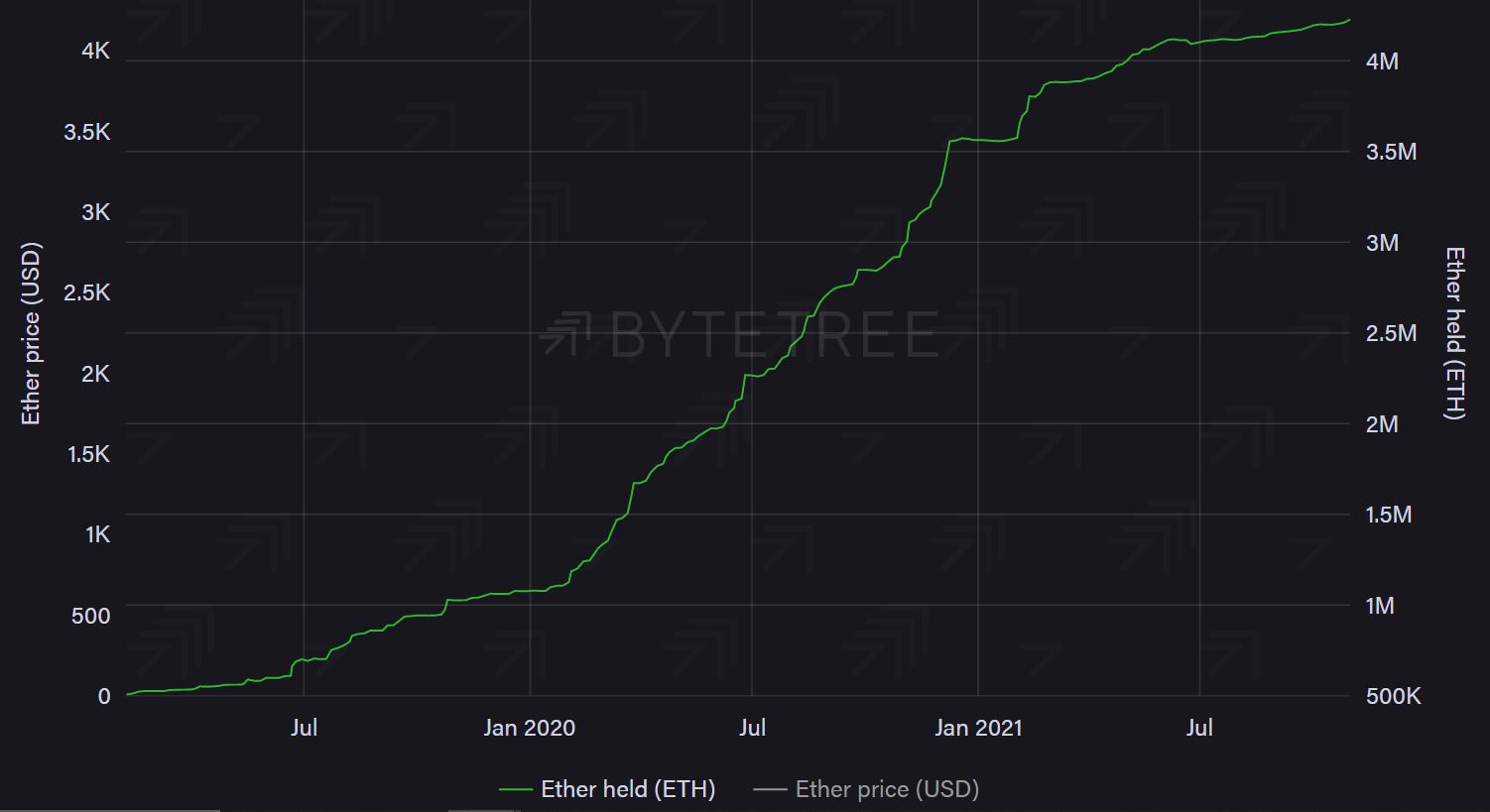

Podobno se je kapital, ki ga hranijo skladi za Ethereum, štirikrat povečal in narasel na 4,232,327 ETH z začetne akumulacije 1,080,705 ETH 1. januarja 2020.

Another interesting observation that can be made for both Bitcoin, Ethereum funds is that a majority of the investments were made during the calendar year of 2020. And, in 2021, the same slowed down significantly.

Ali lahko ustvari bikovsko razhajanje?

Medtem ko sta se Bitcoin in Ethereum konsolidirala nad 60 $ oziroma 4 $, je ocenjeno razmerje finančnega vzvoda na obeh borzah sredstev doseglo letni razpon. Čeprav ta dejavnik nakazuje, da so vlagatelji prepričani v svoja stališča in verjamejo v bikovska čustva, so bili v zadnjem letu ugotovljeni preobrati okoli tega razpona.

Vendar pa lahko tukaj prilivi sredstev omogočijo jasnejšo sliko.

Kot je razvidno iz priloženega grafikona, so prilivi BTC v in iz teh skladov v preteklem letu v veliki meri kazali na najnižje in najvišje cene. Julij 2021 je zaznamoval dno v smislu odlivov in od takrat je opazen nagib, ki sklepa na bikovsko naravo.

Podobno strukturo smo opazili tudi pri Ethereumu in lahko sklepamo, da institucije kljub pomislekom glede trga terminskih pogodb ostajajo pozitivne.

Za Bitcoin: Valkyrie Bitcoin Strategy (BTF), ProShares Bitcoin Strategy ETF (BITO), Osprey (OBTC), Grayscale Bitcoin (GBTC), Bitcoin Tracker Euro (XBTE), Bitcoin Tracker One (XBT), Coinshares Physical Bitcoin (BITC SW) , WisdomTree Bitcoin ETP (BTCW SW), Iconic Funds Physical Bitcoin ETP (XBTI), VanEck Vectors Bitcoin ETN (VBTC), BTCetc Bitcoin Exchange Traded Crypto (BTCE), 21Shares (ABTC), 3iQ CoinShares Bitcoin ETF (BTCQ.U), Namenski Bitcoin ETF – USD (BTCC.U), Namenski Bitcoin ETF – varovan v USD (BTCC.B), Namenski Bitcoin ETF – CAD (BTCC), devet-točkovni (BITC), Galaxy Bitcoin ETF (BTCX.B), Galaxy Bitcoin ETF (BTCX.U), 3iQ (QBTC)

Za Ethereum: Grayscale Ethereum Trust (ETHE), Ether Tracker Euro (COINETHE SS), Ether Tracker One / XBT PROVIDER ETHEREUM (COINETH SS), CoinShares Physical Ethereum (ETHE SW), WisdomTree Ethereum (ETHW SW), VanEck Vectors Ethereum ETN (COINETH SS), ETC Group Physical Ethereum (ZETH), SA1 Ethereum ETP (SETH SW), 21Shares Ethereum ETP (AETH), CI Galaxy Ethereum ETF (Serija USD) (ETHX/U), CI Galaxy Ethereum ETF (C$ Unhedged Series) (ETHX /B)

Kam vlagati?

Naročite se na naše e-novice

Vir: https://ambcrypto.com/tracking-the-movement-of-bitcoin-ethereum-fund-flows-from-2020/