Aşağıda, Bitcoin Magazine Pro'nun yakın tarihli bir sayısından bir alıntı yer almaktadır, Bitcoin Dergisi'nin premium piyasalar bülteni. Bu içgörüleri ve diğer zincir üstü bitcoin pazar analizlerini doğrudan gelen kutunuza alan ilk kişilerden biri olmak için, şimdi abone ol.

This article covers some of the recent action in the bitcoin derivatives market, as well as touches on the evolving relationship between bitcoin and the legacy financial system.

The action in global capital markets has been intense, with massive volatility across currencies, more selling in bonds and a brief bullish deviation for bitcoin, which excited the bulls.

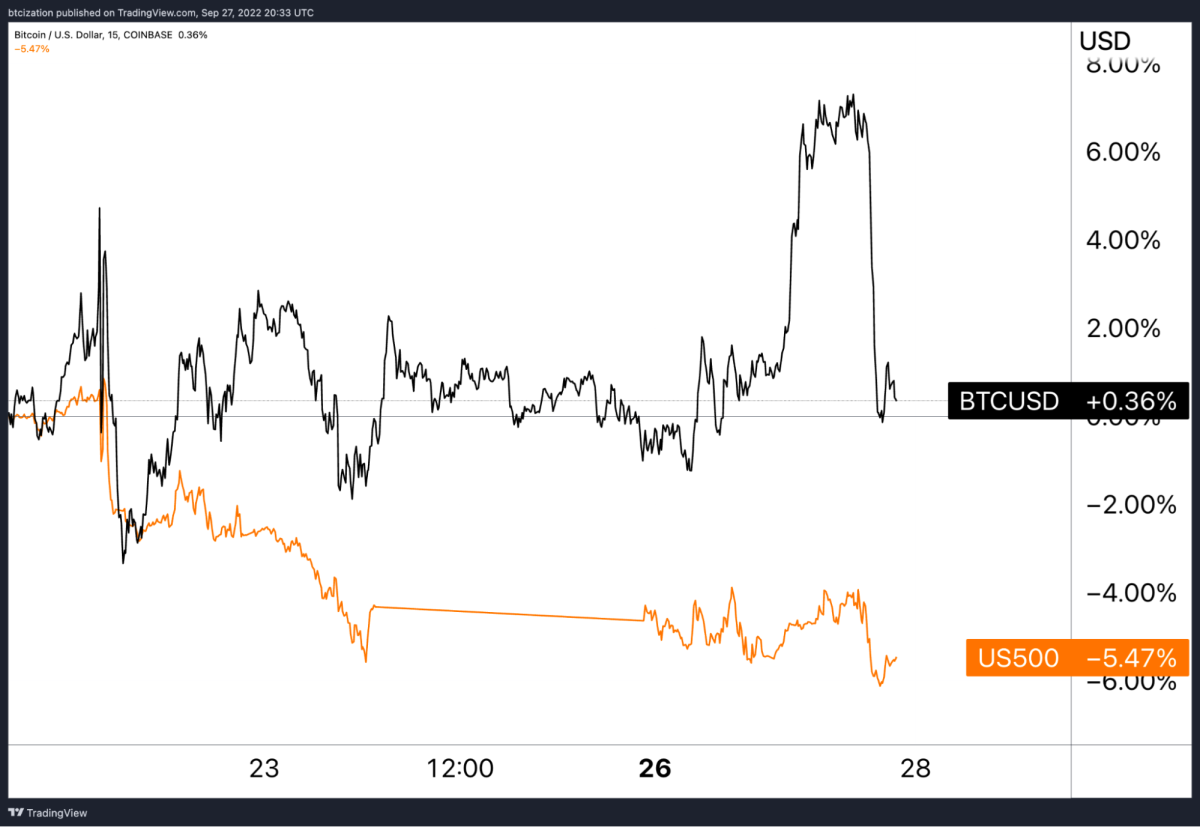

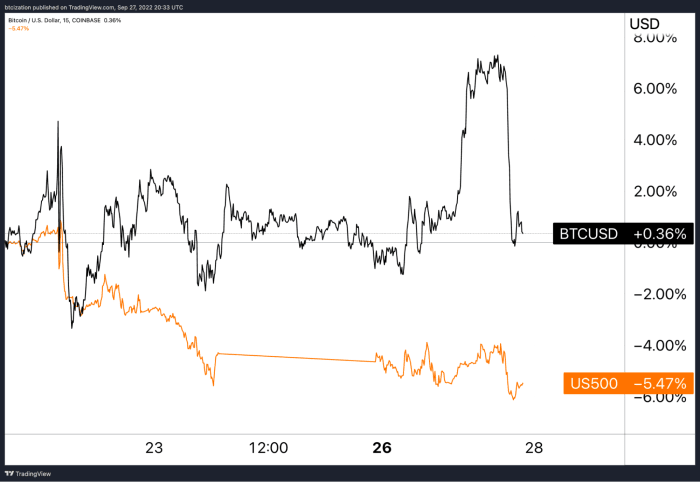

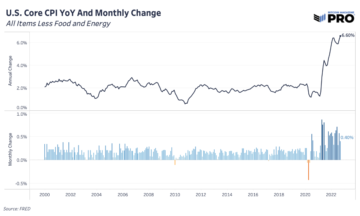

As bitcoin pushed back above $20,000, there was some chatter of a potential decoupling, as bitcoin was up over 7% while U.S. equity markets were down approximately 4% over the last week. While we would certainly love to see a moment where bitcoin finds relief during an increasingly tumultuous environment in the legacy financial system, we remain skeptical on this outcome over the near future, as the data just doesn’t support it.

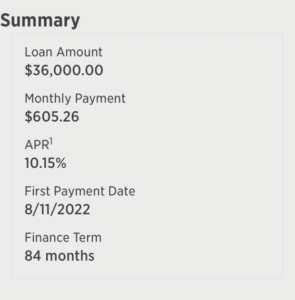

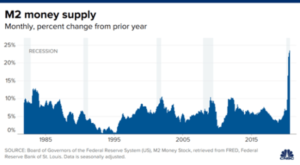

We cannot emphasize enough that the current trading environment for bitcoin is less about bitcoin itself and more about the dollar. As yields across maturities and currencies are soaring higher, the value of global assets is collapsing in tandem, which will subsequently lead to a day of reckoning where everything sells in tandem.

Söylemeyi sevdiğimiz gibi, her şeyin temelindeki varlık olan ABD Hazine tahvili kanamaya devam ederken, her şey balonu çözülüyor.

Let’s return back to bitcoin for a moment. What was the period of outperformance from, and can we expect more of it soon?

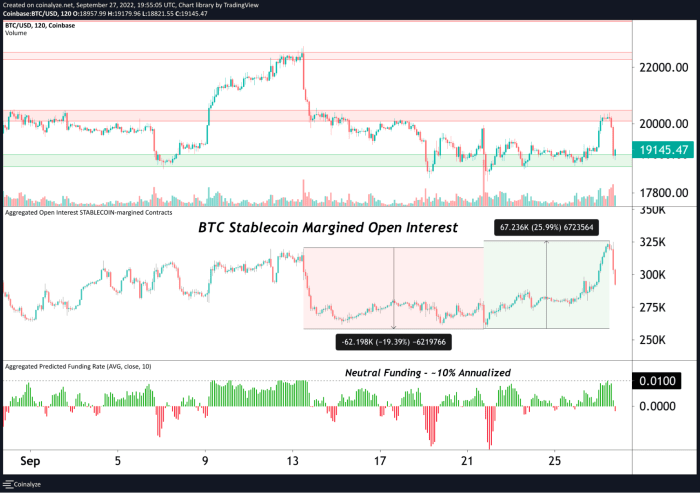

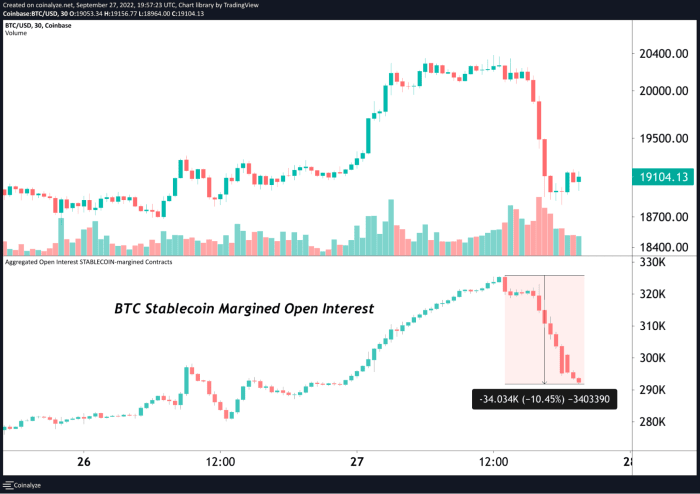

The simple answer is that the type of buying that was occurring — long positions in the bitcoin futures market — is never one of sustainable nature.

Tens of thousands of bitcoin worth of net buying became net sellers in hours, as the surge in open interest that led to the increase in market price quickly fell underwater.

Our belief in regards to the bitcoin derivatives market and its insight into the state of the market cycle is the following:

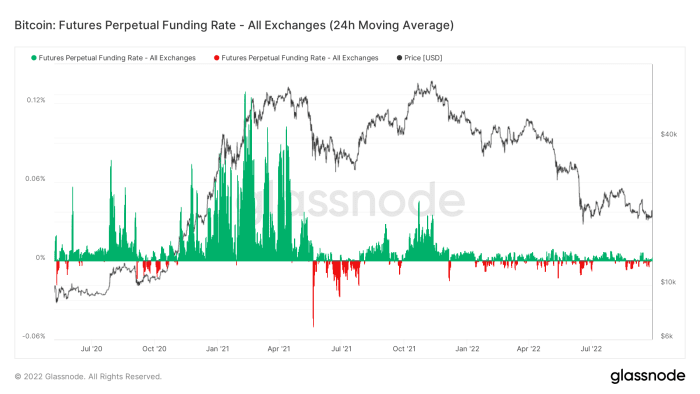

Değişken faiz oranı önemli ölçüde negatif olduğunda, spot satış ve kaldıraç gevşemesinin ağırlığı ortaya çıktı. Sürekli vadeli işlem kompleksindeki değişken faiz oranı, boğaların mı yoksa ayıların mı aşırı agresif olduğu konusunda bize fikir verebilir.

When the funding rate is significantly negative, it can be because of both closing long positions driving the price below the spot market or due to aggressive short positions pushing the price lower. The funding rates in today’s market environment are much more muted than the craziness seen in 2021.

Our expectation is that a volatility in legacy markets would lead to a large liquidation in bitcoin derivatives, driving the price below spot markets, while short traders piled on. This would be seen by a drastically negative perpetual futures funding rate (variable interest rate that incentivizes traders to settle prices close to the spot market rate).

2020 ve 2021 piyasalarının dip yaptığı seviye açısından bunu görmedik.

Tahminimize göre piyasa bugün orada değil.

İlgili konular:

- Pazar Bear

- Bitcoin

- bitcoin türevleri

- Bitcoin Dergisi

- Bitcoin Dergisi Profesyonel

- blockchain

- blockchain uyumluluğu

- blockchain konferansı

- coinbase

- zeka

- Fikir birliği

- kripto konferansı

- kripto madenciliği

- cryptocurrency

- Merkezi olmayan

- Defi

- Dijital Varlıklar

- Ethereum

- makine öğrenme

- Piyasalar

- değiştirilemez jeton

- Platon

- plato yapay zekası

- Plato Veri Zekası

- PlatoVeri

- plato oyunu

- Çokgen

- hissesini kanıtı

- Trading

- W3

- zefirnet