On-chain information reveals the Bitcoin funding charge remains to be at a comparatively excessive optimistic worth, suggesting that the crypto would possibly see extra decline within the close to time period.

Протягом останніх кількох днів швидкість фінансування біткойнів була позитивною

Як виявив аналітик CryptoQuant після, the present funding charge means that the value is in a brand new decline proper now.

"норма фінансування” is an indicator that measures the periodic price that merchants within the Bitcoin futures market should pay one another.

When the worth of this metric is above zero, it means lengthy merchants are presently paying a premium to the brief merchants to maintain their positions. Such values point out {that a} bullish sentiment is extra dominant available in the market in the meanwhile.

Пов'язане читання | Дані в ланцюжку: біткойн-кити з понад 10 тисячами BTC зростають

On the opposite hand, detrimental values of the indicator indicate the bulk sentiment is bearish proper now as shorts are paying longs presently.

Now, here’s a chart that reveals the pattern within the Bitcoin funding charges during the last six months:

The worth of the metric appears to have been optimistic up to now week | Source: CryptoQuant

As you’ll be able to see within the above graph, each time the Bitcoin funding charge has reached a comparatively excessive optimistic worth throughout the previous couple of months, the value of the crypto has usually noticed a decline not too lengthy after. Similarly, detrimental spikes have resulted within the worth of BTC seeing some uptrend.

Here’s what’s happening right here: excessive optimistic values imply longs are piling up available in the market. So, a major sufficient sudden decline can liquidate quite a lot of these, which might find yourself driving the value additional down, and thus liquidating much more lengthy positions. Such an occasion the place liquidations cascade collectively is named a “вичавлювати” (or on this case, an extended squeeze).

Пов'язане читання | Bitcoin NUPL показує, що середній власник повернувся до прибутку, але як довго?

A number of days again, when the value of the crypto was above $23k, the funding charge once more made a optimistic peak and the value subsequently went down. However, the present worth of the indicator nonetheless appears to be like to be fairly optimistic, which can imply the decline remains to be ongoing.

Ціна BTC

На момент написання, Ціна Bitcoin коливається приблизно на 22.7 тис. дол. США, збільшившись на 6% за останні сім днів. За попередній місяць криптовалюта зросла на 8%.

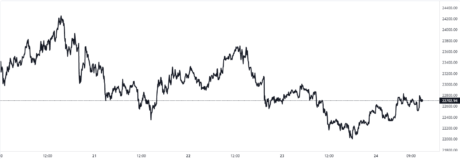

The under chart reveals the pattern within the worth of the coin during the last 5 days.

Looks like the worth of the crypto has been sliding down over the previous couple of days | Source: BTCUSD на TradingView

Featured picture from Brent Jones on Unsplash.com, charts from TradingView.com, CryptoQuant.com

- Біткойн

- Завантаження біткойнів

- blockchain

- відповідність блокчейну

- блокчейн-конференція

- coinbase

- coingenius

- Консенсус

- криптоконференція

- криптографічне видобування

- криптовалюта

- Децентралізований

- Defi

- Цифрові активи

- Ефіріума

- Останні новини про криптовалюту

- навчання за допомогою машини

- не замінний маркер

- plato

- платон ai

- Інформація про дані Платона

- PlatoData

- platogaming

- Багатокутник

- доказ ставки

- W3

- зефірнет