ریلی - House flipping is still happening in the Triangle and across the state even though mortgage rates have doubled from earlier in the year.

Nearly 4,500 North Carolina homes were flipped — or resold within 12 months of purchase — in the third quarter of 2022, a new analysis of real estate data by ATTOM found.

That’s down from about 6,000 home flips during the first quarter of 2022, the highest number on record in North Carolina for homes flipped, according to the methodology in the report.

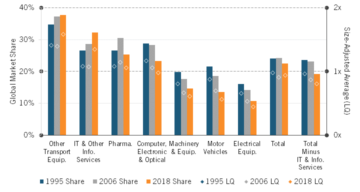

And while home flips still accounted for 9.2% of all real estate sales transactions in North Carolina during the third quarter of 2022, gross profits fell as margins grew slimmer across the state, the analysis concluded.

The new data doesn’t deter Alyssa Upchurch and her husband, who are known as The Cash Offer Couple.

“We’ve been in it awhile. We knew the market shift was coming,” she said. “What used to be say $80,000 profit, $40,000 profit is now $20,000 or $40,000 profit.”

گرم رہائش: سرمایہ کار اور 'فلپر' ریکارڈ تعداد میں مثلث مکانات خرید رہے ہیں۔

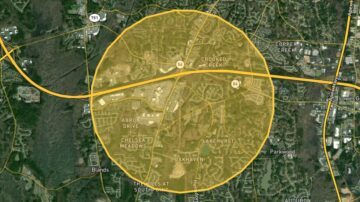

مثلث میں کیا ہو رہا ہے۔

That data includes both the Raleigh and Durham metropolitan statistical areas.

In the Raleigh MSA, there were 557 flip transactions, an increase of 2.4% compared to the third quarter of 2021, but a drop of 7.9% from the prior quarter and almost half as many as the 941 flip transactions that occurred in the پہلی سہ ماہی 2022 کی.

And those Raleigh area transactions delivered investors a median gross margin of 13%, a drop from the 17.5% gross return investors enjoyed in the third quarter of 2021.

But, flipping remained profitable for many investors in the Raleigh region, with a gross profit of $43,000 at the median, according to the data set.

“This is a classic good news/bad news report for fix-and-flip investors,” said Rick Sharga, executive vice president of market intelligence at ATTOM, in a statement. “While flipping activity in the third quarter was among the highest on record, gross profits and profit margins declined significantly, reflecting the overall pricing weakness in today’s housing market.”

Cary-based Realtor Maya Galleta says fewer flippers gives buyers a boost.

“If you think about it, now they’re not only not competing with the general buyer population but not competing with all those investors too,” he said.

رپورٹ میں کہا گیا ہے کہ ریلے میں کرائے سب سے تیز رفتاری سے 50 امریکی شہروں میں بڑھ رہے ہیں۔

Think like an investor

Still, just because profit margins are decreasing doesn’t mean that investor buying activity will plummet to zero. That’s especially true in the Triangle, and in the wider share of the residential investor sector, as کرایہ پوچھنا in the region continue to rise faster than the inflation rate.

“We have seen investors pull back alongside the rest of the market this year,” said Taylor Marr, deputy chief economist at Redfin, in an interview with WRAL TechWire. “The whole market has been impacted by rates.”

Whereas the Triangle saw investors buying roughly one in every four homes, since then, they’ve pulled back, said Marr.

“Investors pulled back earlier, and faster, than other buyers,” he noted. “Their share of the overall market has also slowed.”

Now, according to the most recent data tracked by Redfin, Marr said that investors are still “buying about 1 in 5 homes in Raleigh and 1 in 6 homes in Durham.”

Profit margins for home flips on properties in the Durham-Chapel Hill metropolitan statistical area are down, too. In fact, they’re down three times as much as profit margins in the Raleigh region, according to the data set.

While a year ago, gross return on investment for flipped properties in the Durham-Chapel Hill MSA was 28.4%, in the third quarter of 2022, that had fallen to 12.5%.

The profit on the median flipped home in the region was found to be $38,250. A year ago, that was $69,000.

Flip or flop? For real estate investors in NC, location matters

First out, first back in

But housing markets could adjust fast, and investors who left the market before primary residence homebuyers may also return to the market faster than primary homebuyers, said Marr.

“Overall, investors are expected to pull back as risk persists,” said Marr, adding that once that moderates, investors may rebound quicker than other buyers. One factor could be a decrease in the availability and cost of borrowing funds to acquire and/or renovate properties, and the تازہ ترین ڈیٹا from Freddie Mac shows yet another modest decline in typical mortgage interest rates in the last week.

And, now, there’s much more housing market data available to analyze, and there are some investors who pulled back earlier this year who may still have cash to deploy once the data suggests that there’s opportunity for housing markets to rebound, said Marr.

The Cash Offer Couple are still in business, even if fairytale profits are a thing of the past.

“I don’t feel like anything you can buy in the Raleigh area is a bad buy if you can get a good deal on it,” Upchurch said.

She and her husband are holding on to some of the homes they bought and renting them out instead.

سرمایہ کار Raleigh میں 1 میں سے 4 گھر، Durham میں 1 میں سے 5 گھر خرید رہے ہیں۔

+ + +

WRAL TechWire رپورٹر جیسن پارکر۔, who is also a licensed North Carolina real estate agent, works with journalists from WRAL.com to track and present market data and report on how people are experiencing the region’s changing real estate markets. These special reports will use the category tag “مثلث رئیل اسٹیٹ"یا"مثلث ریئل اسٹیٹ مارکیٹ.

+ + +

WRAL reporter Matt Talhelm contributed to this report.