Let’s finish the 4th chapter once and for all, book lovers. As promised, we’re going to take government money to court and analyze its track record. How do you think it did? We’ll also analyze the hyperinflation phenomenon, which as it turns out, “is a form of economic disaster unique to government money.” How does it work? You’ll know by the end of this article.

Last but not least, we have a definition of “sound money.” A key concept for understanding Bitcoin and what it brings to humanity. A key concept for understanding what has gone wrong with the world in these last few… centuries.

متعلقہ مطالعہ | فیڈ انفلاسیون میٹرک تین دہائی اونچائی تک بڑھتا ہے ، اس کا مطلب بٹ کوائن کا کیا ہے

Without further ado, let’s get into it. But first…

زمین کے بارے میں بہترین کتاب کلب کے بارے میں

Bitcoinist Book Club کے استعمال کے دو مختلف معاملات ہیں:

1. - چلانے کے لئے سپر اسٹار ایکزیکیٹو سرمایہ کار کے ل For ، ہم cryptocurrency کے شوقین لوگوں کے لئے لازمی طور پر پڑھنے والی کتابوں کا خلاصہ کریں گے۔ ایک ایک کر کے. باب بہ باب۔ ہم انہیں پڑھتے ہیں تاکہ آپ کو ضرورت نہ پڑے ، اور آپ کو صرف میٹھی بٹس دیں۔

2.- تحقیق کے لئے یہاں آنے والے مراقبی کتابی کیڑے کے ل we ، ہم آپ کے پڑھنے کے ساتھ لائنر نوٹ فراہم کریں گے۔ ہمارے کتاب کلب کی کتاب ختم ہونے کے بعد ، آپ ہمیشہ تصورات کو تازہ دم کرنے اور اہم قیمت درج کرنے کے لئے واپس آسکتے ہیں۔

سبھی جیت جاتے ہیں۔

اب تک ، ہم نے احاطہ کیا ہے:

And Now Is Time For, “Chapter 4, Part 3: Hyperinflation"

Government Money’s Track Record

The amounts are scary, to say the least. And they won’t stop growing.

The total U.S. M2 measure of the money supply in 1971 was around $600 billion, while today it is in excess of $12 trillion, growing at an average annual rate of 6.7%. Correspondingly, in 1971, 1 ounce of gold was worth $35, and today it is worth more than $1,200.

میں Bitcoin 2021 conference, Mark Yusko said that to get to a trillion, “You’d have to sit here with us for 31.770 years” (…) “And you’d have to spend a Dollar a second.” His point was that the U.S. had “صرف چھ ٹریلین پرنٹ کرنے کا بل پاس کیا۔” So, the growth is exponential. And the beast won’t stop eating. And most of the world’s currencies are doing even worse. By a wide margin.

Government Money And Hyperinflation

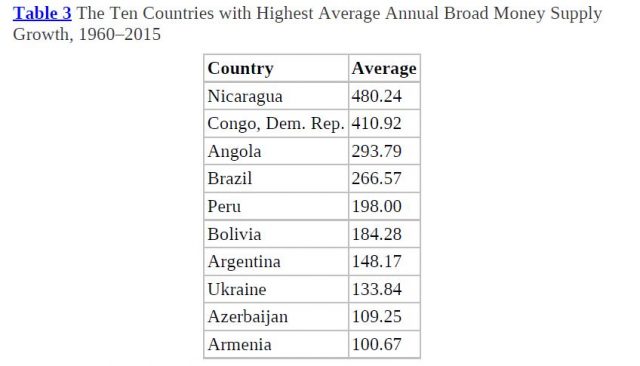

The world’s major national currencies generally have their supply grow at predictably low rates. Developed economies have had slower increases in the supply of their currencies than developing economies, which have witnessed faster price rises and several hyperinflationary episodes in recent history.

یہ قابل غور ہے کہ ،Hyperinflation is a form of economic disaster unique to government money. There was never an example of hyperinflation with economies that operated a gold or silver standard.” The effects of this process are far and wide. Societies collapse when the money stops working.

As these lines are written, it is Venezuela’s turn to go through this travesty and witness the ravages of the destruction of money, but this is a process that has occurred 56 times since the end of World War I, according to research by Steve Hanke and Charles Bushnell, who define hyperinflation as a 50% increase in the price level over a period of a month.

As the money supply expands, the wealth of the holders decreases. Said wealth is transferred to the printers and those who are close to them.

It is ironic, and very telling, that in the era of government money, governments themselves own far more gold in their official reserves than they did under the international gold standard of 1871–1914.

The Definition Of “Sound Money”

If your aim is to understand Bitcoin, this concept is crucial. Austrian economists pose that, “بہترین پیسہ قابل فروخت ہونے اور مارکیٹ پیسے کے طور پر کس چیز کو سمجھنے کے گرد گھومتی ہے۔”سیفڈین اموس نے ایک اور چیز کا اضافہ کیا۔

… the salability of money according to the will of its holder and not some other party. Combining these criteria together formulates a complete understanding of the term sound money as the money that is chosen by the market freely and the money completely under the control of the person who earned it legitimately on the free market and not any other third party.

متعلقہ مطالعہ | تکنیکی سگنل تجویز کرتا ہے کہ سونے بٹ کوائن کے خلاف بدلہ لینے کے لئے تیار ہے

And this, of course, brings us to the topic at hand.

In its infancy, Bitcoin already appears to satisfy all the requirements of Menger, Mises, and Hayek: it is a highly salable free-market option that is resistant to government meddling.

بہت کہا.

BTC price chart on Binance US | Source: BTC/USDT on TradingView.com

- 9

- تمام

- ارد گرد

- مضمون

- BEST

- بل

- ارب

- بائنس

- بٹ کوائن

- بکٹوسٹسٹ

- کتب

- بی ٹی سی یو ایس ڈی ٹی

- مقدمات

- چارلس

- کلب

- کانفرنس

- کورٹ

- cryptocurrency

- کرنسیوں کے لئے منڈی کے اوقات کو واضح طور پر دیکھ پائیں گے۔

- DID

- آفت

- ڈالر

- اقتصادی

- توسیع

- پر عمل کریں

- فارم

- مفت

- گولڈ

- حکومت

- حکومتیں

- بڑھائیں

- بڑھتے ہوئے

- ترقی

- یہاں

- ہائی

- تاریخ

- کس طرح

- HTTPS

- ہائپرینفلشن

- اضافہ

- افراط زر کی شرح

- بین الاقوامی سطح پر

- IT

- کلیدی

- سطح

- اہم

- نشان

- مارکیٹ

- پیمائش

- قیمت

- سرکاری

- اختیار

- دیگر

- قیمت

- قیمتیں

- پڑھنا

- ضروریات

- تحقیق

- رن

- سلور

- چھ

- So

- خرچ

- فراہمی

- وقت

- ٹریک

- ہمیں

- us

- جنگ

- ویلتھ

- ڈبلیو

- کام

- دنیا

- قابل