ہماری نیوز لیٹر کو سبسکرائب کریں!

UnionDigital, the digital banking arm of the Aboitiz-led UnionBank of the Philippines, revealed that it already has 1.73 million customers, reached $70 million in loan book size, and has collected $50 million in deposits, four months after the Bangko Sentral ng Pilipinas (BSP) gave a go signal to the digital bank to start its operations last July.

“Since our launch, UnionDigital Bank has been focusing on serving the needs of the underserved communities within UnionBank by offering digital deposit and lending products to our ecosystem, and we will continue to support the needs of these customers with additional products overtime,” said Arvie de Vera, UnionDigital Bank co-founder, President, and Chief Executive Officer (CEO).

According to de Vera, the growth in its loan book is because the digital bank is using the available data on consumer behavior within the larger Aboitiz ecosystem to create loan products, especially since it is a subsidiary of the Aboitiz-led traditional bank:

“If you’re lending within an ecosystem, you have an anchor community, and that’s a robust way to provide credit because you have more data. Rather than using payments data, which is really not a good proxy for someone’s capacity and willingness to pay. But if you have robust set of data with context on their financial behavior, then you can properly price the risk, because you have historical data on the customer, you know you can give him a customized interest rate. A one-size-fits-all pricing is an inappropriate lending business strategy and sub-optimal consumer experience.”

The UnionDigital CEO also highlighted the digital bank’s balance sheet as its “laser focus” or priority, clarifying that balance sheets generate revenue more than just having a cool app or millions of users.

“It’s about a balance sheet. It’s about growing the loan book because that’s where the revenues come from- it doesn’t come from payments; it doesn’t come from sign ups. Valuation is great, but it’s not profitability,” de Vera added.

ادھر ، ایک اور "سنگ میل" that UnionDigital is looking for is having local exchange giant Philippine Digital Asset Exchange (PDAX) as one of its first corporate account customers, marking the commencement of accumulating corporate account openings at UnionDigital Bank.

"The start we’ve had with PDAX joining us on our journey affirms my excitement to include more corporate partners. We look forward to collaborating with partners of the same caliber to maximize the difference we bring to the financial lives of fellow Filipinos,” de Vera concluded, elaborating that corporate partnerships are vital in reaching the communities that need financial services.

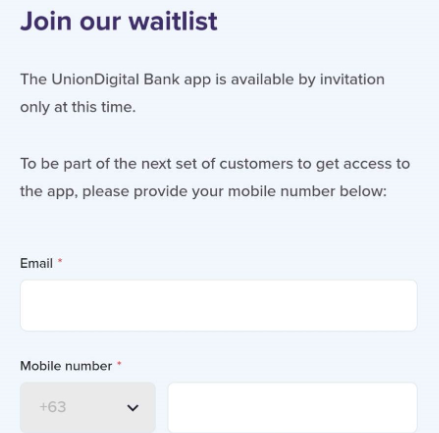

As of now, the UnionDigital Bank app is now live for a limited number of customers only and is available by invitation only. Those who do not have an invitation code cannot access the app but can join the waitlist for the next set of customers that will get access to it.

Before 2021 ended, the Securities and Exchange Commission (SEC) allowed the traditional bank Union Bank of the Philippines to set up a digital banking subsidiary in the name of Union Digital Bank Inc. (Read more: SEC Approves UnionBank Digital Arm)

UnionDigital is one of the six banks to which the BSP granted a digital banking license. As of August this year, all six digital banks are already allowed to operate. (Read: بی ایس پی: تمام چھ ڈیجیٹل بینکوں کو اب کام کرنے کی اجازت ہے۔)

It can also be recalled that de Vera proclaimed that the metaverse needs banking, and UnionDigital is a bank of the metaverse, explaining that the metaverse is affecting e-commerce and vice versa, as well as how that will affect metacommerce.

This statement by de Vera supports the announcement of the digital bank that it will soon launch the Philippine Peso UnionDigital (PHD) stablecoin. (Read more: UnionBank کا UnionDigital Crypto Stablecoin PHD شروع کرنے کے لیے)

یہ مضمون BitPinas پر شائع ہوا ہے: بی ایس پی کا لائسنس یافتہ یونین ڈیجیٹل 1.73 ماہ میں 4 ملین صارفین تک پہنچ گیا ہے۔ PDAX کو پہلے کارپوریٹ کسٹمر کے طور پر شامل کرتا ہے۔

اعلان دستبرداری: BitPinas کے مضامین اور اس کا بیرونی مواد مالی مشورہ نہیں ہے۔ ٹیم فلپائن-کرپٹو اور اس سے آگے کے لیے معلومات فراہم کرنے کے لیے آزاد، غیر جانبدارانہ خبریں فراہم کرتی ہے۔

- بٹ کوائن

- بٹ پینس

- blockchain

- بلاکچین تعمیل

- بلاکچین کانفرنس

- Coinbase کے

- coingenius

- اتفاق رائے

- کرپٹو کانفرنس

- کرپٹو کان کنی

- cryptocurrency

- مہذب

- ڈی ایف

- ڈیجیٹل اثاثے۔

- ethereum

- فن ٹیک

- مشین لرننگ

- خبر

- غیر فنگبل ٹوکن

- PDAX۔

- پلاٹا

- افلاطون اے

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو بلاک چین

- پلیٹو ڈیٹا

- پلیٹو گیمنگ

- کثیرالاضلاع

- داؤ کا ثبوت

- یونین ڈیجیٹل

- W3

- زیفیرنیٹ