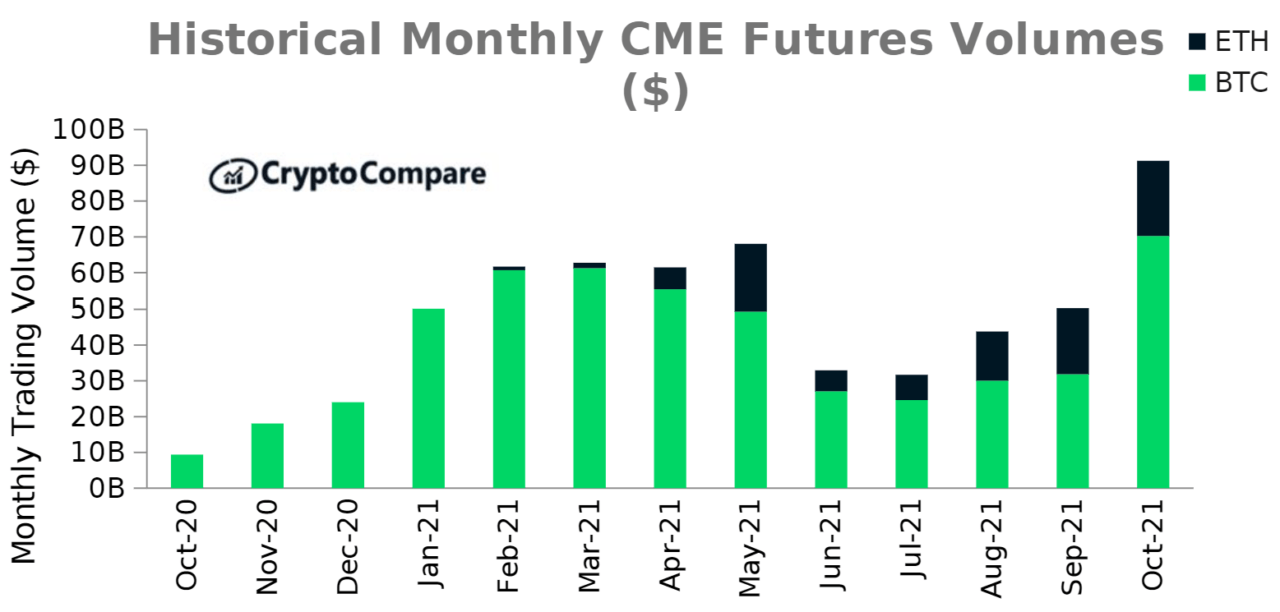

The trading volume of bitcoin futures contracts on the Chicago Mercantile Exchange (CME) has increased 121% to $70.3 billion, a new all-time high, after the launch of the first bitcoin exchange-traded fund (ETF) in the United States.

کے مطابق CryptoCompare’s October 2021 Exchange Review report, CME’s BTC futures volumes increased after the launch of the ProShares Bitcoin ETF on October 19, and was likely triggered by the CME being the only exchange where ProShares’ underlying contracts can be traded.

In its debut, the ProShares Bitcoin Strategy ETF became the second-most heavily traded fund on record, and on the second trading day it brought in a trading volume of $1.2 billion.

CryptoCompare, which recently received FCA authorization to operate as a Benchmark Administrator, added in its report that last month spot volumes of the Top-Tier cryptocurrency exchanges in the space stayed flat at $1.7 trillion, with Binance being the largest top-tier exchange by trading volume, followed by OKEx and Coinbase.

Notably, derivatives volumes increased 1% last month to $3.6 trillion, while total spot volumes decreased 6.4% to $2.6 trillion, meaning the derivatives market now represents 57.9% of the total cryptocurrency market, up from 56% in September.

The daily average open interest for Ethereum futures products has hit a new all-time high at $6.9 billion after rising 18.1% in October. Its previous record was $6 billion in May of this year. The rise is likely related to Ethereum’s recent price performance, as it hit a new high above $4,600.

As CryptoGlobe reported, technical analyst Katie Stockton has revealed she believes ETH could move upward to hot $6,000 per coin if it manages to hold above a key technical level at $4,384 for over two weekly closes.

Similarly, analysts from Goldman Sachs believe Ethereum could soar to $8,000 by the end of the year after finding the cryptoasset has traded in line with inflation breakevens since 2019. Interest in cryptocurrencies has been surging over the last few months, with JPMorgan recently reaffirming its $146,000 bitcoin price target if investors drop gold for BTC.

ڈس کلیمر

مصنف، یا اس مضمون میں مذکور کسی بھی لوگوں کے خیالات اور آراء کا اظہار صرف معلوماتی مقاصد کے لیے ہے، اور وہ مالی، سرمایہ کاری، یا دیگر مشورے پر مشتمل نہیں ہیں۔ کرپٹو اثاثوں میں سرمایہ کاری یا تجارت کرنا مالی نقصان کے خطرے کے ساتھ آتا ہے۔

امیج کریڈٹ

کے ذریعے نمایاں تصویر Pixabay

- 000

- 2019

- 7

- 9

- اشتھارات

- مشورہ

- تمام

- تجزیہ کار

- مضمون

- اجازت

- معیار

- ارب

- بائنس

- بٹ کوائن

- Bitcoin ETF

- بکٹکو فیوچر

- Bitcoin قیمت

- BTC

- شکاگو

- شکاگو مرکنٹائل ایکسچینج

- سی ایم ای

- سی ایم ای بٹ کوائن فیوچرز

- Coinbase کے

- معاہدے

- کرپٹو کمپیکٹ

- کرپٹو کرنسیوں کی تجارت کرنا اب بھی ممکن ہے

- cryptocurrency

- کریپٹوکرنسی تبادلے

- کرپٹپٹورسیسی مارکیٹ

- دن

- مشتق

- چھوڑ

- ETF

- ETH

- ethereum

- ایکسچینج

- تبادلے

- FCA

- مالی

- پہلا

- فنڈ

- فیوچرز

- گولڈ

- گولڈن

- گولڈمین سیکس

- ہائی

- پکڑو

- HTTPS

- تصویر

- افراط زر کی شرح

- دلچسپی

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ

- IT

- JPMorgan

- کلیدی

- شروع

- سطح

- لائن

- مارکیٹ

- ماہ

- منتقل

- OKEx

- کھول

- رائے

- دیگر

- لوگ

- کارکردگی

- قیمت

- حاصل

- رپورٹ

- انکشاف

- رسک

- سکرین

- خلا

- کمرشل

- امریکہ

- حکمت عملی

- ٹیکنیکل

- ٹریڈنگ

- متحدہ

- ریاست ہائے متحدہ امریکہ

- us

- حجم

- ہفتہ وار

- سال