پیشکش MakerDAO کے ساتھ پچھلے ہفتے کی شراکت کے بعد آتی ہے۔

In a move that may raise eyebrows in DeFi, Coinbase, the largest crypto exchange in the US, is offering users 1.5% APY on their USDC stablecoins.

USDC is a US dollar-backed stablecoin that Coinbase co-founded with Circle in 2018. Coinbase is offering the product to customers residing in the US, the U.K. and the European Union, excluding Germany and Italy.

Users holding USDC on Coinbase will start earning interest خود کار طریقے سے with the option to opt-out of the program. There is no stated deposit limit but users of Coinbase Pro are not eligible to participate.

اکتوبر پر 24، MakerDAO voted to allow Coinbase Prime to custody $1.6B worth of USDC, on which it will earn a 1.5% yield.

کم پیداوار

Coinbase’s new USDC program comes at a precarious time as the USDC yield on offer is lower than savings rates at traditional banks. According to بینکریٹ, users can earn in the neighbourhood of 3% when depositing money into savings accounts. By choosing bank deposits, they also avoid any smart contract or regulatory risk posed by holding USDC.

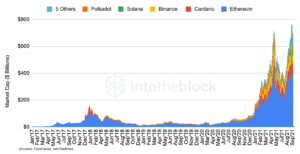

Market participants’ confidence in USDC appears to be dwindling after the Tornado Cash incident, where 38 addresses which had interacted with the protocol were pre-emptively banned. This has led to USDC’s market capitalization dropping by $ 10B in the last two months, while its competitors gained market share.

Coinbase قرض

جون 2021 میں، Coinbase مل کر up with DeFi heavyweight Compound Labs in a bid to offer users 4% APY on their USDC holdings. The company planned to offer this service under a project dubbed Coinbase Lend. The premise was simple: users would be assured of capital preservation and would earn 4% interest. At the time, savings rates at banks were woefully low, but things have changed this year after the Fed’s aggressive rate hikes.

Due to intervention from the U.S. Securities and Exchange Commission (SEC), Coinbase Lend never saw the light of day.

ڈی فائی پر ریگولیٹری کریک ڈاؤن تیز ہونے پر SEC ایکشن کے لیے سکے بیس بریسس

Less than a week after news broke that the U.S. Securities and Exchange Commission was investigating Uniswap, Coinbase, the publicly traded crypto exchange that’s become a bellwether for the burgeoning industry, said it expected to be sued by the agency in connection with its forthcoming offering, Coinbase Lend. “Last Wednesday, after months of effort by …