یہ ایک ہفتہ وار ٹیوٹوریل ہے جو ہمارے دوست نے لکھا ہے۔ ڈی ایف آئی ڈیڈ، دی ڈیفینٹ کے مشیر اور مارکیٹنگ اور پورٹ فولیو سپورٹ کے سربراہ چوتھا انقلاب کیپٹل.

Disclaimer: All opinions expressed by DeFi Dad are solely his own opinion and do not reflect the opinion of 4RC or The Defiant. DeFi Dad disclosed he is in the Orion Saver stablecoin farm. He wishes to disclose this as he could benefit from future upside in an ORION token once it’s generated. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

پروٹوکول کا پس منظر: ایک نیا ڈی فائی پروٹوکول کہا جاتا ہے۔ اورین منی۔ aims to build a cross-chain stablecoin bank for saving and lending. What’s clever about Orion is that it’s bridging demand from two different DeFi communities: the Anchor Rate available on Terra blockchain and the outsized amount of stablecoin liquidity and demand to earn yield on Ethereum. If you’re unfamiliar with the Anchor Rate, think of it as the target APY that Anchor protocol seeks to pay out to depositors of UST. This Anchor Rate isn’t fixed, but is designed to be stable, currently about 19.55% APY.

If you have a reliable source to earn a stable 19-20% yield on stablecoins on one blockchain (Terra) and a larger pool of stablecoin lenders on Ethereum, what happens when you bring the two together? Orion Money addresses this by allowing stablecoin lenders to remain on Ethereum, while lending one of many stablecoins such as DAI, USDC, and UST to earn with the Anchor Rate.

یہاں یہ کس طرح کام کرتا ہے:

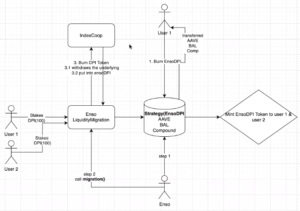

- Orion users deposit ERC20 stablecoins on Ethereum (USDT, USDC, DAI, wrapped UST, FRAX, BUSD).

- Under the hood, Orion Money swaps the stablecoins for wrapped UST using curve.fi/ust and then bridges the wrapped UST to native UST on Terra. There are some higher gas fees to pay and potential slippage to impact anyone’s deposits/withdrawals.

- Lastly, the UST is used to earn the Anchor UST rate, currently at 19.55% APY.

I’m not sure there’s a better example today of cross-chain DeFi than this. Someone depositing stablecoins on Ethereum benefits from yield earned on Terra. Also, like most blue chip DeFi protocols on Ethereum, there’s cover already available at 2.6% APR for Orion deposits, thanks to انشورنس, or at least there was cover until it sold out recently.

Keep in mind, this is simply the first phase of a rollout to support lending stablecoins on Orion Money. Here’s a few milestones ahead:

- In September, the team will facilitate an IDO prior to token generation of ORION.

- Eventually after ORION is created, Orion users will have the option of being paid interest denominated in their deposited stablecoins or a higher interest rate in ORION.

- Additionally, any depositor can earn higher interest for staking ORION. When users stake more ORION, they earn a higher APY, similar to the model used by centralized crypto lenders Celsius and Nexo.

- Different from those CeFi lenders, all net revenue from Orion Money will end up in an ORION staking pool for ORION stakers.

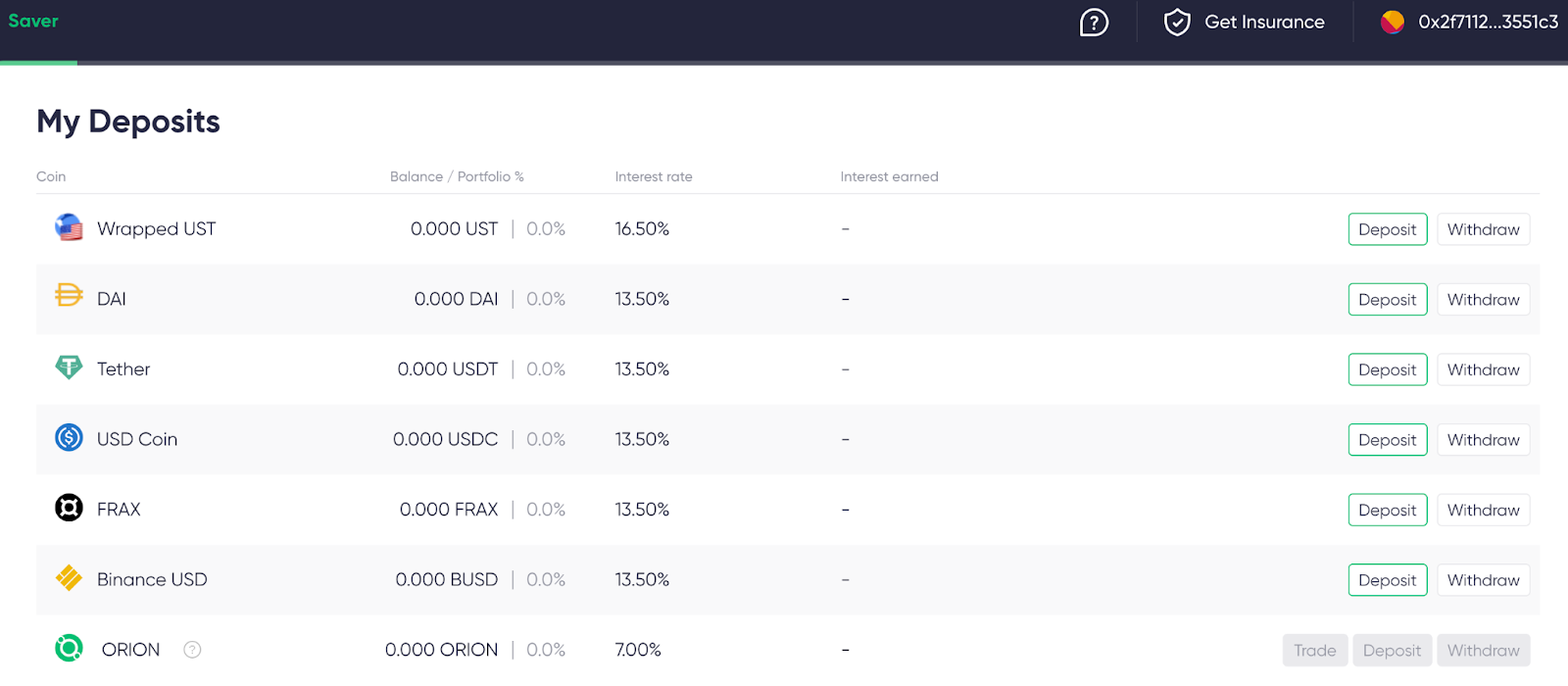

موقع: Today, I will share how I can earn 16.5% APY with UST or 13.5% APY with DAI, USDC, USDT, BUSD, or FRAX.

مکمل کرنے کا وقت: 10 منٹ اگر تجویز کردہ FAST گیس کی قیمت یا اس سے زیادہ ادا کر رہے ہیں۔ gasnow.org.

انعامات کے پروگرام کی تخمینی لمبائی: These pools are only getting started. The rates will actually rise to between 15-25% APY after the ORION token is generated in September, following some future IDO. For now, the rates are fixed at 13.5% for all stablecoins or 16.5% APY for UST.

گیس + پروٹوکول فیس: Ethereum پر 30-60 Gwei کے درمیان گیس کی قیمتوں کی بنیاد پر، اس میں حصہ لینے کے لیے $40-$90 لاگت آئے گی۔

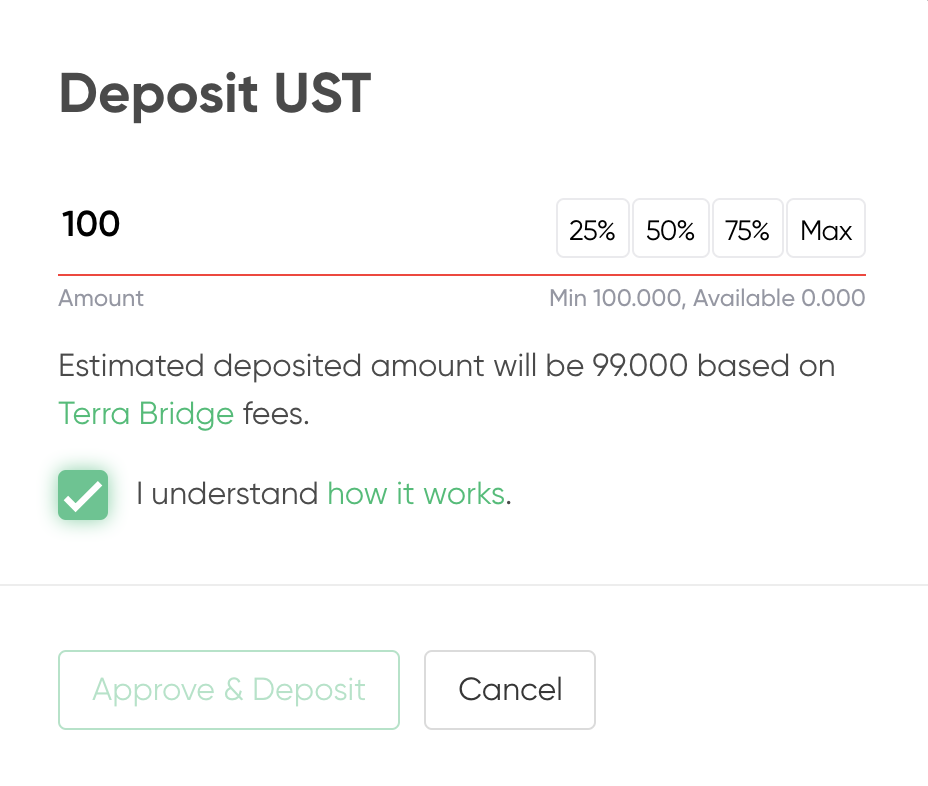

فیس: Other than the usual Ethereum network fees you pay as gas, it’s worth noting that with Orion, users are paying for a convenience to not have to bridge money to Terra. For this service, Orion takes a cut. For example, I can earn 19.55% APY with the Anchor Rate but I’m earning 16.5% APY with UST on Orion. In the future, after ORION token is generated, these rates will rise to an expected 20-25% APY if I stake ORION and choose to be paid interest in ORION tokens. Also for withdrawing from Orion, be aware it involves a transfer between Terra and Ethereum handled by Terra Bridge (Shuttle) which imposes a fee of maximum of $1 or 0.1% of the total amount.

خطرات: ہمیشہ کی طرح، یہ مالی مشورہ نہیں ہے اور آپ کو اپنی تحقیق خود کرنی چاہیے۔ اس موقع میں شرکت کرتے وقت درج ذیل خطرات ہیں۔

- Smart contract risk in Orion Money, Anchor, and Curve (if depositing stablecoins other than UST).

- اوریکل کی ناکامی۔

- لیکویڈیٹی بحران

- ڈی فائی میں نظامی خطرہ

- پیگڈ اثاثے جیسے سٹیبل کوائنز ڈی پیگ کر سکتے ہیں۔

سبق:

- سب سے پہلے، میں جاتا ہوں Orion Money app here, connect my Ethereum wallet via MetaMask or WalletConnect, assuming I have one of the six listed stablecoins.

- In order to save gas, if I have multiple types of stablecoins, I might consider swapping them for a single kind of stablecoin ahead of time.

- If I have wrapped UST on Ethereum, I will notably save money on gas since it doesn’t require Orion to swap to UST via Curve before bridging to Terra.

- Btws, ignore the ORION token option at the bottom.

- Next, I choose whichever token to deposit, in my case UST, and click جمع سبز رنگ میں

- میں پرامپٹس پر عمل کرتا ہوں۔ Approve & Deposit, which will require 2 transactions on MetaMask.

- I’m done! Now, I can track my سود کمایا کے تحت My Deposits. I could also return here to deposit other stablecoins.

مصنف کے بارے میں: ڈی ایف آئی ڈیڈ ایک DeFi سپر صارف، معلم اور سرمایہ کار ہے۔ وہ اور ان کی ٹیم پر 4 آر سی (چوتھا انقلاب کیپٹل) DeFi، NFTs، اور Web3 میں اگلے عظیم پروٹوکول یا ایپلیکیشن بنانے والی ٹیموں میں سرمایہ کاری کریں۔ آپ اس کے یوٹیوب چینل کو سبسکرائب کر سکتے ہیں۔ defidad.com اور ٹویٹر پر اس کی پیروی کریں۔.

- &

- مشورہ

- مشیر

- تمام

- اجازت دے رہا ہے

- اپلی کیشن

- درخواست

- اثاثے

- بینک

- blockchain

- پل

- تعمیر

- عمارت

- BUSD

- دارالحکومت

- سیلسیس

- چپ

- کمیونٹی

- کنٹریکٹ

- کرپٹو

- وکر

- ڈی اے

- ڈی ایف

- ڈیمانڈ

- ERC20

- ethereum

- ایتھریم نیٹ ورک

- کھیت

- کاشتکاری

- فاسٹ

- فیس

- مالی

- پہلا

- پر عمل کریں

- مستقبل

- گیس

- گیس کی فیس

- عظیم

- سبز

- سر

- یہاں

- کس طرح

- کیسے

- HTTPS

- اثر

- دلچسپی

- سرمایہ کاری

- سرمایہ کار

- IT

- قرض دینے

- لیکویڈیٹی

- مارکیٹنگ

- میٹا ماسک

- ماڈل

- قیمت

- خالص

- نیٹ ورک

- نوو

- این ایف ٹیز

- رائے

- رائے

- مواقع

- مواقع

- اختیار

- حکم

- دیگر

- ادا

- پول

- پول

- پورٹ فولیو

- قیمت

- پروگرام

- قیمتیں

- تحقیق

- آمدنی

- انعامات

- رسک

- بچت

- سیکنڈ اور

- چھ

- فروخت

- stablecoin

- Stablecoins

- داؤ

- Staking

- شروع

- حکمت عملی

- حمایت

- ہدف

- زمین

- وقت

- ٹوکن

- ٹوکن

- ٹریک

- معاملات

- USDC

- USDT

- صارفین

- بٹوے

- Web3

- ہفتہ وار

- کام کرتا ہے

- قابل

- پیداوار

- یو ٹیوب پر