چوری چھپے جھانکنا

- ایتھرم fees reach an all-time high amid network congestion.

- Rising trading volume suggests increasing demand for ETH.

- Multiple indicators indicate a potential trend reversal for Ethereum.

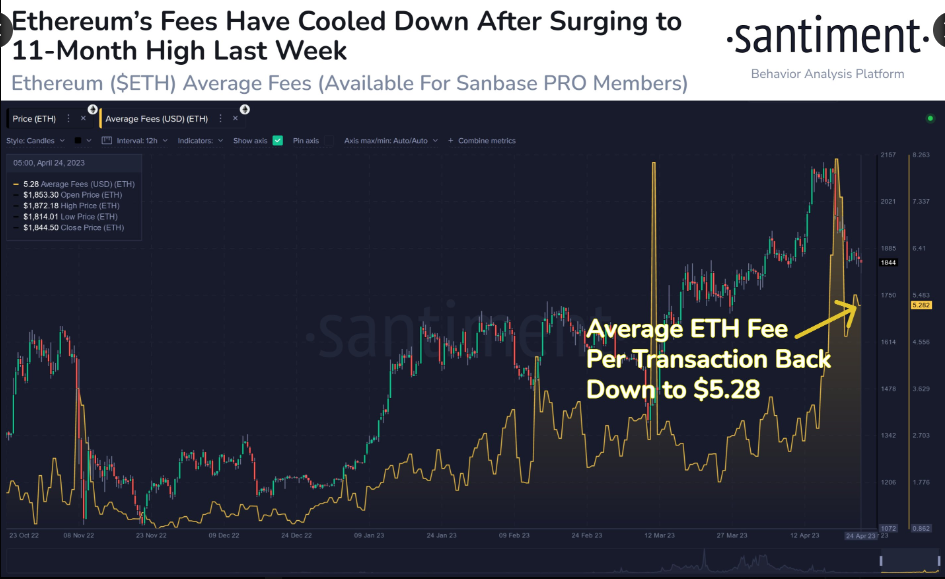

After falling below $2k last week, ایتھرم‘s fees have risen to their highest level since May 2022. This shift was brought about by increasing network transaction demand, which caused congestion and delayed processing times. Though still high, costs have been reduced by 35%, alleviating consumer restraints and boosting network use.

💵 پچھلے ہفتے $2k سے کم کراس کرنے کے بعد، # ایئریرومکے نیٹ ورک نے دیکھا کہ اس کی فیسیں مئی 2022 کے بعد سے اپنی بلند ترین سطح پر پہنچ گئی ہیں کیونکہ تاجروں نے پولرائز کیا اور یہ معلوم کیا کہ خریدنا ہے یا بیچنا ہے۔ اگرچہ اب بھی نسبتاً زیادہ ہے، اس کے بعد سے فیسوں میں 35% کی چھوٹ دی گئی ہے۔ https://t.co/z8AMJr57V4 pic.twitter.com/AIyDWrL5dG

- سینٹمنٹ (@ سینٹینمنٹ فیڈ) اپریل 24، 2023

Despite this, the bear’s hand was strong in the ETH منڈی , with prices falling from a 24-hour high of $1,874.11 to an intraday low of $1,811.79. As of press time, the قیمت of ETH has dropped by 1.60% to $1,817.41.

The market capitalization of ETH fell by 1.72% to $218,700,376,936, while the 24-hour trading volume increased by 9.88% to $7,960,648,581. This rise in trading volume and decrease in fees imply a rising demand for ETH, which might lead to a price hike soon.

The Fisher Transform line, which has a value of -1.22 and is below the signal line on the 4-hour price chart for the ETH market, indicates that the market is oversold and that a potential buy signal is approaching. The reversal will be apparent if the Fisher transform line crosses the signal line successfully.

By indicating escalating selling pressure, the Money Flow Index (MFI), which has a reading of 18.89 and is trending downward, supports the bearish momentum in ETH. Traders should exercise caution when evaluating long positions if the MFI declines and breaks below the oversold level. This movement may signal the start of a more severe downward trend.

ETH may still be under short-term negative pressure as the Relative Strength Index (RSI), currently reading 37.54, falls below its signal line and into the oversold zone. As a result, traders can decide to wait to enter an extended position until the RSI rises above its signal line and leaves the oversold area.

On the 4-hour price chart, the stochastic RSI has a reading of 59.74, which is below its signal line. This action indicates that the asset is oversold and may shortly revert bullishly to the upside. If the stochastic RSI passes the signal line on the ETH market, it can indicate a potential trend reversal or shift in momentum.

Ethereum’s price drop and rising trading volume suggest a possible momentum shift, but caution is advised as the market remains oversold.

ڈس کلیمر: کریپٹو کرنسی کی قیمت انتہائی قیاس آرائی پر مبنی اور غیر مستحکم ہے اور اسے مالی مشورہ نہیں سمجھا جانا چاہیے۔ ماضی اور موجودہ کارکردگی مستقبل کے نتائج کا اشارہ نہیں ہے۔ سرمایہ کاری کے فیصلے کرنے سے پہلے ہمیشہ تحقیق کریں اور مالیاتی مشیر سے مشورہ کریں۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹوآئ اسٹریم۔ ویب 3 ڈیٹا انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ایڈریین ایشلے کے ساتھ مستقبل کا نقشہ بنانا۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://investorbites.com/ethereum-eth-price-analysis-25-04/

- : ہے

- : ہے

- : نہیں

- 1

- 11

- 2022

- 22

- 35٪

- 9

- a

- ہمارے بارے میں

- اوپر

- عمل

- مشورہ

- مشیر

- کے بعد

- ہمیشہ

- کے ساتھ

- an

- تجزیہ

- اور

- واضح

- قریب

- رقبہ

- AS

- اثاثے

- واپس

- BE

- bearish

- بیئرش مومنٹم

- رہا

- اس سے پہلے

- نیچے

- اضافے کا باعث

- وقفے

- لایا

- لیکن

- خرید

- by

- کر سکتے ہیں

- سرمایہ کاری

- وجہ

- سینٹر

- چارٹ

- سمجھا

- صارفین

- اخراجات

- موجودہ

- اس وقت

- فیصلہ کرنا

- کمی

- کمی

- تاخیر

- ڈیمانڈ

- رعایتی

- بحث

- غلبے

- نیچے

- چھوڑ

- گرا دیا

- آسانیاں

- درج

- ETH

- ایتھ مارکیٹ

- ETH / USD

- ethereum

- ایتھریم نیوز

- ایتیروم قیمت

- ایتیروم قیمت تجزیہ

- کا جائزہ لینے

- ورزش

- وسیع

- بیرونی

- نیچےگرانا

- آبشار

- فیس

- سمجھا

- مالی

- مالی مشورہ

- بہاؤ

- کے لئے

- سے

- مستقبل

- ہاتھ

- ہے

- ہائی

- سب سے زیادہ

- انتہائی

- اضافہ

- HTTPS

- in

- اضافہ

- اضافہ

- انڈکس

- اشارہ کرتے ہیں

- اشارہ کرتا ہے

- انڈیکیٹر

- اندرونی

- میں

- سرمایہ کاری

- IT

- میں

- آخری

- قیادت

- سطح

- لائن

- لانگ

- لو

- بنانا

- مارکیٹ

- مارکیٹ کیپٹلائزیشن

- مارکیٹ خبریں

- زیادہ سے زیادہ چوڑائی

- مئی..

- شاید

- رفتار

- قیمت

- زیادہ

- تحریک

- منفی

- نیٹ ورک

- خبر

- of

- on

- or

- گزرتا ہے

- گزشتہ

- کارکردگی

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- پوزیشن

- پوزیشنوں

- ممکن

- ممکنہ

- پریس

- دباؤ

- قیمت

- قیمت تجزیہ

- قیمت چارٹ

- قیمتیں

- پروسیسنگ

- تک پہنچنے

- پڑھنا

- کم

- رشتہ دار طاقت انڈیکس

- نسبتا

- باقی

- تحقیق

- نتیجہ

- نتائج کی نمائش

- الٹ

- واپس

- اضافہ

- طلوع

- اٹھتا ہے

- بڑھتی ہوئی

- rsi

- سینٹیمنٹ

- فروخت

- فروخت

- شدید

- منتقل

- مختصر مدت کے

- جلد ہی

- ہونا چاہئے

- اشارہ

- بعد

- ماخذ

- شروع کریں

- ابھی تک

- طاقت

- مضبوط

- کامیابی کے ساتھ

- پتہ چلتا ہے

- کی حمایت کرتا ہے

- کہ

- ۔

- ان

- اس

- وقت

- اوقات

- کرنے کے لئے

- تاجروں

- ٹریڈنگ

- تجارتی حجم

- TradingView

- ٹرانزیکشن

- تبدیل

- رجحان

- رجحان سازی

- ٹویٹر

- کے تحت

- الٹا

- استعمال کی شرائط

- قیمت

- واٹیٹائل

- حجم

- انتظار

- تھا

- ہفتے

- کیا

- کیا ہے

- جب

- چاہے

- جس

- جبکہ

- گے

- ساتھ

- زیفیرنیٹ