ذیل میں بٹ کوائن میگزین پرو کے حالیہ ایڈیشن کا ایک اقتباس ہے، بٹ کوائن میگزین۔ پریمیم مارکیٹ نیوز لیٹر. یہ بصیرتیں اور دوسرے آن چین بٹ کوائن مارکیٹ کے تجزیے کو براہ راست اپنے ان باکس میں حاصل کرنے والے پہلے لوگوں میں شامل ہونے کے لیے، اب سبسکرائب کریں.

"میںوہ سب سے بڑا,” we briefly discussed the details around Alameda Research’s balance sheet and highlighted some questions around the amount of FTT tokens they own in their asset holdings.

In short, it was revealed by CoinDesk that Alameda Research, a proprietary trading firm co-founded by FTX co-founder Sam Bankman-Fried, has a large amount of its net equity tied up in FTX’s native exchange token.

It didn’t take long before it became a much bigger deal in the rest of the market with CZ, the CEO of Binance, telling the public yesterday that Binance intended to liquidate all of their FTT holdings from their books (approximately $580m worth at the time of writing).

المیڈا ریسرچ کے سی ای او ، کیرولین ایلیسن, responded with the following:

Those comments, along with responses from the heads of FTX and Alameda Research, have generated two reactions from the market:

- A bank run on assets sitting on the FTX platform.

- FTT ٹوکن کی قیمت کے ارد گرد قیاس آرائی کرنے والوں کی کھلی دلچسپی میں ایک دھماکہ۔

Whether strategic or not, FTX is one of Binance’s largest competitors. In just one day, those comments and Binance’s sale of FTT holdings started a chain of second- and third-order effects. Most importantly is a wave of panic taking shape that questions the solvency of both FTX and Alameda Research. As a result, we’ve seen nearly $1 billion in assets and token values fly out of known FTX and Alameda addresses over the last week. That data was compiled by Larray Cermak, VP of research at The Block.

Sam Bankman-Fried responded early this morning to try and calm markets and FTX customers. He highlighted the platform’s ability to cover all client holdings, as well as its excess cash position. Bankman-Fried also responded to the reduced pace of customer withdrawals from FTX.

There’s a broader risk to the market here as we see Alameda unwind many other positions across tokens and bitcoin that will be used to raise additional capital. Don’t forget that this duo is one of the most vital institutions in the space, especially when it comes to providing market making and liquidity for the entire market. We’re just in the beginning stages on what may play out here.

بگ سوال

Two things that aren’t known and remain the biggest questions are:

- What are Alameda’s liabilities, in which currency and lent from whom?

- کمپنیوں کے ایک دوسرے کے ساتھ انتہائی قریبی اور اکثر مبہم تعلقات کے پیش نظر، کیا FTX کا المیڈا کے ساتھ اہم ہم منصب کی نمائش ہے؟

FTX صارفین کی جانب سے انخلاء میں تیزی سے اضافہ ان دونوں سوالوں کے جوابات کی غیر یقینی صورتحال کو ظاہر کرتا ہے۔

In regard to the second question, wallet movements from Alameda yesterday night certainly don’t inspire confidence.

The Speculative Attack

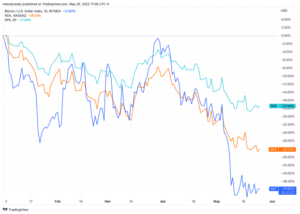

It’s important to remember that we don’t necessarily know the exact terms of Alameda’s finances. However, we have seen their determination to defend the $22 level as well as its significance as support in the next chart. This provides a strong confluence of variables.

Alameda would likely not have such a vested interest in defending this level if it was not leveraged. Otherwise, they would let the market fall as much as it wants and simply acquire FTT at a lower price.

If Alameda has collateralized their FTT position, there are no large buyers to serve as buy side liquidity.

کے طور پر کی طرف سے گندا بلبلا میڈیا, the dynamic between FTX and FTT token looks awfully similar to that of Celsius Network and its token, CEL.

We appear to be watching a classic speculative attack unfold. The best case for Alameda (and the market in general) is that the liabilities have been severely reduced since the end of the second quarter, and they are merely buying their token to prop up the market to inspire confidence.

In our view, this is unlikely. We believe with an increasing level of confidence that there is a much more important battle going on and the FTT exchange rate is a matter of solvency for Alameda.

حتمی نوٹ:

Industry titans have begun to battle. What began as passive-aggressive comments on social media has turned into outright market-based financial warfare. While Alameda attempts to defend the FTX exchange token FTT with its spare capital, CZ looks to be rejoicing in the moment as speculators pile on short, thus increasing the downward exchange rate pressure.

As of now, we are left with more questions than answers as to the state of Alameda’s financial standing.

متعلقہ ماضی کے مضامین:

- بائنس

- بٹ کوائن

- بکٹکو میگزین

- بٹ کوائن میگزین پرو

- blockchain

- بلاکچین تعمیل

- بلاکچین کانفرنس

- Coinbase کے

- coingenius

- اتفاق رائے

- کرپٹو کانفرنس

- کرپٹو کان کنی

- cryptocurrency

- مہذب

- ڈی ایف

- ڈیجیٹل اثاثے۔

- ethereum

- تبادلے

- FTX

- لیکویڈیٹی

- مشین لرننگ

- Markets

- غیر فنگبل ٹوکن

- پلاٹا

- افلاطون اے

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- پلیٹو گیمنگ

- کثیرالاضلاع

- داؤ کا ثبوت

- W3

- زیفیرنیٹ