I’m here to ease any fears you have about your cryptocurrency portfolio after this week’s events.

And by that, I mean the entire market cap reducing by 20% in 24 hours after FTX, one of the leading cryptocurrency exchanges, completely fell apart on Tuesday.

یہ ہے کیا ہوا…

It all started on November 2 when سکےڈسک published a story about the secret liquidity crisis going on at المیڈا ریسرچ, which is FTX’s sister company, also owned by سیم بینک مین فرائیڈ.

A leaked balance sheet from Alameda revealed the bulk of its assets were made up of ایف ٹی ایکس ٹوکن (FTT), FTX’s “stable”-coin.

But things really began to fall apart on Sunday when بننس سی ای او Changpeng زو (who also happens to be FTX’s biggest competitor) tweeted that he’d be exiting Binance’s position in FTT due to liquidity concerns with FTX. This only fueled growing rumors about the exchange’s longevity, and investors started to peace out.

Everything came to a head on Tuesday when SBF finally admitted a) it’s all true, most of Alameda’s assets are held in a cryptocurrency that he created, and b) FTX is definitely broke.

By Wednesday, the FTT (the FTX stablecoin) had collapsed by 50% in 24 hours.

The rest of the market was just collateral damage. Because FTX would only allow investors to withdraw their crypto in fiat currency (like USD), بٹ کوائن (BTC) اور ایتھرم (ETH) experienced a sell-off causing price dips of more than 10% in 24 hours.

Some of our other favorite assets dipped as much as 20%.

That’s why all of our portfolios took a beating this week, even if you didn’t use FTX or own FTT.

تو اب کیا؟

Here’s what I want you to do about your losses this week:

Absolutely nothing. Whatever you do, don’t touch that “Sell” button.

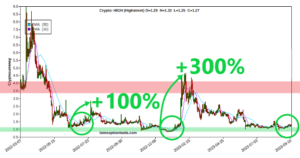

The markets are already starting to rebound. BTC and ETH have already bounced back 6% and 11% in the last 24 hours as of this writing.

Polygon, on the other hand, is up by 30% in the last 24 hours for a price of $1.12. That’s higher than it was a week ago before this all even started.

The moral of the story: don’t panic. Any investor who panic-sold their cryptocurrency this week is surely regretting it today.

Instead of mulling over markets, I spent this morning’s episode of امریکی انسٹی ٹیوٹ برائے کرپٹو سرمایہ کار لائیو reviewing the cryptocurrency exchanges that I do consider trustworthy, unlike FTX.

You might be surprised with my answers, because بننس or Crypto.com aren’t anywhere on the list.

There is one popular name there, سکےباس, but it’s not my favorite, and you need to watch out for the random trash cryptos that show up there all the time.

میں بھی مداح ہوں۔ Kraken for its enhanced security.

مجھے پسند ہے KuCoin for its ease-of-use.

بٹریکس۔ is safe and doesn’t steal, even if its liquidity is a bit low.

آخر میں، بٹرو is where I look for obscure trading pairs.

- اے آئی سی آئی ڈیلی

- سرمایہ کار

- امریکی انسٹی ٹیوٹ برائے کرپٹو سرمایہ کار

- بٹ کوائن

- blockchain

- بلاکچین تعمیل

- بلاکچین کانفرنس

- Coinbase کے

- coingenius

- اتفاق رائے

- کرپٹو کانفرنس

- کرپٹو کان کنی

- cryptocurrency

- مہذب

- ڈی ایف

- ڈیجیٹل اثاثے۔

- ethereum

- مشین لرننگ

- غیر فنگبل ٹوکن

- پلاٹا

- افلاطون اے

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو بلاک چین

- پلیٹو ڈیٹا

- پلیٹو گیمنگ

- کثیرالاضلاع

- داؤ کا ثبوت

- W3

- زیفیرنیٹ