If it wasn’t clear enough already that SEC Chair Gary Gensler views most crypto tokens as securities from the بہت سے اوقات اس کے پاس ہے ایسا کہا, two weeks ago the SEC began walking the walk instead of just talking. It الزام عائد کیا a former Coinbase product manager with insider trading, and in its شکایت listed nine specific tokens غیر رجسٹرڈ سیکیورٹیز کے طور پر۔

It looks to me like the biggest crypto news of the summer so far, with the most wide-reaching implications for the industry.

The nine tokens are AMP, Rally (RLY, DerivaDEX (ڈی ڈی ایکس), XYO, راڑی گورننس ٹوکن (آر جی ٹی), LCX, Powerledger (واپسی), ڈی ایف ایکس, and Kromatika (کروم). The first seven are listed on Coinbase for trading. (DFX and KROM were in an internal Coinbase spreadsheet of tokens it planned to list, but it never did.)

The nine projects behind these tokens have been conspicuously silent in response to the SEC fingering them. Coinbase has not.

سکے بیس blog post retort from chief legal officer پال گریوال was titled, “Coinbase does not list securities. End of story.” Grewal wrote, “None of these assets are securities. Coinbase has a rigorous process to analyze and review each digital asset before making it available on our exchange … this process includes an analysis of whether the asset could be considered to be a سیکورٹی".

But of course, it is not the end of the story. It is just the beginning. And Gensler will not say, “Oh, never mind, Coinbase says they aren’t securities.”

Binance, in response to the SEC’s edict, delisted AMP, the only one of the nine listed on Binance US. It said it was doing so out of an “abundance of caution.” This was some effective trolling of rival Coinbase, which cannot afford the optics of کیپٹولیٹنگ by delisting the tokens.

Last time the SEC came after Coinbase for a specific product or asset was a year ago, when it مقدمہ کی دھمکی دی if Coinbase moved forward with its planned high-yield Lend offering. At that time, Ripple CEO Brad Garlinghouse, who has been fighting the SEC since 2020, tweeted a “Die Hard” meme at Coinbase CEO Brian Armstrong: “Welcome to the party, pal.” Mark Cuban also urged Armstrong to “جارحانہ پر جاؤ".

But 13 days after the SEC threat, Coinbase gave in and dropped the product.

This time, the company can’t back down so quickly. Delisting the tokens, as a source at Coinbase told me, would “undercut our whole position.”

On the same day the SEC labeled nine tokens securities, Coinbase filed a “ضابطہ سازی کی درخواست” calling on the agency to put forth a new regulatory framework for digital assets. Coinbase rival FTX wants the same thing; all the exchanges do.

In an interview with FTX CEO Sam Bankman-Fried on Friday for the next episode of our جی ایم پوڈ کاسٹ, I asked about the nine tokens.

“What I would most like to see would be regulatory frameworks, registration form frameworks, coming out for both platforms and assets, and I’m optimistic that over the next year we will see some from multiple agencies,” he said. “That doesn’t mean you can’t make decisions in the meantime. That doesn’t put you in a position where it is impossible to judge what anything is … and it’s very intentional that we have listed fewer tokens on FTX US than many platforms have.”

That sounds like a touch of shade at Coinbase for opening up its floodgates in the first place to so many “shitcoins.” But now Coinbase must stand by its approach and challenge Gensler and the SEC on behalf of its peers.

کرپٹو خبروں سے باخبر رہیں، اپنے ان باکس میں روزانہ کی تازہ ترین معلومات حاصل کریں۔

سے زیادہ خرابی

Ethereum Layer-2 بلاسٹ صرف 400 دنوں میں $4 ملین لاک ہو گیا، خدشات کے باوجود - ڈکرپٹ

MakerDAO کے بانی نے DAI سے ٹورنیڈو کیش فال آؤٹ کے درمیان ڈالر پیگ گرانے کا مطالبہ کیا

جنوبی کوریا غیر رجسٹرڈ کرپٹو ایکسچینج پر کریک ڈاؤن میں KuCoin، Poloniex کو بلاک کرے گا

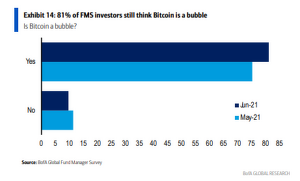

فنڈ مینیجرز میں سے 81 فیصد اب بھی سوچتے ہیں کہ بٹ کوائن ایک بلبلا ہے: بینک آف امریکہ سروے

Musée d'Orsay نئے سامعین تک پہنچنے کے لیے پش میں NFTs کو اپناتا ہے - ڈکرپٹ

آرک انویسٹ کے بٹ کوائن ای ٹی ایف نے GBTC کو پیچھے چھوڑتے ہوئے $87 ملین نیٹ آؤٹ فلو دیکھا - ڈیکرپٹ

ایپل کی تازہ ترین جاب پوسٹنگ میں نئے کریپٹو مقاصد کی تجاویز ہیں

اب آپ بٹ کوائن پر نائنٹینڈو 64 گیمز کھیل سکتے ہیں، اس آرڈینلز پروجیکٹ کی بدولت - ڈکرپٹ

پہلے Bitcoin Runes میں سے ایک کو مِنٹ کرنے کی دوڑ جاری ہے - ڈکرپٹ

PFP NFT مجموعے کیا ہیں؟ ٹویٹر پر 2D اوتار لے رہے ہیں۔

ایل سلواڈور کے 77٪ رہائشیوں کا خیال ہے کہ بوکل کے بٹ کوائن قانون کوئی حکمت عملی نہیں ہے