- The US dollar is the top performer against the JPY on a 5-day rolling basis (+3%).

- A monthly US NFP jobs gain of between +240K to +260K may ignite another bout of US dollar rally.

- Bullish momentum is supporting a potential extension of the ongoing countertrend rebound in USD/JPY.

- Watch the next intermediate resistance at 146.70/147.45

这是我们之前报告的后续分析, “USD/JPY Technical: Potential countertrend USD corrective rebound on the horizon” 发布于 2 年 2023 月 XNUMX 日。点击 相关信息 回顾一下。

USD / JPY has staged the expected countertrend corrective rebound from its 5-month low of 140.25 printed on 28 December 2023. It has rallied by +470 pips/+3.35% to hit a current intraday high of 145.37 today, 5 January Asian session at this time of the writing (see Fig 1).

Revival of short-term US dollar strength

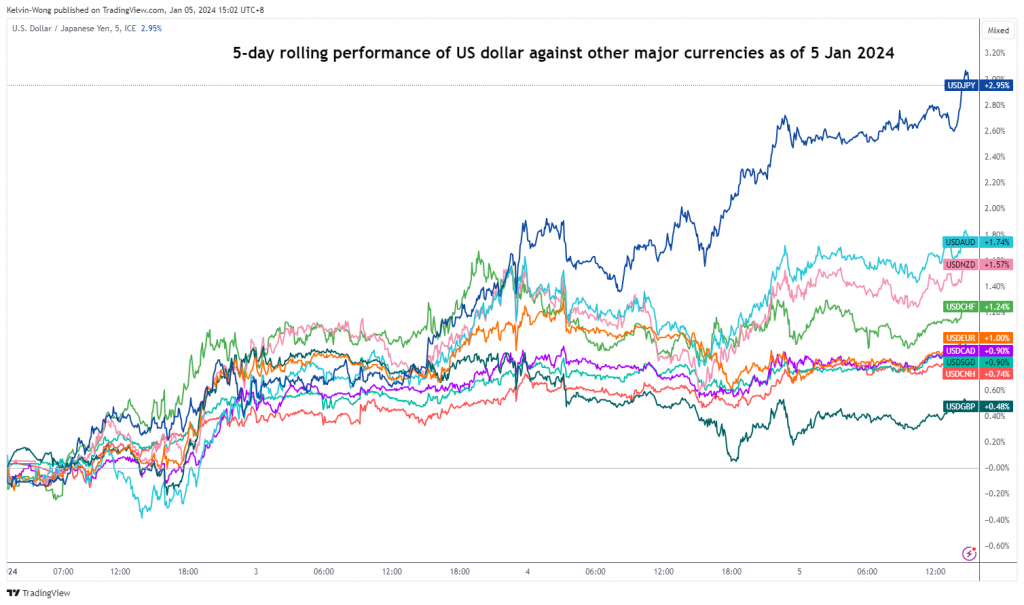

So far, the US dollar has been on a bullish beat since the start of the new year and the USD/JPY is the top performer with a rolling 5-day return of +3% over the USD/AUD (+1.7%), USD/CHF (+1.2%), USD/EUR (+1%), and USD/GBP (+0.5%) ahead of today’s US non-farm payrolls (NFP) jobs data release where the consensus has pencilled in a lower number of +170K jobs added for December 2023 over the prior November’s print of +199K.

The persistent US dollar weakness seen throughout Q4 2023 has been driven by rising expectations on the US Federal Reserve’s dovish pivot to kick start its accommodating monetary policy in 2024 with six cuts on its Fed funds rate being priced in by the interest rate futures market according to the CME FedWatch tool.

+240K to +260K for December NFP may ignite further US dollar strength

Hence, if today’s NFP number shows a higher number of jobs added in December in a range of +240K to +260K that is above the prior 12 months’ average of around +240K monthly gain, the current dovish optimism on the Fed to enact the expected six interest rates cuts is likely to be tapered downwards as the US job market is not in the doldrums which in turn may see a continuation of the current bout of US dollar strength.

Bullish momentum remains intact

图2:截至5年2024月XNUMX日美元/日元中期趋势(来源:TradingView,点击放大图表)

图3:截至5年2023月XNUMX日美元/日元短期小幅走势(来源:TradingView,点击放大图表

The prior three-day rally seen in the USD/JPY is not showing any clear signs of fatigue as its price actions have just surpassed the 20 and 200-day moving averages.

In addition, the hourly RSI momentum indicator has continued to trace out a series of “higher lows” above the 50 level which suggests short-term upside momentum remains intact.

If the 143.75 key short-term pivotal support manages to hold, the USD/JPY may continue its current countertrend corrective rebound leg to see the next intermediate resistances coming in at 146.70 and 147.45 (also the downward sloping 50-day moving average & 61.8% Fibonacci retracement of the medium-term downtrend from 13 November 2023 high to 28 December 2023 low).

However, failure to hold at 143.75 negates the bullish tone to expose the next intermediate support at 142.20 in the first step.

内容仅供一般参考之用。 它不是投资建议或买卖证券的解决方案。 意见是作者; 不一定是 OANDA Business Information & Services, Inc. 或其任何附属公司、子公司、管理人员或董事的信息。 如果您想复制或重新分发 MarketPulse 上的任何内容,这是一项由 OANDA Business Information & Services, Inc. 制作的屡获殊荣的外汇、商品和全球指数分析和新闻站点服务,请访问 RSS 提要或联系我们: info@marketpulse.com。 访问 https://www.marketpulse.com/ 了解有关全球市场节奏的更多信息。 © 2023 OANDA 商业信息与服务公司。

- :具有

- :是

- :不是

- :在哪里

- 1

- 12

- 13

- 140

- 143

- 15 年

- 15%

- 2%

- 20

- 2023

- 2024

- 25

- 28

- 35%

- 50

- 7

- 70

- 700

- 75

- a

- 关于

- 以上

- ACCESS

- 容纳

- 根据

- 行动

- 添加

- 增加

- 忠告

- 分支机构

- 驳

- 向前

- 还

- an

- 检测值

- 分析

- 和

- 另一个

- 任何

- 保健

- 围绕

- AS

- 亚洲的

- At

- 作者

- 作者

- 头像

- 奖

- 基础

- BE

- 打

- 很

- 作为

- 如下。

- 之间

- 盒子

- 看涨

- 商业

- 购买

- by

- 图表

- 清除

- 明确的标志

- 点击

- 芝商所

- COM的

- 组合

- 未来

- 商品

- 进行

- 连接

- 共识

- CONTACT

- 内容

- 延续

- 继续

- 持续

- 课程

- 电流

- 裁员

- data

- 十二月

- 团队介绍

- 美元

- 鸽派的

- 跌势

- 向下

- 驱动

- 埃利奥特

- 放大

- 交换

- 期望

- 预期

- 体验

- 技术专家

- 延期

- 失败

- 远

- 疲劳

- 美联储

- 联邦基金利率

- 联邦

- 美联储

- 斐波那契

- 图

- 金融

- 找到最适合您的地方

- (名字)

- 流

- 针对

- 国外

- 外汇

- 外汇

- 发现

- 止

- 基金

- 根本

- 资金

- 进一步

- 期货

- Gain增益

- 其他咨询

- 全球

- 全球市场

- 有

- 高

- 更高

- 击中

- 举行

- HTTPS

- if

- 点燃

- in

- 公司

- 指示符

- 指数

- 信息

- 兴趣

- 利率

- 利率

- 投资

- IT

- 它的

- 一月三十一日

- 一月

- 工作

- 工作机会

- JPY

- 只是

- 开

- 键

- 踢

- (姓氏)

- Level

- 各级

- 喜欢

- 容易

- 低

- 降低

- 宏

- 管理

- 市场

- 市场前景

- 市场调查

- MarketPulse

- 市场

- 最大宽度

- 可能..

- 未成年人

- 动力泉源

- 货币

- 货币政策

- 每月一次

- 更多

- 移动

- 移动平均线

- 移动平均线

- 一定

- 全新

- 新年

- 消息

- 下页

- NFP

- 非农就业人数

- 十一月

- 数

- 众多

- of

- 人员

- on

- 正在进行

- 仅由

- 意见

- 乐观

- or

- 我们的

- 输出

- Outlook

- 超过

- 多情

- 工资单

- 表演者

- 观点

- 照片

- 枢

- 关键的

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 请

- 政策

- 定位

- 帖子

- 潜力

- 车资

- 打印

- 先

- 生成

- 优

- 目的

- 团结

- 范围

- 率

- 价格表

- 反弹

- 概括

- 释放

- 遗迹

- 报告

- 研究

- 抵制

- 零售

- 回撤

- 回报

- 翻转

- 上升

- 卷

- RSI

- RSS

- 证券

- 看到

- 看到

- 出售

- 前辈

- 系列

- 服务

- 特色服务

- 会议

- 共享

- 短期的

- 作品

- 迹象

- 自

- 新加坡

- 网站

- SIX

- 倾斜

- 方案,

- 来源

- 专业

- 开始

- 步

- 库存

- 股市

- 战略家

- 实力

- 提示

- SUPPORT

- 支持

- 超越

- 文案

- 技术分析

- 十

- 这

- 美联储

- Free Introduction

- 数千

- 三天

- 始终

- 次

- 至

- 今晚

- 今天的

- TONE

- 工具

- 最佳

- 追踪

- 交易商

- 交易

- TradingView

- 产品培训

- 趋势

- 转

- 独特

- 上边

- us

- 美元

- 美国联邦

- 美国非农

- USD

- USD / CHF

- USD / JPY

- 运用

- v1

- 参观

- 波

- 虚弱

- 井

- 这

- 胜利

- 弘

- 将

- 写作

- 年

- 年

- 完全

- 和风网