Nedenstående er et uddrag fra en nylig udgave af Bitcoin Magazine Pro, Bitcoin Magazine premium markets nyhedsbrev. For at være blandt de første til at modtage disse indsigter og andre on-chain bitcoin markedsanalyser direkte til din indbakke, Tilmeld nu.

Opdatering af optioner og derivater

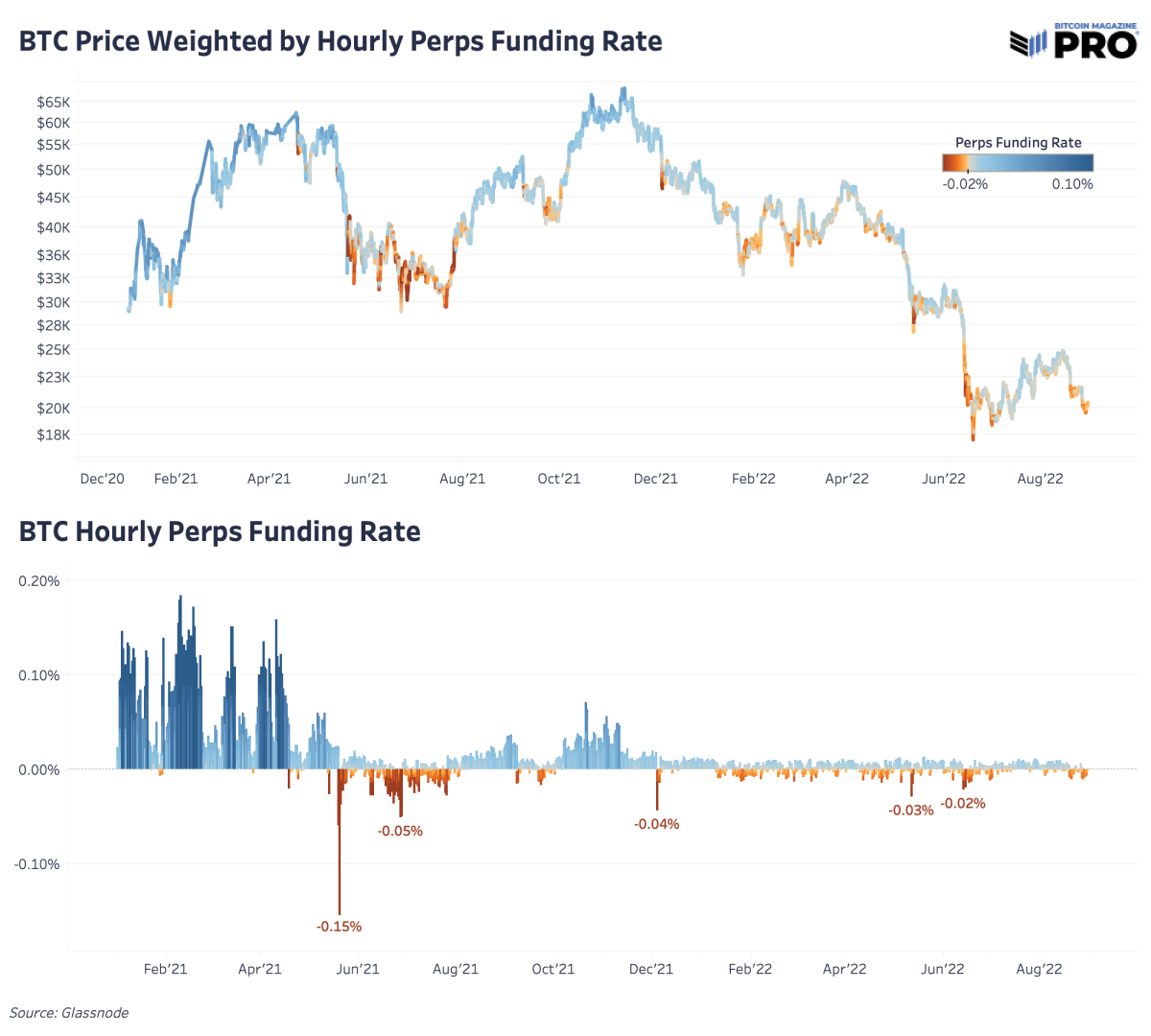

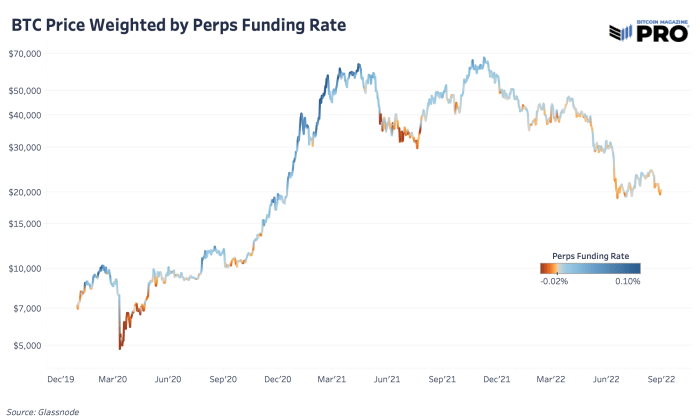

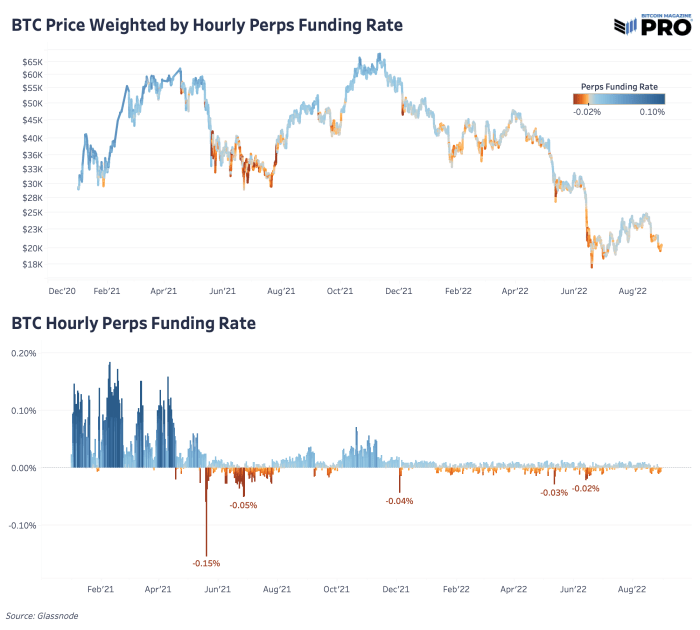

One dynamic and chart we’ve covered extensively before is bitcoin’s perpetual futures market funding rate compared to price. In the previous 2021 bull run, the perpetual (perps) futures market played a key role in moving short-term prices to both the upside and downside with excessive leverage. It’s worth reviewing the state of the derivatives market and the system’s current leverage as bitcoin price has broken down from its latest rally, following U.S. equities on a potential path towards new lows.

Siden toppen i november 2021 har det evige futuresmarked været konsekvent skævt mod nedsiden (neutral funding rate er 0.10%). Enkelt sagt, flere af markedsdeltagerne var og er stadig biased short i løbet af de sidste otte måneder. Selv under det seneste rally på bjørnemarkedet har det ikke ændret sig. Vi så ikke finansieringsrenten gå over neutralt territorium, hvilket viser et tydeligt tegn på, at lange spekulanter og risikovillighed ikke er vendt tilbage til markedet.

With the successful launch of a bitcoin futures ETF in U.S. markets last fall, along with a general unwind in speculative activity across the bitcoin/cryptocurrency market, perp funding rates have been teetering from a neutral to short bias with much less explosive moves in funding rates. Although derivatives market dynamics have changed, it’s still worth watching for an actionable signal from the perps market where the shorting bias gets heavily offside as it’s shown to do throughout history marking significant bottoms. It’s worth noting that in previous bear market cycles (where new incoming spot demand was diminished by willing sellers) funding could stay negative for long periods of times, due to lack of demand to speculate/leverage the asset from the bulls.

In previous bitcoin bear markets, funding could stay negative for long periods of times due to lack of demand to speculate/leverage BTC.

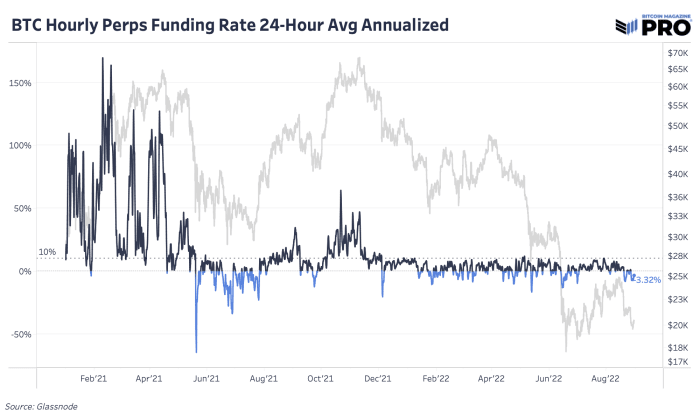

En anden måde at visualisere finansieringsrenten på er at se på en årlig værdi med de nuværende negative finansieringsrater, der giver estimeret 3.32 % for at tage en long mod størstedelen af shorts. Siden sammenbruddet i november 2021 er markedet endnu ikke kommet tilbage over den årlige neutrale finansieringsrente.

Prisen har bevæget sig med tendensen til faldende futuresmarkeds åben interesse i USD siden markedstoppen. Det er nemmere at se i det andet og tredje diagram nedenfor, som blot viser perps futures markedsandel af alle futures open interest. Perps-markedet tegner sig for broderparten af åbne renter på over 75% og er vokset betydeligt fra cirka 65% i starten af 2021.

Med den mængde af gearing, der er tilgængelig på perps-markedet, giver det mening, hvorfor perps-markedsaktivitet har så stor en indflydelse på prisen. Ved at bruge en grov beregning af den samlede perps markedsvolumen fra Glassnode på 26.5 milliarder dollars om dagen (7-dages glidende gennemsnit) versus Messaris rigtige spotvolumen (7-dages glidende gennemsnit justeret for oppustede børsvolumener) på 5.7 milliarder dollar, handler perps-markedet næsten fem gange volumen til spotmarkeder. Derudover er det daglige spotvolumen faldet med næsten 40 % i forhold til sidste år, en statistik, der hjælper med at forstå, hvor meget likviditet der har forladt markedet.

Given the volume of the bitcoin derivative contracts relative to spot markets, one may arrive at the conclusion that derivatives can be used to suppress bitcoin. We actually disagree, given the dynamically priced interest rate associated with bitcoin futures products, we believe that on a long enough time frame the effect of derivatives is net neutral on price. While bitcoin likely exploded much higher than it otherwise would have due to the reflexive effects of leverage, those positions eventually were forced to close, thus an equal negative reaction was absorbed by the market.

- Bitcoin

- Bitcoin Futures

- Bitcoin Magazine

- Bitcoin Magazine Pro

- Bitcoin Price

- blockchain

- overholdelse af blockchain

- blockchain konference

- coinbase

- coingenius

- Konsensus

- kryptokonference

- krypto minedrift

- cryptocurrency

- decentral

- Defi

- Digitale aktiver

- ethereum

- machine learning

- Markeder

- ikke fungibelt symbol

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- bevis for indsatsen

- W3

- zephyrnet