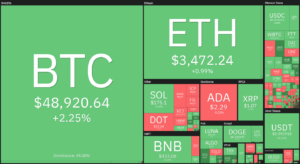

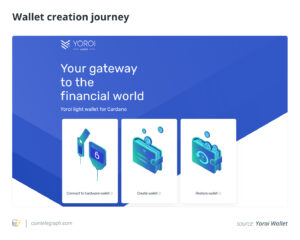

Architect Financial Technologies, the startup founded by former FTX.US president Brett Harrison, will provide derivatives brokerage services after its Architect Financial Derivatives subsidiary received approval from the National Futures Association (NFA) to operate as an independent introducing broker. The company is eyeing both the cryptocurrency derivatives market and the traditional market, Harrison said.

En introducerende mægler er en NFA medlem that “solicits or accepts orders to buy or sell futures contracts, commodity options, retail off-exchange forex contracts, or swaps,” but does not receive money from customers for doing it. Architect is a software provider.

Harrison fortalt Bloomberg Markets hovedfokus for virksomheden er at:

“Build out regulated businesses in the exchange-traded derivatives spaces, not just for crypto derivatives, but for derivatives at large.”

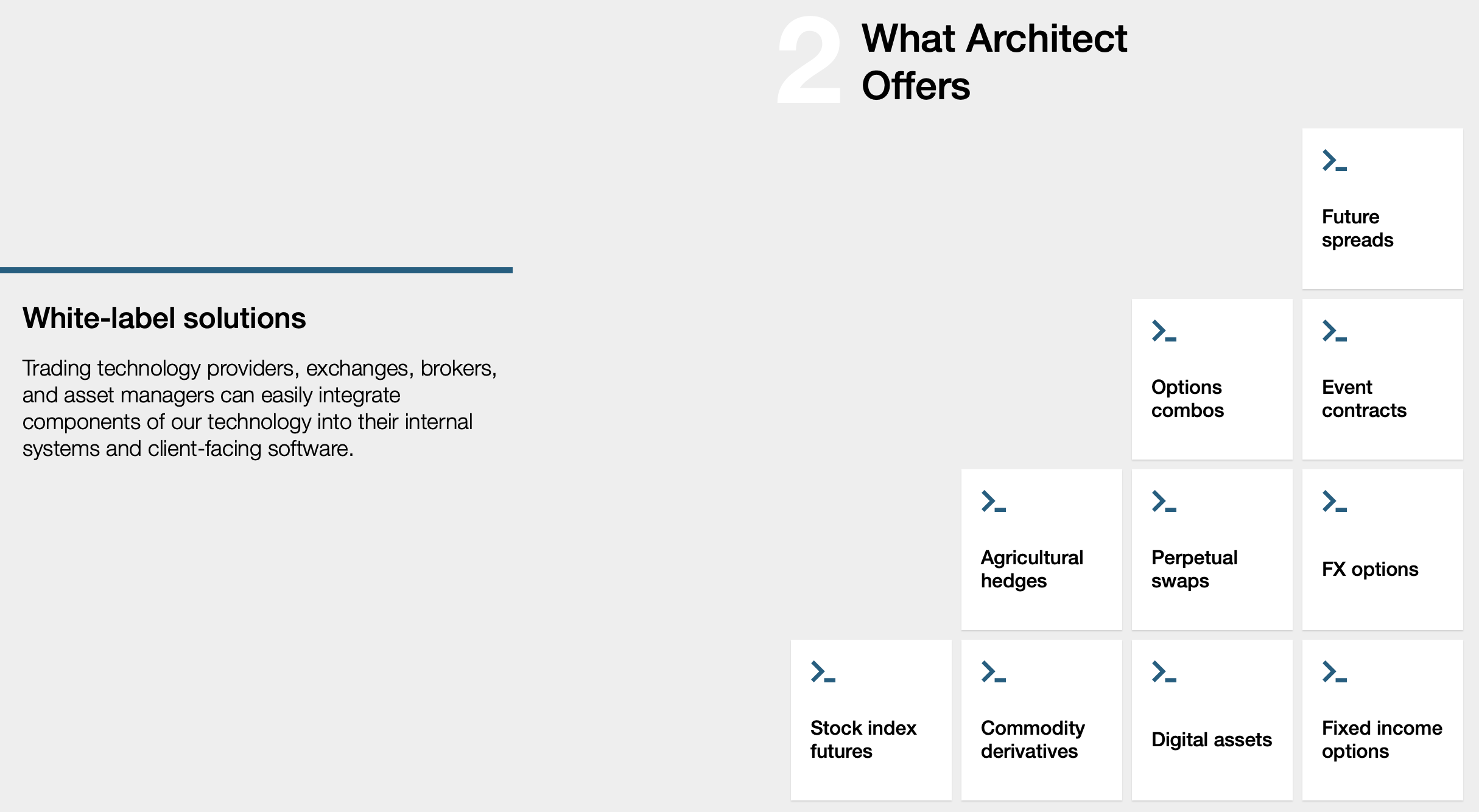

Ifølge en meddelelse vil Architect-handelsplatformen tilbyde handel med en række derivater på børser reguleret af United States Commodity Futures Trading Commission med clearingtjenester gennem regulerede partnere. Det vil også tilbyde adgang til over 20 regulerede børser internationalt til kvalificerede kunder.

Relateret: Skyhøje renter er præcis, hvad kryptomarkedet har brug for

Harrison startede Architect i januar med $5 millioner fra investorer, der blandt andet inkluderede Coinbase Ventures og Circle Ventures. Det blev skabt med den hensigt at levere handelssoftware til institutionelle investorer.

Harrison was the president of FTX.US from May 2021 to September 2022, fratræde før kryptovalutabørsen gik konkurs sammen med andre FTX-tilknyttede virksomheder i november samme år. Harrison dokumenterede hans forhold with FTX CEO Sam Bankman-Fried in a massive Twitter (now X) thread in January.

Ensartede, konfigurerbare optioner med flere børser, der handles videre @Architect_xyz pic.twitter.com/cgd8JfaFow

— Brett Harrison (@BrettHarrison88) September 1, 2023

Under Harrison’s leadership, Chicago-based FTX.US afsluttet en finansieringsrunde på 400 millioner dollars , annonceret planer om at åbne en aktiehandelsplatform. Ligesom Bankman-Fried og andre tidligere FTX-direktører begyndte Harrison sin karriere hos Jane Street Capital.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- PlatoHealth. Bioteknologiske og kliniske forsøgs intelligens. Adgang her.

- Kilde: https://cointelegraph.com/news/architect-fintech-receives-nfa-approval-operate-introducing-broker

- :er

- :ikke

- 1

- 20

- 2021

- 2022

- a

- accepterer

- adgang

- Efter

- sammen

- også

- blandt

- an

- ,

- godkendelse

- ER

- AS

- Association

- At

- Bankmand-Fried

- bankerot

- før

- begyndte

- begynde

- Bitcoin

- Bloomberg

- både

- Brett Harrison

- mægler

- mæglervirksomhed

- virksomheder

- men

- købe

- by

- kapital

- Karriere

- Direktør

- Circle

- Circle Ventures

- Rydning

- coinbase

- Coinbase Ventures

- Cointelegraph

- Kommissionen

- råvare

- Virksomheder

- selskab

- kontrakter

- oprettet

- krypto

- Crypto Market

- cryptocurrency

- Kunder

- Derivater

- Fordøje

- gør

- gør

- præcist nok

- børsnoteret

- Udvekslinger

- ledere

- eyeing

- gebyr

- finansielle

- Finansielle derivater

- finansielle teknologier

- fintech

- Fokus

- Til

- forex

- Tidligere

- Grundlagt

- fra

- FTX

- direktør for FTX

- FTX ledere

- FTX tokens

- finansiering

- Futures

- Futureshandel

- hans

- HTML

- HTTPS

- in

- medtaget

- uafhængig

- Institutionel

- Institutionelle investorer

- Intention

- interesse

- Renter

- internationalt

- indføre

- Investorer

- IT

- ITS

- jane

- januar

- lige

- stor

- Leadership" (virkelig menneskelig ledelse)

- ligesom

- Main

- Marked

- Markeder

- massive

- Kan..

- million

- penge

- national

- nyheder

- november

- nu

- of

- tilbyde

- tilbud

- on

- betjene

- Indstillinger

- Options Trading

- or

- ordrer

- Andet

- Andre

- ud

- i løbet af

- partnere

- planer

- perron

- plato

- Platon Data Intelligence

- PlatoData

- præsident

- give

- udbyder

- leverer

- kvalificeret

- rækkevidde

- priser

- modtage

- modtaget

- modtager

- reguleret

- detail

- Said

- salg

- Sam

- Sam Bankman Fried

- sælger

- syv

- september

- Tjenester

- sæt

- Software

- Kilde

- rum

- påbegyndt

- opstart

- Statement

- Stater

- bestand

- aktiehandel

- gade

- datterselskabet

- Swaps

- Teknologier

- at

- Gennem

- til

- Tokens

- Trading

- Trading Platform

- traditionelle

- Forenet

- Forenede Stater

- us

- Amerikanske præsident

- Ventures

- var

- gik

- Hvad

- vilje

- med

- X

- år

- zephyrnet