Bitcoin pris, which had been striving to break the $28k threshold over the past three days, ultimately yielded to the prevailing sell pressure within the last 24 hours. As per the latest crypto price oracles, Bitcoin experienced a decline of approximately 2.4 percent during this period, now hovering around $27,159 during the early London market hours on Wednesday. If this downward trend continues, Bitcoin is likely to conclude the month of May on a bearish note, marking a shift from the bullish sentiments observed in the initial four months of the year.

Bitcoin markedsanalyse

I en nylig YouTube-video kastede en analytiker fra InvestAnswers lys over en bemærkelsesværdig udvikling: oddsene favoriserer et Bitcoin-guldkryds på den ugentlige tidsramme, der potentielt finder sted i august i år. Denne prognose kommer på trods af Bitcoins første ugentlige dødskors, set mellem 50 og 200 glidende gennemsnit. Analytikeren påpegede, at Bitcoin reagerede på denne hændelse med en bullish udsigt, hvilket viste sin modstandskraft.

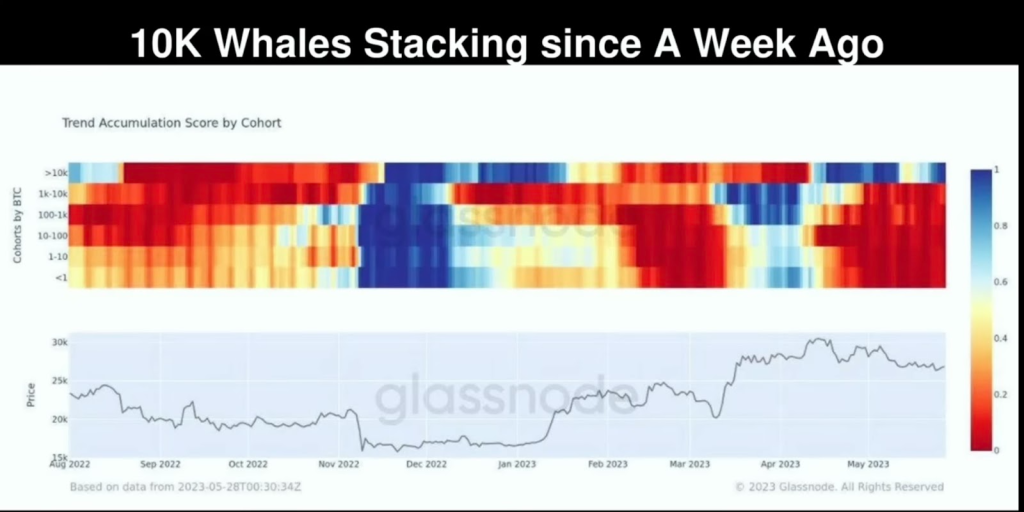

Ifølge analytikeren har Bitcoin-hvaler med mere end 10 enheder stablet i den seneste uge på trods af den øgede volatilitet.

Ikke desto mindre advarede analytikeren handlende om en indkommende recession ifølge data fra konferencens bestyrelses førende indeks, hvis globale monetære regulatorer ikke træffer foranstaltninger for at sikre en blød landing.

Investorbekymringer stiger

Bitcoin’s dominance over the entire crypto market retraced from 48 percent following today’s dip. A further decline in Bitcoin dominans is likely to trigger rising dominos in the altcoin market. From another perspective, Bitcoin’s capitulation could send fear and shock waves in the entire crypto industry and cause more sell-offs in the near term.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoAiStream. Web3 Data Intelligence. Viden forstærket. Adgang her.

- Udmøntning af fremtiden med Adryenn Ashley. Adgang her.

- Køb og sælg aktier i PRE-IPO-virksomheder med PREIPO®. Adgang her.

- Kilde: https://coinpedia.org/bitcoin/bitcoin-golden-cross-in-august-heres-what-next-for-btc-price/

- :er

- :ikke

- 10K

- 200

- 24

- 50

- 7

- a

- Ifølge

- Altcoin

- an

- analyse

- analytiker

- ,

- En anden

- cirka

- ER

- omkring

- AS

- AUGUST

- bearish

- været

- mellem

- Bitcoin

- Bitcoin Gold

- bitcoin hvaler

- board

- Pause

- BTC

- btc pris

- Bullish

- kapitulation

- Årsag

- Coinpedia

- kommer

- Bekymringer

- konkluderer

- Konference

- konference bestyrelse

- fortsætter

- kunne

- Cross

- krypto

- Kryptoindustri

- Crypto Market

- Kryptopris

- data

- Dage

- Død

- Afvis

- Trods

- Udvikling

- Dyp

- do

- Dominans

- nedad

- i løbet af

- Tidligt

- sikre

- Hele

- erfarne

- frygt

- fintech

- Fornavn

- efter

- Til

- Forecast

- fire

- FRAME

- fra

- yderligere

- Global

- Guld

- Golden

- havde

- Have

- link.

- Høj

- HOURS

- HTTPS

- if

- in

- Indgående

- øget

- indeks

- industrien

- initial

- InvestAnswers

- ITS

- juni

- landing

- Efternavn

- seneste

- førende

- niveauer

- lys

- Sandsynlig

- London

- Lav

- lave niveauer

- Marked

- Markedsanalyse

- mærkning

- max-bredde

- Kan..

- foranstaltninger

- Monetære

- Måned

- måned

- mere

- flytning

- glidende gennemsnit

- I nærheden af

- næste

- bemærkelsesværdigt

- nu

- forekommende

- Odds

- of

- on

- orakler

- ud

- Outlook

- i løbet af

- forbi

- procent

- periode

- perspektiv

- plato

- Platon Data Intelligence

- PlatoData

- punkter

- potentiale

- potentielt

- forudsigelse

- tryk

- pris

- Prediction

- sætte

- Læs

- nylige

- recession

- Regulators

- modstandskraft

- stigende

- s

- sælger

- send

- kaste

- skifte

- fremvisning

- Soft

- stabling

- semester

- end

- at

- Den ugentlige

- denne

- i år

- tre

- tærskel

- tid

- til

- nutidens

- Traders

- Trend

- udløse

- Ultimativt

- enheder

- video

- Volatilitet

- bølger

- Onsdag

- uge

- ugentlig

- hvaler

- Hvad

- som

- med

- inden for

- vidne

- år

- gav efter

- youtube

- zephyrnet