For many people, Bitcoin is synonymous with freedom, decentralization, independence and the future. Some consider it akin to anarchy, an online revolution that began with the minting of the first block of Bitcoin that flipped the proverbial bird at central banks and government policy makers.

For regeringer er udsigten dog anderledes. Generelt opfatter de, der styrer andre, rutinemæssigt kryptovaluta-økosfæren som et lovløst sted, der bruges til at finansiere terrorisme og andre ulovlige aktiviteter, hvidvaske penge og unddrage skat.

Som svar på billioner af dollars af investor- og kommerciel interesse, præsident Joe Biden udstedte en udøvende ordre calling on the government to examine the risks and benefits of cryptocurrencies. The executive order’s explicit aim is to explore a U.S. central bank digital currency (CBDC), which would be a digital fiat, backed by the United States government. But if the original purpose behind the creation of cryptocurrency was to eliminate government control and oversight over fiat and monetary policy, how far will the U.S. government’s control over its citizens’ digital currency extend?

Bekendtgørelsen siger, at "USAs vigtigste politiske mål med hensyn til digitale aktiver er som følger: Vi skal beskytte forbrugere, investorer og virksomheder i USA." Politikken fortsætter med at artikulere, at digitale aktiver har "dybe implikationer" på "kriminalitet; national sikkerhed; evnen til at udøve menneskerettigheder; finansiel inklusion og egenkapital; og energiefterspørgsel og klimaændringer." Bekendtgørelsen isolerer aktivklassen som "ikke-statsligt udstedte digitale aktiver." Fremtidige regulerings-, styrings- og teknologiske foranstaltninger vil angiveligt være designet til at "modvirke ulovlige aktiviteter" og "forbedre effektiviteten af vores nationale sikkerhedsværktøjer." Selvom der ikke kan benægtes den mørke side af kryptovaluta og dens mulige kriminelle anvendelser, ønsker den amerikanske regering ikke kun at regulere kryptovaluta, de søger at kontrollere den.

It appears a sure bet that the United States government will (1) regulate private cryptocurrency while (2) issuing its own government-controlled digital token. And in the context of the world’s leading liberal democracy founded on a rule of law based on limitation of government powers, this development warrants serious scrutiny.

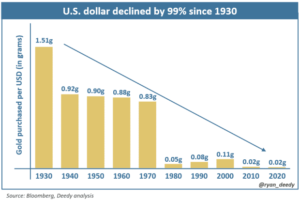

Går man helt tilbage til dannelsen af USA, var grundlæggerne skeptiske over for at give banker og regeringer kontrol over valutaer. Under udarbejdelsen af den amerikanske forfatning trak John Adams på kolonistens mistillid til regeringsudstedte penge og erklærede that every dollar of printed fiat money was “a cheat upon somebody.” The drafters left the federal government with only the power to “coin money,” and forbade the states from making anything but gold and silver coin legal “tender.” Years later, in 1816, Thomas Jefferson skrev that “banking establishments are more dangerous than standing armies… [and] the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

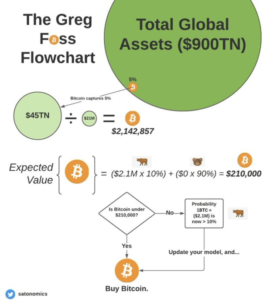

The advent of Bitcoin appeared to be the antidote to the centuries-old problem identified by Jefferson. Bitcoin was specifically designed to obviate the need for a central bank or single administrator. In fact, Bitcoin does not need government support, or to be “backed” by gold and silver. Bitcoin was architected to comprise a store of value who’s value would be determined by the global population’s free market dynamics, via simply supply and demand arithmetic.

So why should any of this matter? At times, the U.S. government has historically suppressed the rights of Americans, and many Americans have shown that they are more than willing to give up those freedoms. It is only a matter of time before the United States issues a digital currency, and likely attempts to suppress, through whatever means, the value and utility of bitcoin, along with the rights of its citizens.

Med en amerikansk udstedt digital mønt vil regeringen blandt andet have den tekniske kapacitet til at begrænse og lægge pres på, hvad amerikanere kan købe, til at spore og overvåge borgernes udgifter og sætte grænser for mængden eller mængden af produkter, vi køber. .

I ekstreme tilfælde kunne regeringen ophæve eller fjerne alle CDBC-midler fra cirkulation eller fra en persons kontrol. Det er allerede en realitet i straffesager, men her er bekymringen regeringens evne og vilje til at bruge digitale dollars til at overvåge og kontrollere, selv uden eksistensen af strafferetlige anklager eller en domfældelse. Disse bekymringer er ikke blot hypotetiske. Sidste år beordrede den canadiske regering finansielle virksomheder til ophøre med at lette alle transaktioner fra 34 krypto-punge, der er knyttet til finansiering af vognmandsledede protester over COVID-19-vaccinemandater.

Examples in the United States are easy to conceptualize. If Congress believes that cutting down on gasoline would lower emissions enough to reverse climate change, they could put spending limits on the amount of gas one could purchase. Instead of raising taxes on cigarettes, the government could nullify all cigarette purchases made with digital dollars. While the “in party” will be temporarily satisfied at the expense of the “out party,” fortunes can change fast. Constitutional questions (which often take years to resolve) notwithstanding, where a Republican administration might ban the use of digital dollars to pay for Planned Parenthood services for example, a Democratic administration could just as easily ban the use of digital dollars to purchase guns or ammunition. The reality is that both political parties may well be tempted to utilize digital dollars to influence societal behavior and punish transgressors by restraining the ability to use the currency for travel, education and other essential life activities.

Så er vi på vej ubønhørligt og i kædefart mod en fremtid, hvor, som George Orwell advarede, “nothing was your own except the few cubic centimeters in your skull?” Will the United States government utilize digital coins to create a social credit scoring system on par with China’s? That depends. Not only on the government’s actions, but on the vigilance of lawyers in private practice and civil libertarians more generally. Careful attention must be paid to any efforts by the government to utilize digital dollars for surveillance, control or unlawful restriction of individual privacy and liberty. Because, after all, if “love of money is the root of all evil,” then unconstrained U.S. government-issued digital dollars may turn into the “mother of all evils.”

Zachary Reeves, en associeret med Baker McKenzie, bidrog også til denne artikel.

Dette er et gæsteindlæg af Bradford Newman. Udtalte meninger er helt deres egne og afspejler ikke nødvendigvis dem fra BTC Inc Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

- overholdelse af blockchain

- blockchain konference

- CBDCA

- Borgerrettigheder

- coinbase

- coingenius

- Konsensus

- kryptokonference

- krypto minedrift

- cryptocurrency

- Medarbejder kultur

- decentral

- Defi

- Digitale aktiver

- ethereum

- Liberty

- machine learning

- ikke fungibelt symbol

- Udtalelse

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- bevis for indsatsen

- amerikansk dollar

- W3

- zephyrnet