Bitcoin (BTC) is entering a new “speculation cycle” typical of a bull run, new analysis says.

I en tweet on May 16, Philip Swift, creator of data resource LookIntoBitcoin and co-founder of trading suite Decentrader, revealed history repeating itself according to the RHODL-forhold metrisk.

RHODL Ratiocreator på BTC-pris: "Zoom ud"

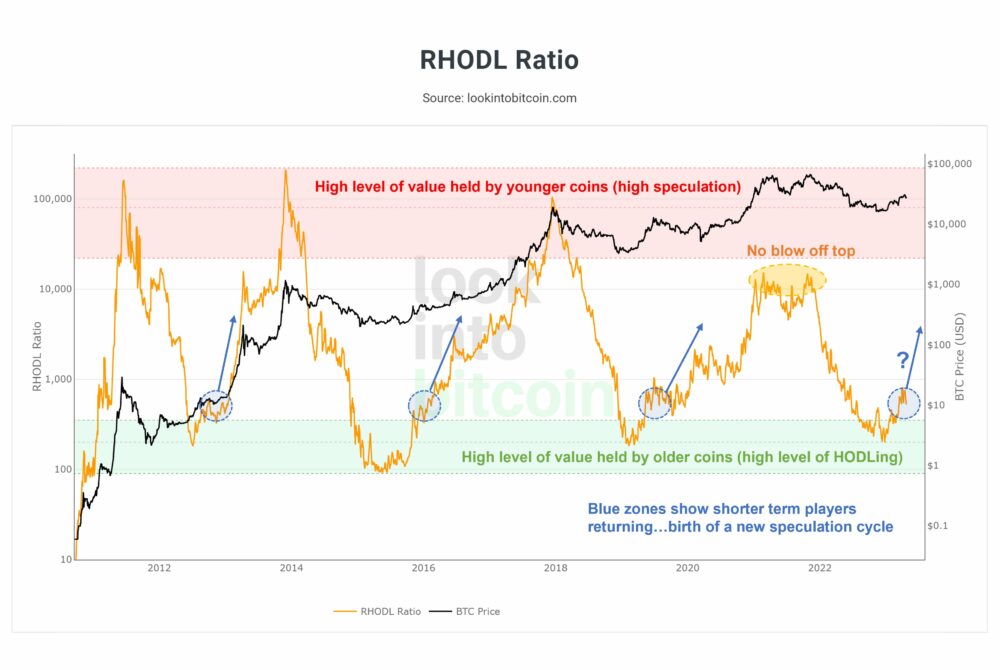

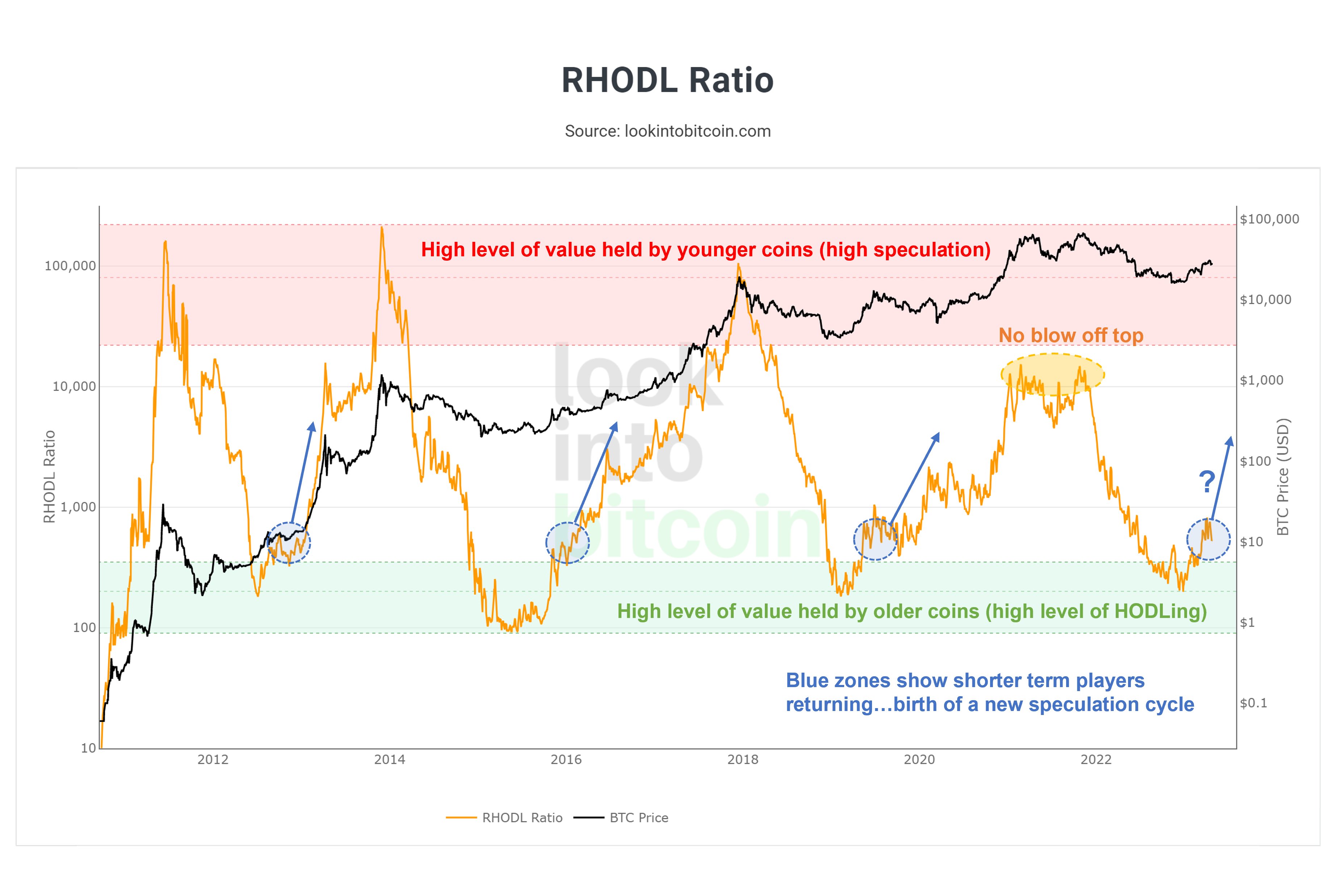

RHODL Ratio er en metode til at spore BTC-prisadfærd baseret på den realiserede pris på forsyningen - den pris, som mønter sidst flyttede til.

Created by Swift in 2020, it compares the relative ages of coins which moved one week ago to those which moved 1-2 years ago.

This ratio gives an insight into the relative activity of short-term (STHs) and long-term holders (LTHs), and by extension the extent to which speculation is present on the market.

I øjeblikket hopper RHODL højere, efter at have ramt sin grønne akkumuleringszone i slutningen af 2022.

At the time, Swift fortalt Cointelegraph that Bitcoin was “at the point of maximum opportunity” — something which has since proven true, with BTC/USD gaining 70% in Q1 2023.

Prior to that, its descent toward that point had faldt sammen with Bitcoin’s own retreat to macro lows.

Nu, hvor den spekulative aktivitet tilsyneladende er stigende, mener han, at en ny tyrecyklus allerede er i gang.

"Da jeg oprettede bitcoin RHODL Ratio-indikatoren i 2020, var en ting, der slog mig, hvordan den viste, at et nyt tyreløb dannedes ... da forholdsværdien af yngre mønter begyndte at stige. Det er der, vi er lige nu,” kommenterede han.

"Gå ikke i panik over små pristilbagetrækninger. Zoome ud."

Swift er ikke alene i sin overbevisning. Reagerende, Checkmate, ledende on-chain analytiker hos Glassnode, kaldet RHODL Ratio "et af de største onchain-fund."

An accompanying chart meanwhile added that the 2021 bull market, despite delivering a blow-off top for BTC/USD, did not see a copycat move for RHODL. The last time the metric hit its red “high speculation” zone was at Bitcoin’s prior all-time high in late 2017.

Frygt, depression og manglende interesse

Swift hævdede fortsat, at markedsdeltagere på korte tidsrammer forbliver risikable på kryptomarkeder.

Relateret: Se disse BTC-prisniveauer, da Bitcoin truer med at miste $27K support

The conclusion followed a scan of funding rates on exchanges, with a slew of “bearish” ratings for Bitcoin generated by Decentrer. These concerned open interest and long/short ratio in addition to funding rates themselves.

"Markedet er stadig bange/deprimeret/uinteresseret..." han opsummeret på dagen.

Earlier this month, Swift gave Cointelegraph an opdateret prognose on what might happen to Bitcoin in the final year before its next block subsidy halving. Among other eventualities, a return to $20,000 is not out of the question.

Magazine: Alamedas $38B IRS-regning, Do Kwon sparkede aktiverne ind, Milady-vanvid: Asia Express

Denne artikel indeholder ikke investeringsrådgivning eller anbefalinger. Enhver investerings- og handelsbevægelse indebærer risiko, og læsere bør foretage deres egen forskning, når de træffer en beslutning.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoAiStream. Web3 Data Intelligence. Viden forstærket. Adgang her.

- Udmøntning af fremtiden med Adryenn Ashley. Adgang her.

- Køb og sælg aktier i PRE-IPO-virksomheder med PREIPO®. Adgang her.

- Kilde: https://cointelegraph.com/news/one-of-the-greatest-bitcoin-metrics-says-btc-price-bull-run-is-here

- :har

- :er

- :ikke

- :hvor

- 000

- 2017

- 2020

- 2021

- 2022

- 2023

- a

- Om

- Ifølge

- akkumulering

- aktivitet

- tilføjet

- Desuden

- rådgivning

- Ages

- siden

- alene

- allerede

- blandt

- an

- analyse

- analytiker

- ,

- ER

- argumenteret

- artikel

- AS

- asia

- Aktiver

- At

- baseret

- før

- begyndte

- mener

- Bill

- Bitcoin

- Bloker

- blok tilskud

- afblæsning

- BTC

- btc pris

- BTC / USD

- tyr

- Bull Market

- Tyreløb

- by

- Chart

- Medstifter

- Mønter

- Cointelegraph

- kommenteret

- pågældende

- konklusion

- Adfærd

- indeholder

- overbevisning

- oprettet

- skaberen

- krypto

- Crypto Markets

- cryptocurrencies

- cyklus

- data

- dag

- beslutning

- leverer

- depression

- Trods

- DID

- do

- Gør Kwon

- gør

- ende

- indtastning

- Hver

- Udvekslinger

- udvidelse

- endelige

- fund

- efterfulgt

- Til

- vanvid

- finansiering

- finansieringssatser

- vinder

- genereret

- giver

- Glassnode

- størst

- Grøn

- havde

- halvering

- ske

- have

- he

- link.

- Høj

- højere

- hans

- historie

- Hit

- holdere

- Hvordan

- HTTPS

- i

- in

- Forøg

- stigende

- Indikator

- indsigt

- interesse

- ind

- investering

- IRS

- IT

- ITS

- selv

- Kwon

- Mangel

- Efternavn

- Sent

- føre

- niveauer

- langsigtet

- langsigtede indehavere

- taber

- Nedture

- Makro

- større

- Making

- Marked

- Markeder

- maksimal

- Kan..

- I mellemtiden

- metode

- metrisk

- Metrics

- måske

- Måned

- bevæge sig

- Ny

- næste

- Næste blok

- nu

- of

- on

- On-Chain

- Onchain

- ONE

- åbent

- åben interesse

- or

- Andet

- ud

- egen

- Panic

- deltagere

- plato

- Platon Data Intelligence

- PlatoData

- Punkt

- præsentere

- pris

- Forud

- gennemprøvet

- Q1

- spørgsmål

- priser

- ratings

- forholdet

- læsere

- gik op for

- realiseret pris

- anbefalinger

- Rød

- forblive

- forskning

- ressource

- reagere

- Retreat

- afkast

- Revealed

- højre

- Risiko

- Kør

- s

- siger

- scanne

- se

- Kort

- kort sigt

- bør

- viste

- siden

- lille

- noget

- Kilde

- spekulation

- spekulative

- Stadig

- tilskud

- suite

- forsyne

- SWIFT

- at

- deres

- selv

- Disse

- ting

- denne

- dem

- truer

- tid

- til

- top

- mod

- Sporing

- Trading

- sand

- typisk

- undervejs

- værdi

- forskellige

- var

- we

- uge

- Hvad

- hvornår

- som

- med

- år

- år

- Yngre

- zephyrnet

- zoom