- The U.S. Fed announced an interest rate hike of 75 basis points this week.

- Investors and traders may need to brace for a long crypto bear market.

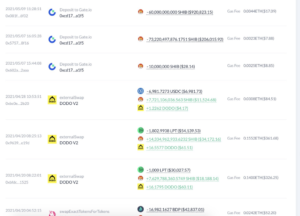

- The cost basis of the BTC network is ever increasing or marginally declining.

Macroeconomic headwinds are currently in the driver’s seat as the US Federal Reserve has announced an interest rate hike of 75 basis points this past week. However, the ultimate panic moment has yet to arrive. With this being the case, BTC may or may not have reached its price bottom.

Looking at the history of Bitcoin (BTC) market cycles, on-chain data shows the consistency in which the price of BTC falls below its realized price during the depths of a bear market. Previous cycles have proven that this is not a once-off event but rather one that also comes with duration.

With all of the macroeconomic factors coming into play in this crypto bear market, investors and traders may need to brace for this bear market to last longer than those that took place historically as the duration of the bear market may be more painful than the percentage drawdown.

BTC / USD daily exchange rate is set at the margin and marginal sellers have and will likely continue to dominate marginal buyers until a distinct change in liquidity conditions occurs, as macroeconomic headwinds continue to increase.

For investors that see this period as an opportunity to accumulate long-term undervalued BTC, the realized market cap is an assuring chart that shows the log growth of BTC’s cost basis over time.

Despite the wild daily exchange rate volatility, the cost basis of the network is ever increasing or marginally declining. The cost basis for BTC has only dropped a maximum of 24.07% from cycle highs and is currently down 12.71%.

Disclaimer: Synspunkter og meninger samt alle de oplysninger, der deles i denne prisanalyse, offentliggøres i god tro. Læsere skal lave deres egen research og due diligence. Enhver handling foretaget af læseren er udelukkende på egen risiko. Coin Edition og dets tilknyttede selskaber vil ikke holdes ansvarlige for nogen direkte eller indirekte skade eller tab.

Indlæg Visninger:

33

- Bitcoin

- Bitcoin News

- blockchain

- overholdelse af blockchain

- blockchain konference

- Møntudgave

- coinbase

- coingenius

- Konsensus

- kryptokonference

- krypto minedrift

- cryptocurrency

- decentral

- Defi

- Digitale aktiver

- ethereum

- machine learning

- Marked

- Market News

- nyheder

- ikke fungibelt symbol

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- Prisanalyse

- bevis for indsatsen

- W3

- zephyrnet