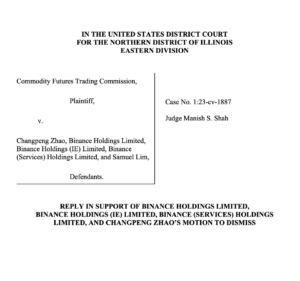

En dommer i Californien har kombineret tre investorsager mod den hedengangne kryptobank Silvergate Bank, der involverer den konkursramte kryptobørs FTX.

Den 19. april afgjorde den amerikanske distriktsdommer Jacqueline Scott Corley fra Northern District of California, at de tre retssager ville blive konsolideret. Hver anklager Silvergate for at hjælpe med at lette investorsvindel af den kollapsede kryptobørs FTX.

The three cases were brought against Silvergate by four former investors. They will remain separate from other federal cases against FTX and its founder Sam Bankman-Fried but will be combined by mutual agreement of the litigants, according to an April 19 report from Law360.

I ordren stod der:

"Silvergate-sagerne involverer almindelige spørgsmål om retlige og faktiske omstændigheder, da de navngiver fælles anklagede, opstår fra den samme påståede adfærd og hævder overlappende sager, således at Silvergate-sagerne er passende til konsolidering."

Matson Magleby, Golam Sakline, Nicole Keane og Sonam Bhatia indgav trioen af sager i februar.

Sagsøgerne hævder, at Silvergate hjalp og medvirkede til FTX's påståede forseelse. Handlinger omfattede behandling af illegitime overførsler af FTX-kundemidler til dets søsterhandelsfirma Alameda Research.

Silvergate afsløret sine planer to “voluntarily liquidate” assets and shut down operations in early March following a bank run. Additionally, the bank was hit with a class-action suit in January for securities law violations.

FTX filed for bankruptcy in November last year and its collapse and the resultant crypto market crash created likviditetsproblemer for Silvergate.

Relateret: Hvad betyder Silvergate-kollapset for krypto?

In a related development, New York state’s financial regulator has said that the collapse of Signature Bank was caused by a run from a broad base of depositors across business sectors, ikke krypto.

Krypto-venlig Signature Bank blev beslaglagt af føderale regulatorer i marts.

I en høring i House Financial Services Committee om stablecoins den 18. april sagde New York State Department of Financial Services (NYDFS) Superintendent Adrienne Harris "det er en misvisende betegnelse, at Signature Banks fiasko var relateret til krypto."

Ifølge en Bloomberg den 19. april indberette, she said that depositors including wholesale food vendors, fiduciaries, trust accounts and law firms left the bank and caused the run.

Magazine: Ustabile mønter: Depegging, bankrun og andre risici truer

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- Platoblokkæde. Web3 Metaverse Intelligence. Viden forstærket. Adgang her.

- Udmøntning af fremtiden med Adryenn Ashley. Adgang her.

- Kilde: https://cointelegraph.com/news/multiple-silvergate-lawsuits-over-alleged-ftx-ties-combined-by-judge

- :har

- :er

- a

- Ifølge

- Konti

- tværs

- Handling

- aktioner

- Derudover

- Adrienne

- adrienne harris

- mod

- Aftale

- Alameda

- ALAMEDA FORSKNING

- påståede

- ,

- passende

- april

- ER

- AS

- Aktiver

- Bank

- Bank køre

- bank kører

- Bankmand-Fried

- bankerot

- Konkurs

- bund

- BE

- Bloomberg

- bred

- bragte

- virksomhed

- by

- california

- tilfælde

- forårsagede

- årsager

- Cointelegraph

- Bryder sammen

- kollapsede

- kombineret

- udvalg

- Fælles

- Adfærd

- konsolidering

- Kursus

- Crash

- krypto

- krypto udveksling

- Krypto-udveksling FTX

- Crypto Market

- Kryptomarkedsnedbrud

- kunde

- Kundemidler

- tiltalte

- hedengangne

- Afdeling

- DEPEGGING

- indskydere

- Udvikling

- distrikt

- ned

- hver

- Tidligt

- udveksling

- lette

- Manglende

- februar

- Federal

- føderale tilsynsmyndigheder

- finansielle

- finansielle tjenesteydelser

- Firm

- firmaer

- efter

- mad

- Til

- Tidligere

- grundlægger

- fire

- bedrageri

- fra

- FTX

- fonde

- høre

- hjælpe

- Hit

- hus

- HTTPS

- in

- medtaget

- Herunder

- investor

- Investorer

- involvere

- ITS

- januar

- jpg

- dommer

- Efternavn

- Sidste år

- Lov

- advokatfirmaer

- Retssager

- Likviditet

- Marts

- Marked

- markedskraksis

- flere

- gensidig

- navn

- Ny

- New York

- Staten New York

- New York State Department of Financial Services

- november

- NYDFS

- of

- on

- Produktion

- ordrer

- Andet

- i løbet af

- plato

- Platon Data Intelligence

- PlatoData

- forarbejdning

- Spørgsmål

- regulator

- Regulators

- relaterede

- forblive

- indberette

- forskning

- risici

- Kør

- Said

- Sam

- Sam Bankman Fried

- samme

- Sektorer

- Værdipapirer

- beslaglagt

- adskille

- Tjenester

- Luk ned

- Silvergate

- SILVERGATE BANK

- søster

- Stablecoins

- Tilstand

- State Department

- erklærede

- Stater

- sådan

- Dragt

- at

- tre

- Slips

- til

- Trading

- overførsler

- Stol

- Forenet

- Forenede Stater

- leverandører

- Overtrædelser

- engros

- vilje

- med

- ville

- år

- zephyrnet