The prepaid card sector stands at a dynamic crossroads, marked by fierce competition and expansive growth. As we delve into 2024, several pivotal trends are shaping the future of prepaid cards, from gig economy dynamics to millennial spending habits, the surge in virtual card usage, the popularity of eGift cards, and the innovative approach of prepaid-as-a-service models. Here’s a comprehensive look into these trends, offering insights for providers looking to thrive in this evolving market landscape.

Industrilandskab: Et konkurrencedygtigt og ekspanderende rige

Markedet for forudbetalte kort, engang domineret af traditionelle finansielle giganter som

American Express , MasterCard, is now witnessing an influx of tech-savvy players such as PayPal and Apple. This shift is fueled by a growing demand across diverse consumer segments, including the unbanked and underbanked, seeking accessible banking alternatives.

Industrien, drevet frem af det pandemi-inducerede fremstød mod digitale betalinger, oplever en bemærkelsesværdig stigning, hvor den amerikanske markedsværdi når op på

$2.5T i 2022, og forventes at nå $14.4T i 2032. På trods af dens betydelige størrelse er sektorens potentiale for yderligere ekspansion fortsat stort.

Gig Economy's Payment Revolution: En præference for forudbetalte

Koncertøkonomien, der spirer globalt, har fundet en pålidelig betalingsledsager i forudbetalte kort. Efterhånden som de traditionelle arbejdsmarkeder svinger, henvender et betydeligt antal arbejdstagere sig til spillemuligheder og værdsætter den fleksibilitet og umiddelbarhed, som disse roller tilbyder.

Prepaid cards emerge as a crucial solution, enabling faster, hassle-free payments and sidestepping the delays of conventional banking systems. This trend is not only enhancing freelancer satisfaction but also positioning prepaid cards as a strategic tool for businesses aiming to attract top talent.

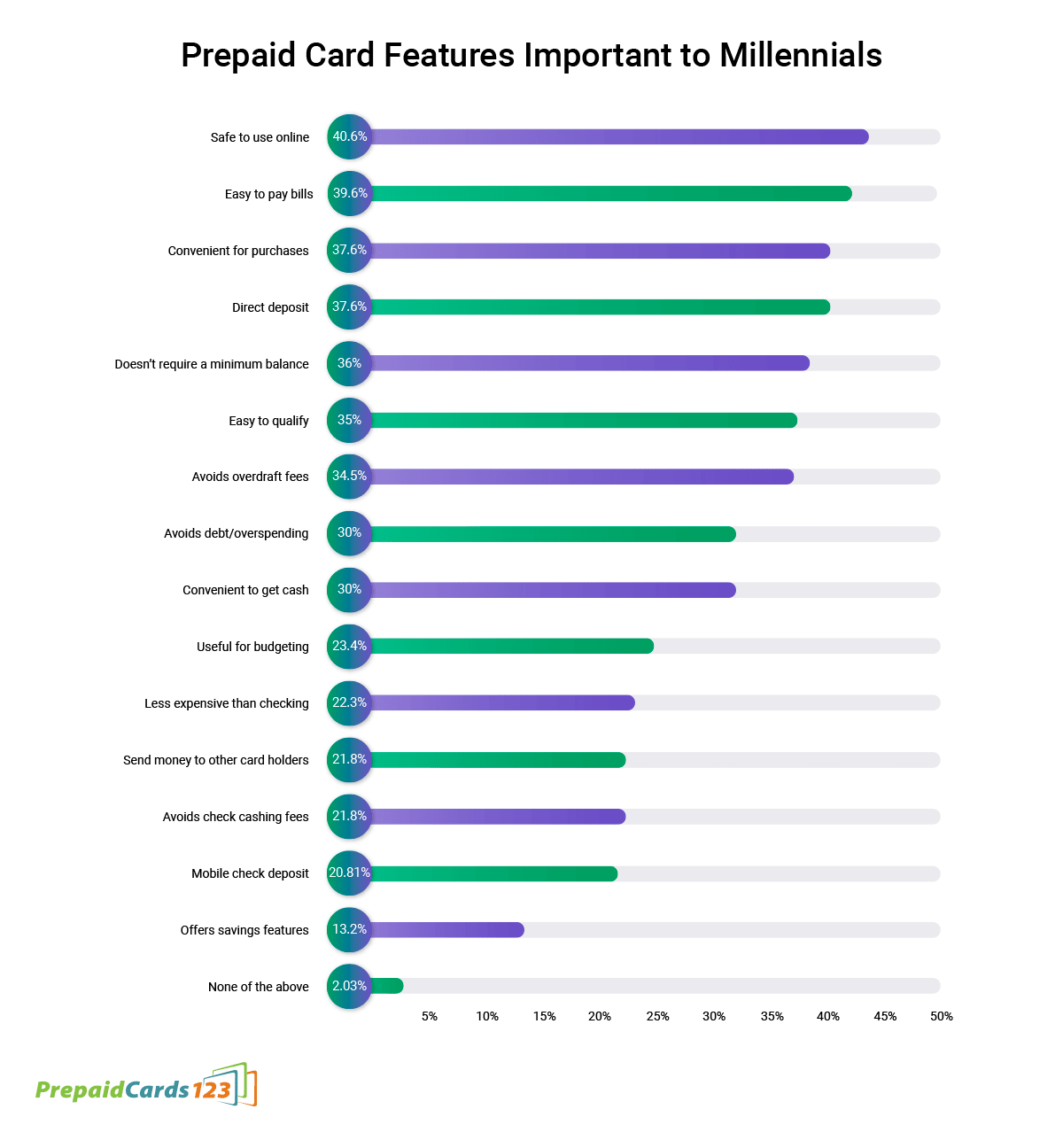

Millennial Momentum: Driving Adoption Fremad

Millennials, now a dominant force in the workforce, are increasingly choosing prepaid cards for their financial transactions. This demographic’s preference is driven by the convenience, security, and flexibility prepaid cards offer, aligning perfectly with their digital-first lifestyle. Providers that cater to millennial preferences, focusing on seamless, tech-enabled experiences, are well-placed to capture this growing market segment.

The Virtual Wave: Forudbetalte kort i det digitale rige

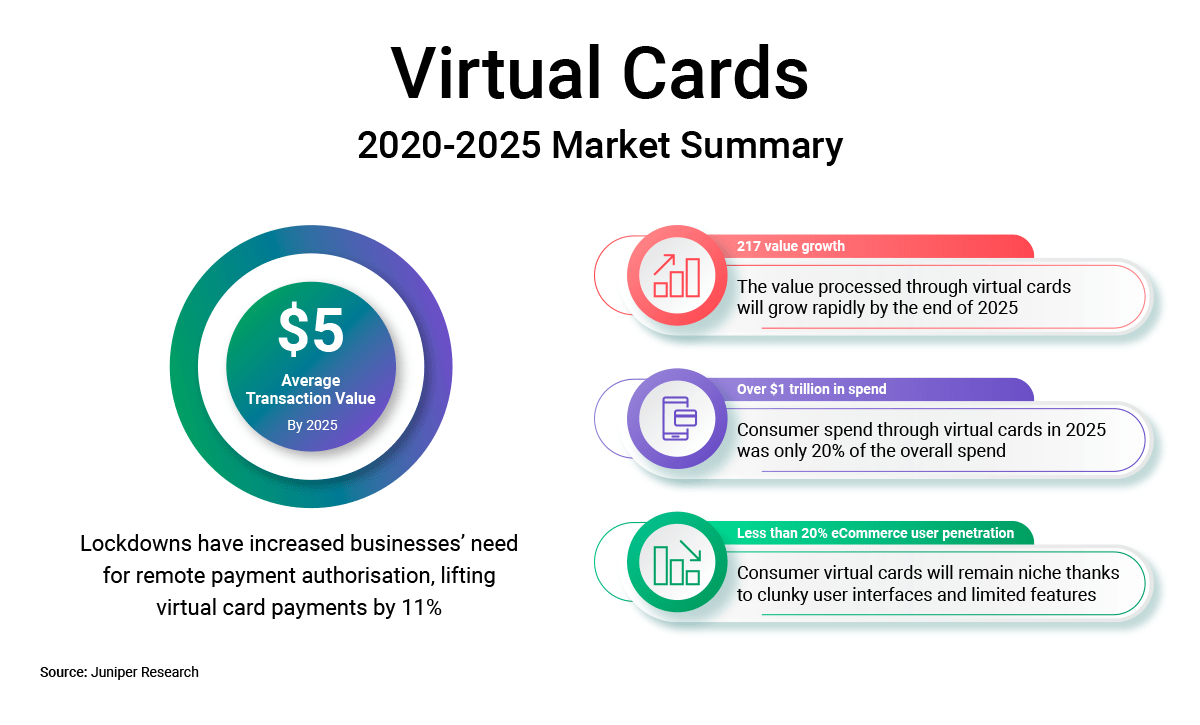

The shift towards e-commerce, accelerated by the pandemic, has catapulted virtual prepaid cards into the spotlight. Offering a secure alternative for online transactions, virtual cards protect users’ personal information while facilitating a seamless shopping experience. With transaction volumes soaring, the adoption of virtual cards in both consumer and business payments is a trend with significant momentum, underscoring the need for prepaid card providers to innovate continually.

e-gavekort: En stigning i digitale gaver

Fremkomsten af eGift-kort afspejler skiftende forbrugeradfærd i retning af bekvemmelighed og digitale præferencer. Med

salget skyder i vejret in both the U.K. and the U.S., eGift cards are becoming a staple in the digital gifting economy. This growth presents an opportunity for businesses to leverage social media and digital marketing strategies to increase awareness and drive adoption, tapping into the vast potential of the eGift card market.

Forudbetalt-som-en-tjeneste: En ny grænse for innovation

Udvidelsen af markedet for forudbetalte kort har givet anledning til

forudbetalte-som-en-tjeneste (PaaS) løsninger, enabling businesses to offer branded prepaid cards without the complexities of in-house development. This model, exemplified by partnerships between tech giants and traditional providers, offers a lucrative avenue for growth. Companies venturing into PaaS must navigate regulatory, technological, and market challenges, ensuring their offerings meet the evolving needs of consumers and businesses alike.

Afsluttende indsigt

As we navigate through 2024, the prepaid card industry is poised for significant transformation. Driven by technological advancements, shifting consumer preferences, and the evolving gig economy, the trends highlighted above offer a roadmap for providers seeking to capitalize on the opportunities ahead. Embracing innovation, understanding market dynamics, and prioritizing user experience are key strategies for success in this competitive and ever-changing landscape.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- PlatoHealth. Bioteknologiske og kliniske forsøgs intelligens. Adgang her.

- Kilde: https://www.finextra.com/blogposting/25696/gig-economy-and-millennial-momentum-key-trends-shaping-the-prepaid-card-market-in-2024?utm_medium=rssfinextra&utm_source=finextrablogs

- :har

- :er

- :ikke

- 2024

- a

- over

- accelereret

- tilgængelig

- tværs

- Vedtagelse

- fremskridt

- forude

- sigter

- justering

- ens

- også

- alternativ

- alternativer

- amerikansk

- an

- ,

- Apple

- tilgang

- ER

- AS

- At

- tiltrække

- Avenue

- bevidsthed

- Bank

- blive

- adfærd

- mellem

- både

- mærkevarer

- spirende

- virksomhed

- virksomheder

- men

- by

- kapitalisere

- fange

- kort

- Kort

- imødekomme

- udfordringer

- skiftende

- vælge

- Virksomheder

- følgesvend

- konkurrence

- konkurrencedygtig

- kompleksiteter

- omfattende

- forbruger

- Forbrugere

- løbende

- bekvemmelighed

- konventionelle

- Vejkryds

- afgørende

- forsinkelser

- dykke

- Efterspørgsel

- Trods

- Udvikling

- digital

- digital markedsføring

- Digital Betalinger

- forskelligartede

- dominerende

- domineret

- køre

- drevet

- kørsel

- dynamisk

- dynamik

- e-handel

- økonomi

- økonomiens

- omfavne

- emerge

- muliggør

- styrke

- sikring

- evigt skiftende

- udviklende

- eksemplificerede

- ekspanderende

- udvidelse

- ekspansiv

- erfaring

- Oplevelser

- oplever

- faciliterende

- hurtigere

- hård

- finansielle

- Fleksibilitet

- svinge

- fokusering

- Til

- Tving

- fundet

- fra

- Frontier

- næring

- yderligere

- fremtiden

- giganter

- gig økonomi

- given

- Globalt

- Dyrkning

- Vækst

- vaner

- Fremhævet

- HTML

- HTTPS

- in

- Herunder

- Forøg

- stigende

- industrien

- tilgang

- oplysninger

- innovere

- Innovation

- innovativ

- indsigt

- ind

- ITS

- Job

- Nøgle

- landskab

- Leverage

- livsstil

- ligesom

- Se

- leder

- lukrative

- markeret

- Marked

- markedsværdi

- Marketing

- Marketing strategier

- Markeder

- mastercard

- Medier

- Mød

- Millennial

- Millennials

- model

- modeller

- momentum

- skal

- Naviger

- Behov

- behov

- Ny

- bemærkelsesværdig

- nu

- nummer

- of

- tilbyde

- tilbyde

- tilbud

- Tilbud

- on

- engang

- online

- kun

- Muligheder

- Opportunity

- PaaS

- pandemi

- partnerskaber

- betaling

- betalinger

- PayPal

- perfekt

- personale

- afgørende

- plato

- Platon Data Intelligence

- PlatoData

- spillere

- klar

- popularitet

- positionering

- potentiale

- præferencer

- Prepaid

- Forudbetalt kort

- gaver

- prioritering

- fremskrevet

- fremdrevet

- beskytte

- udbydere

- Skub ud

- nå

- nå

- afspejler

- lovgivningsmæssige

- pålidelig

- resterne

- revolution

- Rise

- køreplan

- roller

- s

- salg

- tilfredshed

- sømløs

- sektor

- sikker

- sikkerhed

- søger

- segment

- segmenter

- flere

- forme

- skifte

- SKIFT

- Shopping

- signifikant

- Størrelse

- skyhøje

- Social

- sociale medier

- løsninger

- udgifterne

- Spotlight

- står

- hæftning

- Strategisk

- strategier

- succes

- sådan

- bølge

- Systemer

- Talent

- aflytning

- tech

- tech-giganter

- tech-aktiveret

- teknologisk

- at

- Fremtiden

- deres

- Disse

- denne

- Trives

- Gennem

- til

- værktøj

- top

- mod

- traditionelle

- transaktion

- Transaktioner

- Transformation

- Trend

- Tendenser

- Drejning

- UK

- os

- uden bankkonto

- banktjenester

- forståelse

- Brug

- Bruger

- Brugererfaring

- værdi

- værdsættelse

- Vast

- Virtual

- virtuelle kort

- mængder

- ønsker

- Wave

- we

- Hvad

- mens

- med

- uden

- vidne

- arbejdere

- Workforce

- zephyrnet