I den dynamiske verden af finansielle tjenesteydelser er hurtig innovation, stigende kundeforventninger og stigende kompleksitet normen. Denne virkelighed nødvendiggør et skift fra traditionel intern drift til mere specialiserede, eksterne partnerskaber.

Historisk set har disse forhold overvejende fulgt en kunde-leverandør model, focusing mainly on financial negotiations. However, there’s a growing trend towards* long-term strategic partnerships*. Financial considerations remain crucial, but there’s an increasing awareness that squeezing partners for short-term gains is unsustainable and leads to higher long-term costs. The emerging model emphasizes long-term trust, striving for a win-win-win situation for both partners and their customers. Succesfulde partnerskaber er præget af delte risici og belønninger, fremme gensidig investering i hinandens succes.

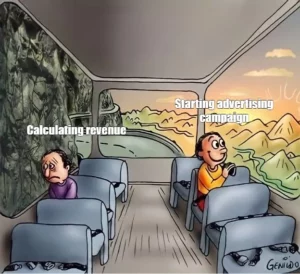

A vital component of these partnerships is aligning commercial agreements with shared objectives. For example, consider Company A, which profits from customer transactions based on a percentage of the transaction amount, and partners with Company B, to whom it pays a fixed amount per transaction. Company A benefits from fewer, high-value transactions, which is not in Company B’s best interest. Despite seeming balanced, this model reveals a clear misalignment in mutual interests and goals.

Konsekvenserne af sådanne fejljusteringer er måske ikke umiddelbart synlige, da de endda kan føre til kortsigtede gevinster. Men i det lange løb resulterer de i ustabilitet, dårligt samarbejde og ineffektiv kommunikation, potentially ending the partnership.

Eksempler på fejlstilling er alt for almindelige i erhvervslivet:

-

Konsulentfirmaer, for instance, often have objectives misaligned with the financial service companies they serve. A consultancy’s primary goal is to maximize billable hours and revenue by staffing numerous consultants for extended periods. In contrast, a bank or insurance company aims to complete projects quickly with minimal staffing to reduce costs and speed up platform launches. Moreover, consultancies may inflate the importance of trends like AI, cloud, and blockchain to create future business opportunities.

-

Ratingbureauer og revisorer are another example. They are paid by the companies they rate or audit, but their work is meant for shareholders to validate the company’s financial reporting. High-profile cases of such misalignment illustrate this issue, e.g. the role of rating agencies in the subprime financial crisis or financial scandals overlooked by auditors like Enron and Wirecard.

-

Certificeringsbureauer face a similar dilemma. They aim to deliver certifications with minimal effort, while customers seek quick certification with little change to existing systems. This often results in certifications based more on documentation and interviews rather than actual practice, diminishing their value.

-

Advokatfirmaer, har også en tendens til at udarbejde komplekse kontrakter og fremhæve juridiske risici, der sjældent bliver til virkelighed, hvilket øger den opfattede risiko for at generere mere forretning.

-

Et almindeligt scenarie i finansielle tjenesteydelser involverer IT-supportdesk outsourcing. Payments are typically made per closed ticket, with set SLAs for ticket response and resolution times. However, the quality of resolution is hard to quantify and often overlooked, leading to hastily closed tickets without proper resolution. This results in lost time, frustration, increased costs, and reduced revenue.

These external misalignments are mirrored internally within organizations, as seen between different departments of the same firm. For example, IT departments may focus on system stability and bug reduction, which can conflict with the company’s overarching goal of continuous improvement and innovation. Similarly, sales teams may push for quick sales with custom, tailor-made solutions that negatively impact operational costs, ultimately making some customer relationships unprofitable.

Disse eksempler fremhæver hvordan forkerte mål kan føre til ineffektive resultater, øgede omkostninger, tabte indtægter, forsinkede leverancer og anstrengte relationer. Performance-based remuneration and shared revenue models are generally effective in aligning objectives, but perfect alignment is an ongoing challenge that requires continuous revision and strategic foresight.

At opretholde denne tilpasning kræver åbne kommunikationskanaler, regelmæssige fælles strategiske planlægningssessioner og gennemsigtig måling af fælles mål. Værdistrømskortlægningsøvelserare particularly useful in identifying and quantifying each party’s contribution, ensuring mutual benefits are clear and balanced.

While perfect alignment in partnerships is an elusive goal, striving for it is crucial. It ensures that both parties work towards shared financial outcomes, strengthening the partnership. However, this requires a long-term strategy, careful consideration of how to maintain alignment, and planning for transitions in response to strategic shifts by either party.

- SEO Powered Content & PR Distribution. Bliv forstærket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk dig selv. Adgang her.

- PlatoAiStream. Web3 intelligens. Viden forstærket. Adgang her.

- PlatoESG. Kulstof, CleanTech, Energi, Miljø, Solenergi, Affaldshåndtering. Adgang her.

- PlatoHealth. Bioteknologiske og kliniske forsøgs intelligens. Adgang her.

- Kilde: https://www.finextra.com/blogposting/25415/the-shift-to-trust-based-partnerships-in-financial-services-aligning-the-objectives?utm_medium=rssfinextra&utm_source=finextrablogs

- :er

- :ikke

- $OP

- 8

- a

- faktiske

- agenturer

- aftaler

- AI

- sigte

- målsætninger

- justering

- tilpasning

- Alle

- beløb

- an

- ,

- En anden

- tilsyneladende

- ER

- AS

- revision

- revisorer

- bevidsthed

- afbalanceret

- Bank

- baseret

- BE

- fordele

- BEDSTE

- mellem

- blockchain

- både

- begge fester

- Bug

- virksomhed

- men

- by

- Opkald

- CAN

- forsigtig

- tilfælde

- Certificering

- certificeringer

- udfordre

- lave om

- kanaler

- klar

- lukket

- Cloud

- kommerciel

- Fælles

- Kommunikation

- Virksomheder

- selskab

- Selskabs

- fuldføre

- komplekse

- kompleksitet

- komponent

- konflikt

- Konsekvenser

- Overvej

- overvejelse

- overvejelser

- konsulenter

- kontinuerlig

- kontrakter

- kontrast

- bidrag

- samarbejde

- Omkostninger

- skabe

- krise

- afgørende

- skik

- kunde

- kundens forventninger

- Kunder

- Forsinket

- levere

- afdelinger

- skrivebord

- Trods

- forskellige

- faldende

- dokumentation

- udkast

- dynamisk

- e

- hver

- Effektiv

- indsats

- enten

- smergel

- understreger

- slutter

- sikrer

- sikring

- Endog

- eksempel

- eksempler

- eksisterende

- forventninger

- udvidet

- ekstern

- Ansigtet

- færre

- finansielle

- finanskrise

- finansiel service

- finansielle tjenesteydelser

- Finextra

- Firm

- fast

- Fokus

- fokusering

- efterfulgt

- Til

- fremsyn

- fremme

- fra

- frustration

- fremtiden

- gevinster

- generelt

- generere

- mål

- Mål

- Dyrkning

- Hård Ost

- Have

- høj-profil

- højere

- Fremhæv

- HOURS

- Hvordan

- How To

- Men

- HTTPS

- identificere

- illustrere

- straks

- KIMOs Succeshistorier

- betydning

- in

- øget

- stigende

- ineffektiv

- oppumpning

- Innovation

- instans

- forsikring

- interesse

- interesser

- internt

- Interviews

- investering

- spørgsmål

- IT

- fælles

- jpg

- lanceringer

- føre

- førende

- Leads

- Politikker

- ligesom

- lidt

- Lang

- langsigtet

- tabte

- lavet

- hovedsageligt

- vedligeholde

- Making

- kortlægning

- markeret

- realitet

- Maksimer

- Kan..

- betød

- måling

- mindste

- model

- modeller

- mere

- Desuden

- gensidig

- nødvendiggør

- negativt

- forhandlinger

- talrige

- målsætninger

- of

- tit

- on

- igangværende

- operationelle

- Produktion

- Muligheder

- or

- organisationer

- udfald

- overordnet

- betalt

- især

- parter

- partnere

- Partnerskab

- partnerskaber

- part

- betalinger

- land

- per

- opfattet

- procentdel

- perfekt

- perioder

- planlægning

- perron

- plato

- Platon Data Intelligence

- PlatoData

- fattige

- potentielt

- praksis

- overvejende

- primære

- overskud

- projekter

- passende

- Skub ud

- kvalitet

- Hurtig

- hurtigt

- hurtige

- sjældent

- Sats

- hellere

- bedømmelse

- Vurderingsbureauer

- Reality

- reducere

- Reduceret

- reduktion

- fast

- Relationer

- forblive

- vederlag

- Rapportering

- Kræver

- Løsning

- svar

- resultere

- Resultater

- afslører

- indtægter

- indtægter

- stigende

- Risiko

- risici

- roller

- Kør

- salg

- samme

- skandaler

- scenarie

- Søg

- set

- tjener

- tjeneste

- Tjenester

- sessioner

- sæt

- delt

- Aktionærer

- skifte

- Skift

- kort sigt

- lignende

- Tilsvarende

- Situationen

- Løsninger

- nogle

- hastighed

- Stabilitet

- bemanding

- Strategisk

- Strategi

- styrkelse

- stræben

- succes

- vellykket

- sådan

- support

- support desk

- systemet

- Systemer

- hold

- end

- at

- deres

- Disse

- de

- denne

- billet

- billetter

- tid

- gange

- til

- også

- mod

- traditionelle

- transaktion

- Transaktioner

- overgange

- gennemsigtig

- Trend

- Tendenser

- Stol

- typisk

- Ultimativt

- uholdbar

- VALIDATE

- værdi

- afgørende

- som

- mens

- med

- inden for

- uden

- Arbejde

- world

- zephyrnet