If you ask most people in crypto what a digital asset is they usually reply that it covers everything in crypto. For over a year major exchanges and projects have been asking regulators the same question and are repeatedly frustrated by their inability to answer clearly. The reason is that the term ‘digital asset’ is one you’re likely to hear or read about frequently in the coming months.

According to well-placed sources within financial journalism, regulators and lobbyists backed by legacy financial institutions are gearing up to label every cryptocurrency and NFT with living founders as a digital asset. Bitcoin is perhaps the only exception to this soon-to-be-imposed rule as its founder remains anonymous and is most likely deceased.

The reason for categorizing practically everything as a digital asset is that it enables regulators to effectively shut down any project that poses a systemic threat to the present global financial system. If they fail to comply with the regulator’s demands they will become pariahs and every centralized exchange, wallet, and user will be penalized for interacting with them.

We recently saw this happen when MetaMask and OpenSea blocked access to anyone from IP addresses within Iran or Venezuela. The most surprising aspect of this incident was that many people assumed MetaMask to be fully decentralized and beyond the control or influence of regulators.

Just a few weeks ago, on the basis of demands from the US Treasury Department, Tornado Cash became another outcast. This forced any US companies such as Coinbase and Binance to cease interacting with it. GitHub suspended its developer’s accounts and removed its code repository, eventually restoring it on September 13th when the US Treasury Department allowed them to.

The key to being able to more fully exercise regulatory control over cryptocurrencies is to classify them in law as assets. According to insiders familiar with the advice being given to regulators at present, we are 6–24 months away from this becoming a reality in the UK, Europe, and the US.

An asset is defined by Investopedia as, “a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit.” This would mean that all NFTs and cryptocurrencies except Bitcoin would pass the Howey test and fall under the regulatory authority of the Securities and Exchanges Commission (SEC) in the US and similar organizations elsewhere.

While the SEC doesn’t want to outlaw cryptocurrencies, this move will make it much harder for the space to develop by increasing its barriers to entry. For instance, all exchanges that are based in the US will have to register with the SEC as securities trading platforms. As well as the high costs involved in doing so it also means the SEC could deem certain tokens as off-limits to unqualified investors, such as those whose net worth is less than $1 million.

When new projects start out they may also have to register with the SEC and file detailed financial documents. This is likely to take a significant amount of financial and legal resources to comply with, effectively locking smaller projects out of the space, which is the precise intention of the lobbyists backing these proposals.

The present push for increased regulation is coming primarily from legacy financial institutions which recognize the effectiveness of blockchain technology for improving the speed and efficiency of financial transactions. The current global banking system is based on archaic infrastructure that adds massively to its operating costs. By stifling access to the space they hope to capitalize on the technology and buy some time to transition their systems across.

This approach is similar to that taken by large tech companies in the early 2000s towards the new wave of technology the internet unlocked. YouTube, for example, was heavily bogged down by copyright infringement claims from major media companies which helped to push them to accept Google’s offer to buy the platform.

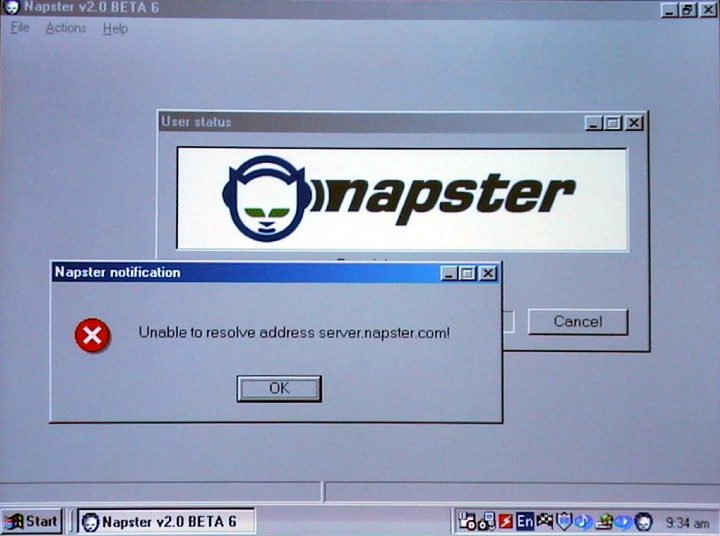

At the same time, Napster cornered the market with its innovative approach to peer-to-peer music streaming. They were targeted by major music labels and forced into bankruptcy while the labels managed to copy and develop the technology to launch their own subscription-based streaming services. The present approach of lobbyists bears a striking similarity.

It appears that the cryptocurrency market has shown a proof of concept that major players in financial technology (FinTec) want to capitalize upon. The challenges ahead are how to ensure that crypto projects and users have a voice that can effectively influence regulators.

Maximalism and in-fighting between projects and blockchains are music to the ears of the FinTec lobbyists. While people argue about which chain is superior the lobbyists can use that disharmony to divide and conquer. The only hope is for chains, projects, and users to come together to support crypto-friendly politicians and put their personal differences aside.

To help with this Coinbase has integrated a feature into their app to help US users identify how crypto-friendly their local politicians are ahead of November’s mid-term elections. As their Chief Policy Officer, Faryar Shirzad wrote, “The leaders we elect this November will be the ones making critical decisions about the future of crypto, blockchain, and Web3 — and about your economic freedom”. As the US is the world’s leading financial superpower, what happens there is likely to be replicated by regulators elsewhere, which makes these elections crucially important for the future of crypto.

Those who think this is a storm in a teacup and is unlikely to adversely affect crypto might like to wonder why one of the lead lobbyists, the Financial Action Task Force (FATF) is pushing so hard for crypto, particularly stablecoins, to be classed as digital assets. Especially when they also claim that Central Bank Digital Currencies (CBDCs) shouldn’t be classed as digital assets.

Join Paribus-

Website | Twitter | Telegram | Medium | Discord

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange. Click Here

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: Plato Data Intelligence: Platodata.ai