My son recently celebrated his fifth birthday. We had a party for him and we did the obligatory “party packs” for the children. The highlight was the bubbles. It always is. The kids ran around and showered one another in bubbles. But there weren’t as many bubbles at that party as there have been bitcoin bubble-critics, kellest mõned on maailmas tunnustatud intellektuaalid.

Ma ei saa jätta vaatamata neid kriitikuid samamoodi, nagu vaatasin lapsi oma poja peol. Ma ei mõtle seda halvustavalt. Ma ei saa olla nende intellektuaalsete hiiglaste suhtes alandlik, isegi kui ma seda tahaksin. Aga ausalt, kuidas muidu vaadata kedagi, kes ei suuda (või lihtsalt ei taha) võtta laiemat vaatenurka?

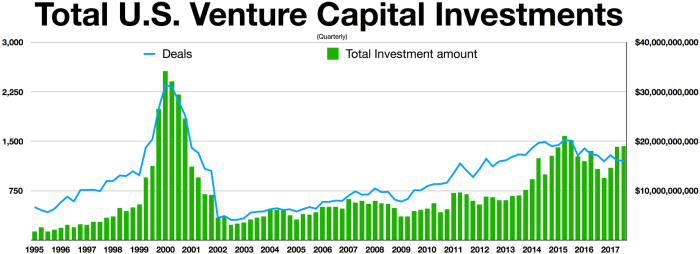

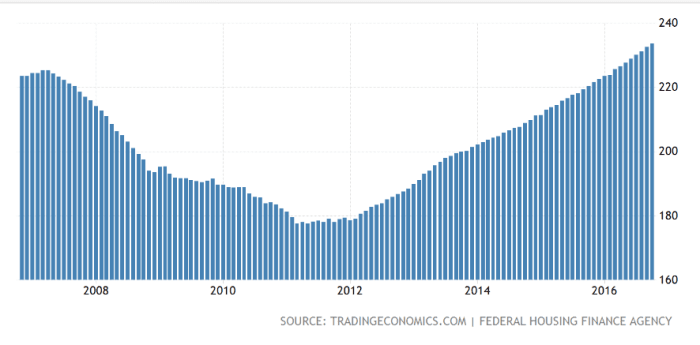

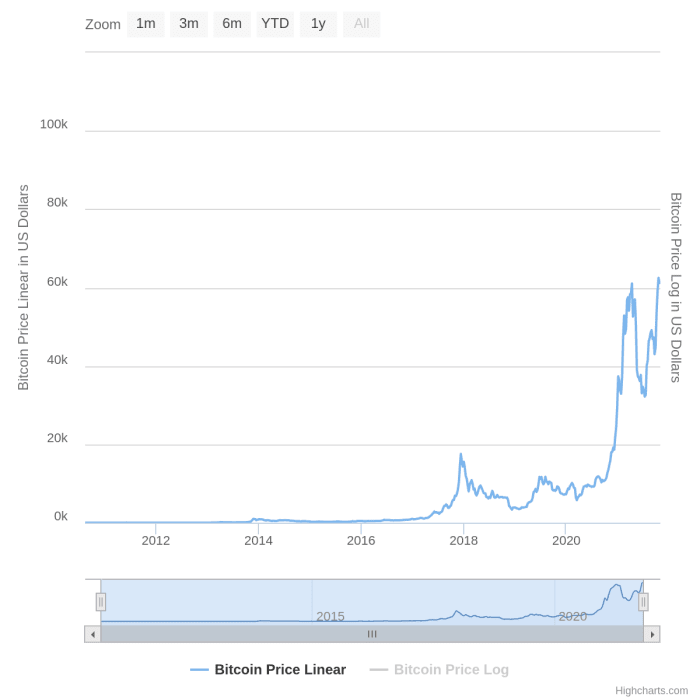

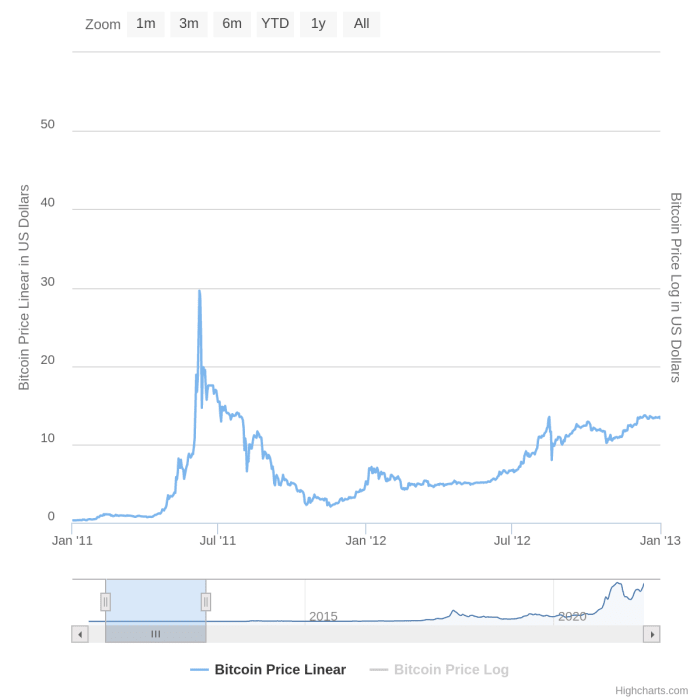

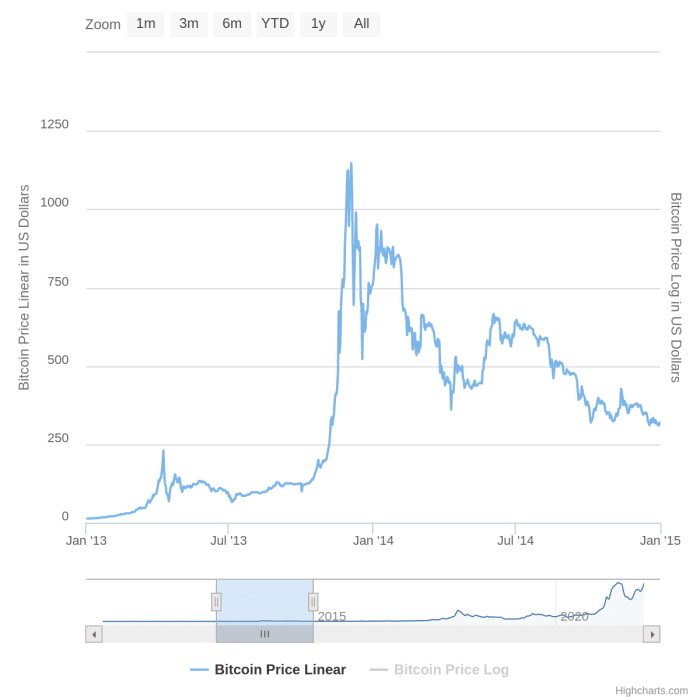

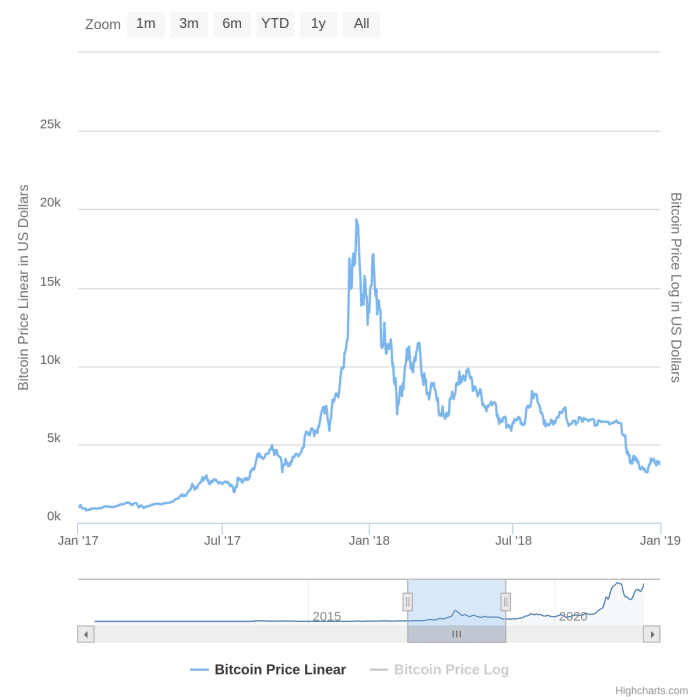

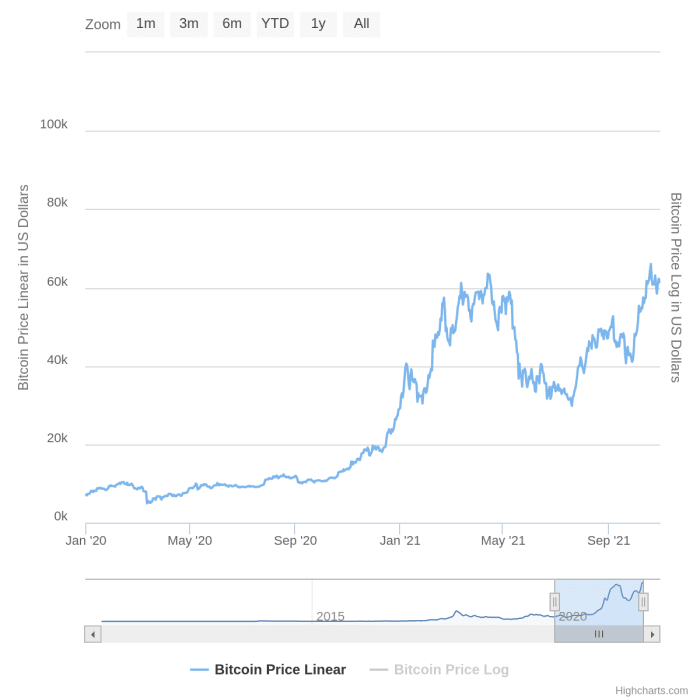

It is entirely true that bitcoin did, at various stages in its 13-year history, enter “bubble-territory” where the price was due for a major correction. But describing bitcoin itself as a bubble (in its entirety) ignores any comparison between its price history and that of other infamous bubbles.

But before I go any further I have to put a disclaimer here. I am not qualified to draw conclusions based on the technical analysis of price charts. This article only attempts to make a generalized comparison between what we know were bubbles, and bitcoin’s price history. Based on that it should be pretty clear that, whatever it is, bitcoin is something other than what is usually described as a bubble.

Bubbles pop. And while markets may recover, bubbles certainly do not re-inflate themselves again and again. If bitcoin is a bubble, it’s a magic bubble. It would be something that exists in an entirely new category unlike any other bubble we’ve ever seen before.

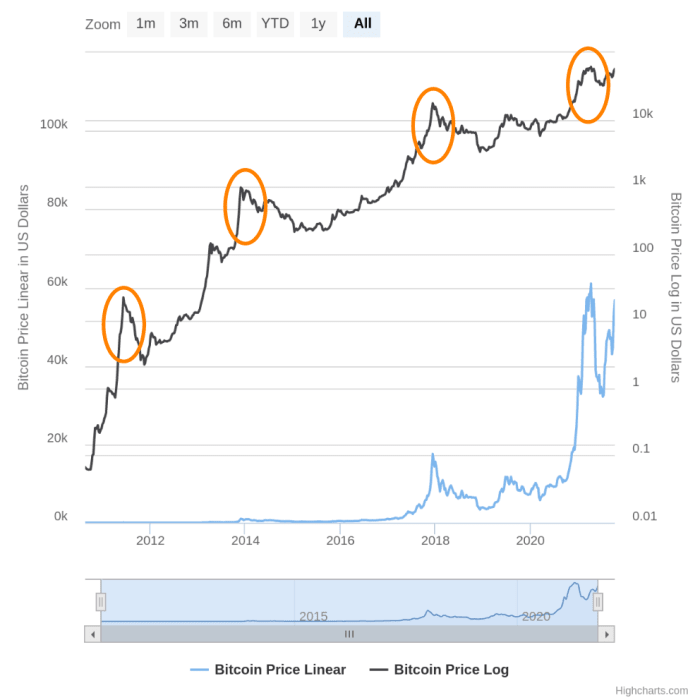

Having recently set a new all-time-high at over $68,500, the bitcoin price surpassed it’s previous all-time high of $64,000 from April 2021. Which, in turn, surpassed the December 2017 all-time high of $20,000. This has happened FIVE times in less than 13 years.

Not only that, but soon after bitcoin entered what traditional experts labelled “bubble territory” during these new successive all-time high peaks, a catastrophic “crash” of 50% – 80% always followed — only for the price to consolidate again, then build to new all-time highs at levels multiple times higher than previous records, all within relatively short periods of time. This pattern has played itself out around record highs set in mid-2011, late-2013, late-2017, April 2021 and now again in November 2021.

BTC - 1 dollar. Mull, krahh. Konsolideerida.

BTC - 10 dollar. Mull, krahh. Konsolideerida.

BTC - 100 dollar. Mull, krahh. Konsolideerida.

BTC - 1,000 dollar. Mull, krahh. Konsolideerida.

BTC - 10,000 dollar. Mull, krahh. Konsolideerida.

BTC – 100,000 XNUMX dollarit –?

Bitcoin meenutab fööniksit oma tuhast tõustes järelehüüded, palju rohkem kui see, mis meenutab mulli. See on olnud surnuks kuulutatud multiple times since 2010 and yet, despite multiple major corrections, bitcoin has maintained a 200% aastapõhine tootlus läbi selle kõige.

Ja lihtsalt öeldes, muud varamullid tavaliselt seda ei tee.

Tegelikult pole ükski ajaloo kuulsaim mull seda teinud.

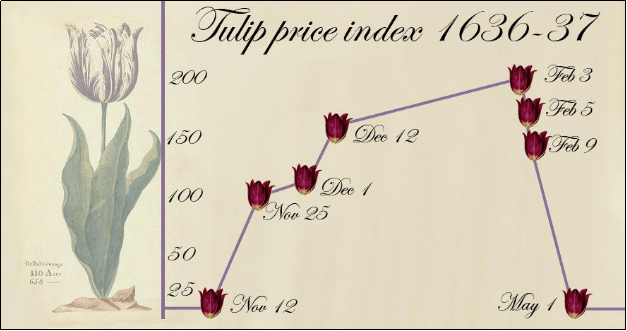

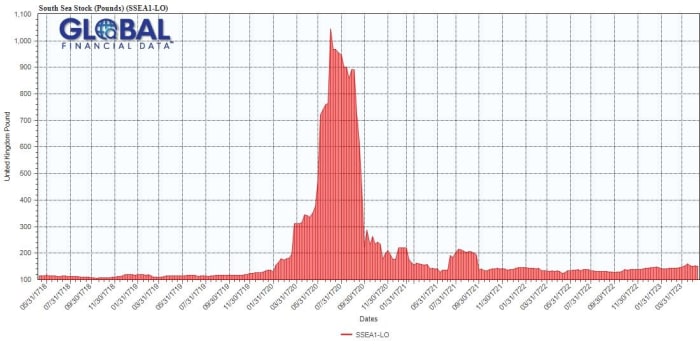

Hollandi tulbimaania (1600. aastate algus) ega ka South Sea Company (1700. aastad), Wall Streeti krahh 1929. aastal enne suurt depressiooni, dot com-buum (1990. aastate lõpp) ega USA 2000. aastate keskpaiga elamumull tõi kaasa suure majanduslanguse aastatel 2007-2009.

Kõik sisenesid täispuhutud mulli territooriumile, kukkusid alla ega taastunud kunagi. Või taastus, kuid mitte vähem kui kümne aasta või enama ajaga.

Kuid ükski neist, isegi mitte USA eluasememull, ei kukkunud alla ega paisunud uuesti alla kümne aasta jooksul. Rääkimata VIIS korda veidi enam kui kümnendi jooksul senisest kordades kõrgemal tasemel.

This makes the notion that bitcoin is a bubble less likely each and every time bitcoin does its thing. And, instead of several consecutive magically self-reinflating bubbles, even the hardcore skeptic must admit it’s beginning to look like waves of adoption.

Above is bitcoin’s all-time price history in simple linear terms, but it is deceiving because it does not give the full picture of what happened in 2011, 2013 and 2017. Seen in linear terms, 2020 and 2021 completely overshadows the other “bubbles.”

Suhteliselt vaadatuna muutuvad need "mullid" võrreldavaks: hinna tõus ja korrigeerimine, millele järgneb konsolideerumine tasemetel, mis on tunduvalt kõrgemad kui enne "mulli".

And again, in 2021, we have the same story: a sllow build-up, dramatic rise, correction, consolidation, ultimately followed by further buildup and yet another all-time high.

Seetõttu on logidiagrammid kasulikud. See võimaldab teil näha kõiki neid "mulle" samal diagrammil, kuid logaritmilisel skaalal, nii et suurusjärkude kaupa erinevaid hinnatsükleid saab kõrvuti võrrelda.

Suhteliselt järgivad 2011., 2013., 2017. ja 2021. aasta aprilli "mullid" kõik sarnast trendi:

Sinine joon kujutab hinda lineaarselt, selle skaala on vasakul, liikudes ülespoole 20,000 10 dollari kaupa. Kui must joon kujutab hinda logaritmilisel skaalal ja selle skaala paremal, liigub 0.01-kordselt üles, alustades 0.10 dollarist, seejärel 1 dollarist; 10 dollar; 100 dollarit; 1,000 dollarit; 10,000 ja XNUMX XNUMX dollarit, oranžid ringid tõstavad esile "mullid".

It seems clear that there’s a steady upward trend and that the price could be heading towards a plateau of sorts. Plus, the volatile cycles for which bitcoin has become so infamous for, are becoming less so.

I just don’t see how anyone can confuse the bitcoin price chart with any of the other charts above. And I’d welcome any effort to disprove this perspective. But I suspect that, even based purely on its price charts and ignoring all of its other paradigm-shifting fundamentals, bitcoin looks unlike any other bubble in history, no matter what chart you look at.

Ja kui te olete kahtlustav just seetõttu, et hinna tõus on olnud erinev millestki muust enne seda, kui arvate, et kui see pole mull, siis peab see olema mingi Ponzi skeem, siis on palju suurepäraseid kaubad see näitab, miks see nii ei ole.

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” – Satoshi Nakamoto

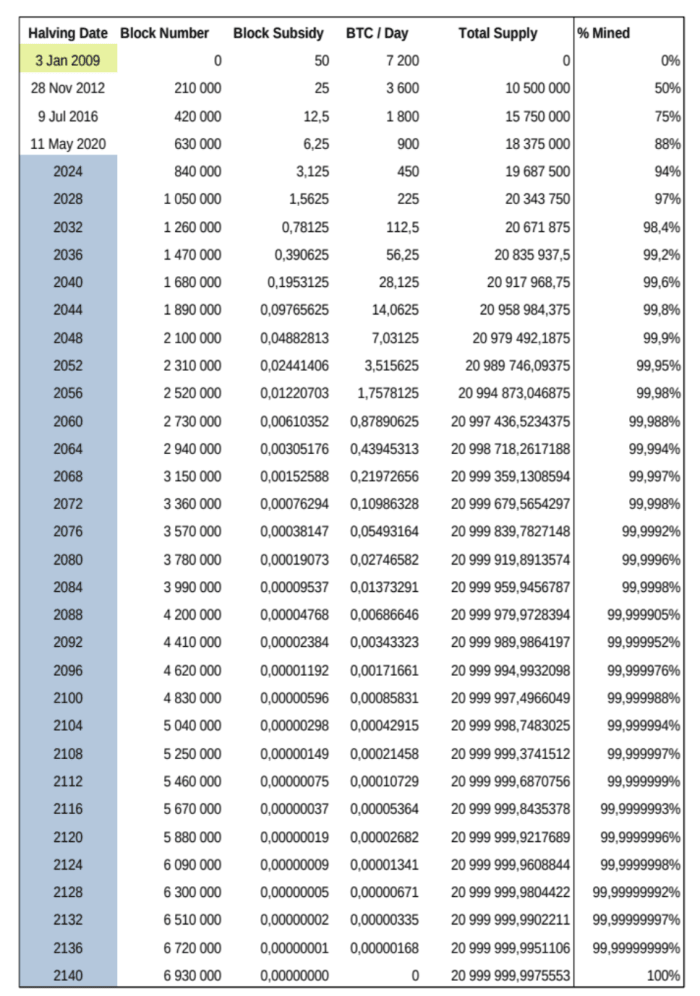

Piisab, kui öelda, et sellele väga ebatavalisele hinnatõusule on kindlad seletused, millest kõige tavalisem on tähelepanek, et hinnatsükleid on suuresti ajendatud tsüklit pooleks, which is a pre-programmed diminishing supply schedule hard coded into the Bitcoin protocol.

Iga järjestikuse poole võrra (iga 210,000 XNUMX ploki järel, mis toimub ligikaudu iga nelja aastase vahega) hakkab stabiilne nõudlus hinda tõstma. See hinnatõus meelitab ligi rohkem inimesi, tekitades suuremat nõudlust, tõstes hinda veelgi, kuni see on jälle ajutiselt üle ostetud ja see tuleb korrigeerida.

Kuid selle parandamise ajaks on piisavalt uusi inimesi õppinud tundma võrgu põhialuseid ja selle aluseks olevat mehaanikat, mis on 100% läbipaistev neile, kes soovivad vaadata. Nendest inimestest saavad hoobid ja nad taluvad nii-öelda tormi. Sest lõppkokkuvõttes ei määra võrgu väärtust rangelt vara kõikuv hetkehind, vaid hoopis probleemid, mida see lahendab.

Nii kujuneb eelmisest kõrgem hinnapõrand, mis põhineb asjaolul, et iga järgnev laine jätab endast maha haritumad kasutajad kui paanikasse sattunud ja merre pühkinud. Seega on seatud etapp uueks tsükliks, mis algab uuesti, kui toimub poolitamine ja stabiilne nõudlus hakkab hindu taas kergitama.

There’s no denying it: In most cases it’s self interest and profit (or least wealth preservation) that initially attract people to Bitcoin. But those who stay, do so to learn about the technology.

Because at the end of the day, if you stay long enough, you’ll learn that the dollar value of bitcoin pales in comparison to its value as the world’s first working implementation of a fully-distributed societal coordination and consensus mechanism.

And ultimately the price history reflects the steadily-spreading understanding that bitcoin is set to change the world’s power structures forever.

See on Hermann Vivieri külalispostitus. Avaldatud arvamused on täiesti nende endi omad ega pruugi kajastada BTC Inc või Bitcoin ajakiri.

Source: https://bitcoinmagazine.com/culture/bitcoin-magic-bubbles-and-history

- "

- &

- 000

- 2020

- Vastuvõtmine

- ADEelis

- Materjal: BPA ja flataatide vaba plastik

- analüüs

- Aprill

- ümber

- artikkel

- eelis

- Bitcoin

- Bitcoin poole võrra

- Bitcoin Hind

- Must

- Bloomberg

- buum

- Breakout

- BTC

- BTC Inc.

- mull

- ehitama

- mis

- juhtudel

- muutma

- Äritegevus

- Lapsed

- Münt

- ühine

- ettevõte

- üksmeel

- konsolideerimine

- Parandused

- krahh

- loomine

- andmed

- Kuupäevad

- päev

- Nõudlus

- depressioon

- detail

- DID

- dollar

- ajendatud

- sõidu

- hollandi

- Varajane

- sündmus

- ekspertide

- esimene

- järgima

- täis

- Põhialused

- suur

- külaline

- Külaline Postitus

- Pooleks

- siin

- Suur

- Esile tõstma

- ajalugu

- Hodlerid

- elamispind

- Kuidas

- HTTPS

- pilt

- Suurendama

- huvi

- IT

- lapsed

- Õppida

- õppinud

- Led

- joon

- Pikk

- Vaatasin

- peamine

- turud

- Meedia

- Meta

- võrk

- Mõiste

- Arvamused

- tellimuste

- Muu

- Muster

- Inimesed

- perspektiiv

- pilt

- ponzi

- Ponzi skeem

- võim

- hind

- Kasum

- protokoll

- langus

- andmed

- Taastuma

- Satoshi

- Skaala

- SEA

- komplekt

- Lühike

- lihtne

- SUURUS

- So

- selle

- Lõuna

- Kaubandus-

- Stage

- jääma

- torm

- tänav

- varustama

- Tehniline

- Tehniline analüüs

- Tehnoloogia

- Mõtlemine

- aeg

- meie

- us

- Kasutajad

- väärtus

- Wall Street

- Wave

- lained

- Jõukus

- Mis on

- WHO

- Wikipedia

- jooksul

- aastat