The big move to adopt bitcoin as legal tender in El Salvador could have some unforeseen consequences for insurers according to Fitch Ratings.

In a report issued on Aug 16, the American credit rating agency stated that the BTC adoption plan will likely be a credit negative for local insurance companies.

Fitch Ratings väljendatud that insurance companies with exposure to bitcoin may be exposed to higher forex and earnings lenduvus risk as well as additional regulatory and operating risk considerations.

Three weeks to legal tender

El Salvador’s legislature voted and passed its Bitcoin Law on June 9 that will see the country formally adopting the digital asset as legal tender on Sept. 7, just three weeks away.

The practical implementation of bitcoin has yet to be defined by regulators worldwide. This increases the challenges of using it as a store of value and means of payment, “particularly given no previous or comparable usage or adoption by central banks in other global financial markets,” Fitch added.

It added that the ability of insurers to minimize their holding period will depend on whether the regulatory and operational framework allows for bitcoin to be immediately converted to USD. Extended periods of exposure will increase volatility and asset risks, it added, which is a credit negative.

The new legislation will need to clearly define how the digital asset should be accounted for on financial statements, and if it can be considered eligible to back policyholder reserves.

“Fitch views bitcoin’s lack of transparency as a downside risk and anticipates treating bitcoin as a “risky asset” in its Risky Asset Ratio, to the extent such holdings can be identified.”

The rating agency views speculative activities and risky exposures such as bitcoin as a credit negative, since gains could quickly reverse, creating a volatile earnings stream, it explained.

See väitis, et El Salvadori insurance sector is already exposed to low credit quality securities, mainly sovereign bonds which have a negative outlook and B- rating. “Additional holdings of high-risk assets will only compound this risk,” it concluded.

Bitcoini hinnaväljavaated

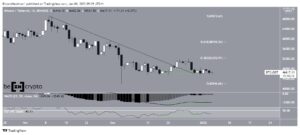

At the time of press, bitcoin prices had retreated 2.7% on the day to $46,960 according to CoinGecko. It’s now back where it was this time last week, but has gained a whopping 45% over the past month.

Prices are moving back towards the 200-day moving average which is likely to serve as support at $45,550. On the upside, BTC needs to break the psychological $50,000 barrier for the uptrend to resume.

Kaebused

Kogu meie veebisaidil sisalduv teave avaldatakse heas usus ja ainult üldiseks teavitamiseks. Mis tahes toimingud, mida lugeja võtab meie veebisaidil leiduva teabe põhjal, on rangelt tema enda vastutusel.

Source: https://beincrypto.com/el-salvador-bitcoin-adoption-could-create-credit-issues-for-insurers/

- 000

- 7

- 9

- tegevus

- tegevus

- Täiendavad lisad

- Vastuvõtmine

- Materjal: BPA ja flataatide vaba plastik

- eelis

- vara

- Pangad

- Bitcoin

- bitcoini adopteerimine

- blockchain

- Võlakirjad

- BTC

- Keskpankade

- MüntGecko

- Ettevõtted

- SEGU

- loomine

- krediit

- krüpto

- Krüptotööstus

- cyber

- küberturvalisus

- päev

- digitaalne

- Digitaalne vara

- Töötasu

- kogemus

- finants-

- forex

- Raamistik

- Üldine

- Globaalne

- hea

- Kuidas

- HTTPS

- Suurendama

- tööstus

- info

- kindlustus

- küsimustes

- IT

- hiljemalt

- Seadus

- Õigus

- Seadusandlus

- kohalik

- turud

- liikuma

- Uus seadusandlus

- tegutsevad

- Muu

- väljavaade

- makse

- vajutage

- hind

- kvaliteet

- hinnangust

- lugeja

- Regulaatorid

- aru

- tagasikäik

- Oht

- Väärtpaberite

- turvalisus

- salvestada

- toetama

- aeg

- Kauplemine

- läbipaistvus

- ravimisel

- USD

- väärtus

- Lenduvus

- veebisait

- nädal

- ülemaailmne