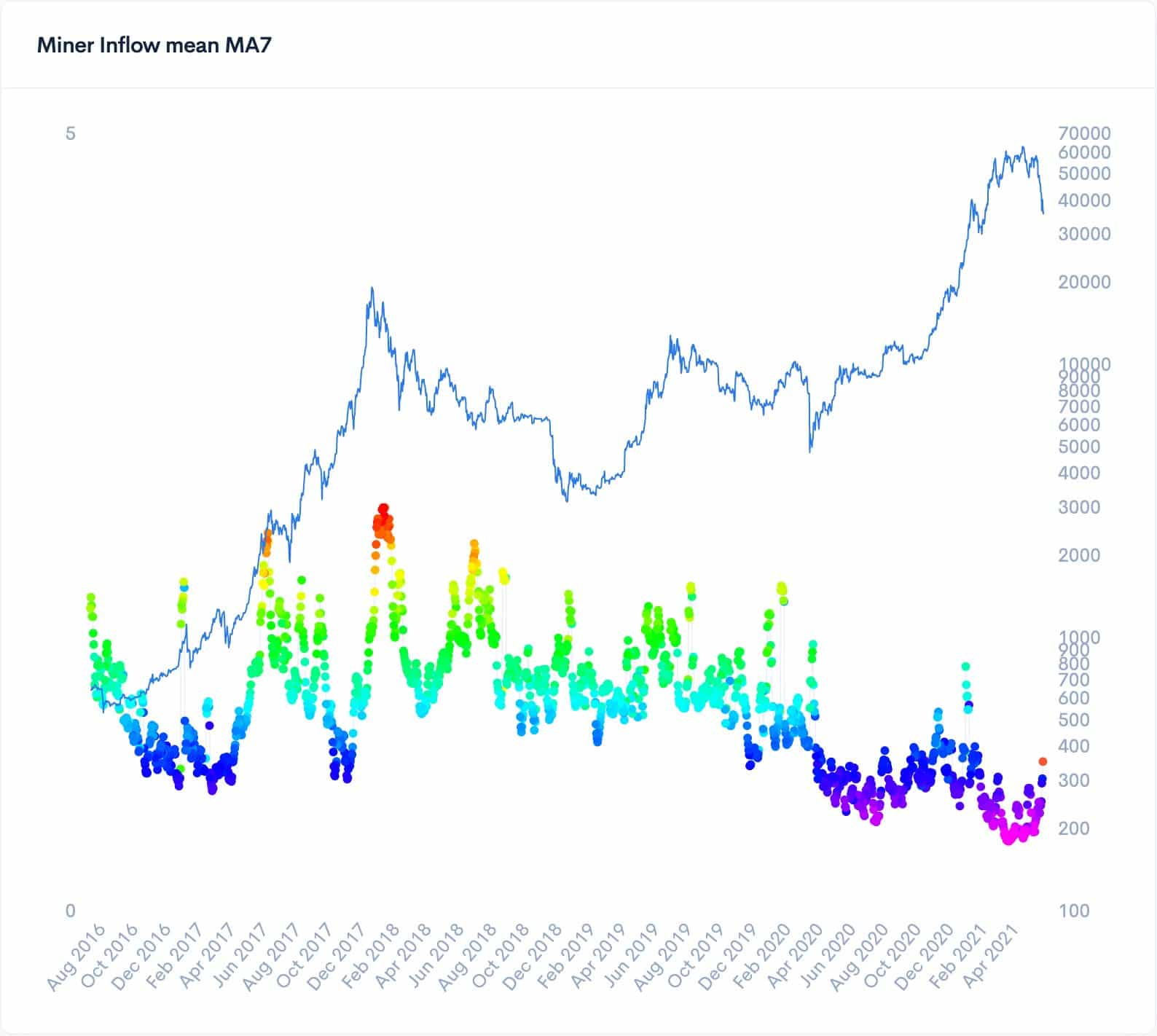

The Miner inflow MA7 data indicates biktsiinide kaevandajad are yet to start selling their holdings indicating we haven’t reached a potential top this bull cycle. Bitcoin miner’s trading activity acts as an important market indicator as it affects their mining cost.

Crypto market blood bath this week saw more than $500 billion getting wiped off the market and top cryptocurrencies such as Bitcoin and Ethereum also lost more than 50% of their value from their ATH. Bitcoin fell to a new 3-month low of $30,681 on Wednesday before making a significant recovery of more than $10,000 within 24-hours. The on-chain data indicates the ongoing panic selling is primarily led by new ostjad and benefited by Whales who sold more than 50,000 BTC over the past week and later bought the dip with a collective institutional purchase of 34,000 BTC.

The current Bitcoin sell-off is being attributed to a number of FUDs, the most recent being China’s crackdown on Bitcoin mining activities. Such warnings by the Chinese government are not new and they have issued many from time to time, however, industry insiders suggest that this time around the focus on süsiniku neutraalsus could have a major part to play in the crackdown.

How Miners Impact Bitcoin Price?

The growing mining difficulty has made Bitcoin mining an increasingly expensive business as any c0mpetetive mining machines to make a good profit can cost upwards of $1,500, on top of that these machines are required to run for 24-hours a day with high energy consumption, making Bitcoin mining a costly affair. Thus in order for miners to continue offering hash power input, the price of Bitcoin must remain higher than the cost of operations.

Last year in March, when Bitcoin price fell to sub-$4k levels, there was fear that the Bitcoin network’s hash power input might suffer dearly as many miners would have to discontinue owing to the low price of BTC. With every halving, mining becomes more expensive as there is half the Bitcoin to mine with almost the same number of miners as before.

Krüptovärskenduste reaalajas jälgimiseks järgige meid puperdama & Telegramm.

Kaebused

Esitatud sisu võib sisaldada autori isiklikku arvamust ja see võib sõltuda turutingimustest. Enne krüptovaluutadesse investeerimist tehke oma turu-uuringud. Autor ega trükis ei vastuta teie isikliku rahalise kahju eest.

Käsitsi valitud lood

- &

- 000

- 9

- tegevus

- Vastuvõtmine

- ümber

- avatar

- Miljard

- Bitcoin

- Bitcoini kaevandamine

- Bitcoin Hind

- blockchain

- Plokkheli tehnoloogia

- veri

- BTC

- äri

- hiina

- tarbimine

- sisu

- jätkama

- krüpto

- cryptocurrencies

- Praegune

- andmed

- päev

- energia

- Inseneriteadus

- ethereum

- finants-

- Keskenduma

- järgima

- hea

- Valitsus

- koolilõpetaja

- Kasvavad

- Pooleks

- hash

- räsi jõud

- Suur

- hoidma

- HTTPS

- mõju

- tööstus

- Institutsionaalne

- investeerimine

- IT

- Led

- masinad

- peamine

- Tegemine

- Märts

- Turg

- turu uuring

- turud

- Kaevurid

- Kaevandamine

- kaevandusmasinad

- pakkumine

- Operations

- Arvamus

- et

- Paanika

- võim

- hind

- Kasum

- ostma

- taastumine

- teadustöö

- jooks

- Jaga

- müüdud

- algus

- Tehnoloogia

- aeg

- ülemine

- jälgida

- Kauplemine

- Uk

- Uudised

- us

- väärtus

- nädal

- WHO

- jooksul

- aasta

✓ Jaga: