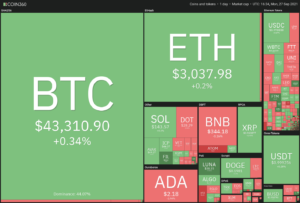

Bitcoin (BTC) has been trading in a descending pattern since the strong $53,000 rejection that occurred on Sept. 7, and the $3.4 billion futures contracts liquidation along with China’s ban on crypto trading appear to have severely impacted traders’ morale.

Adding to the negative sentiment, major crypto exchanges like Binance ja Huobi halted some services in mainland China, and some of the largest Ethereum mining pools, like Sparkpool and BeePool were forced to shut down completely.

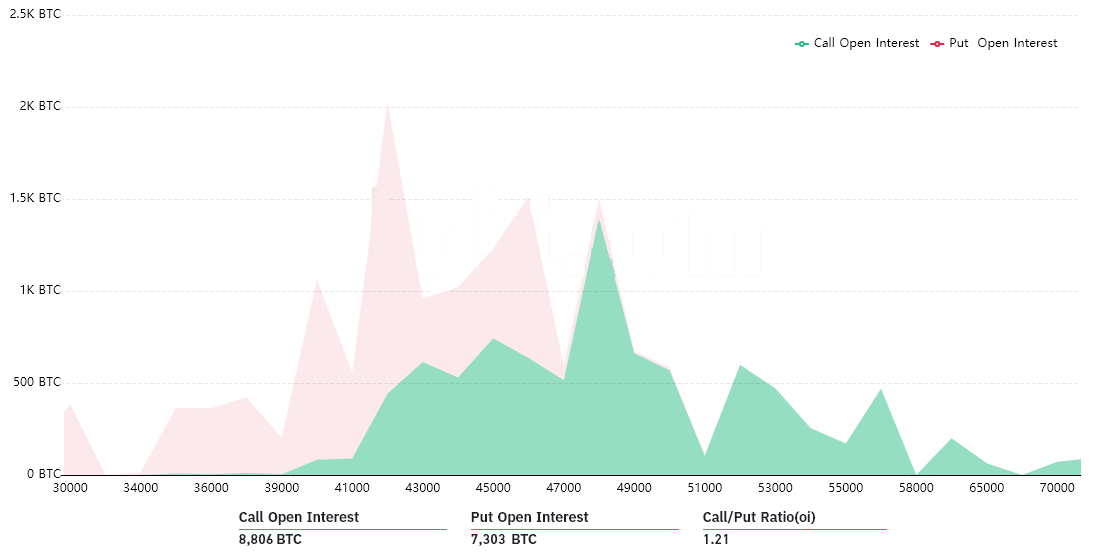

Based on the above chart, it is possible to understand why buyers placed 80% of their bets at $44,000 or higher. However, the past two weeks definitively caused those call (buy) options to lose value quickly.

On Sept. 25, the People’s Bank of China (PBoC) posted a nationwide ban on crypto and barred companies from providing financial transactions and services to market participants. The news triggered an 8% dip in Bitcoin’s price along with a broader pullback on altcoins.

The bearish sentiment was confirmed after Tesla CEO Elon Musk avaldas toetust for cryptocurrency at the Code Conference in California.

Musk ütles:

"Ma arvan, et krüptot pole võimalik hävitada, kuid valitsustel on võimalik selle edenemist aeglustada."

Had we been in a neutral-to-bullish market, those remarks would likely have reversed the negative trend. For example, on July 21, Elon Musk said that Bitcoin had already hit his benchmark on renewable energy. As a result, Bitcoin price, which had previously dropped 12% in ten days, reverted the move and hiked 35% over the next ten days.

The Oct. 1 expiry will be a strength test for bulls because any price below $42,000 means a bloodbath with absolute dominance of put (sell) options.

Initially, the $285 million neutral-to-bullish instruments dominated the weekly expiry by 21% compared to the $320 million puts (sell) options.

However, the 1.21 call-to-put ratio is deceiving because the excessive optimism seen from bulls could wipe out most of their bets if Bitcoin price remains below $43,000 at 8:00 am UTC on Friday.

After all, what good is a right to acquire Bitcoin at $50,000 if it’s trading below that price?

Üllatus tabas ka karusid

Sixty-six percent of the put options, where the buyer holds a right to sell Bitcoin at a pre-established price, has been placed at $42,000 or lower. These neutral-to-bearish instruments will become worthless if Bitcoin trades above that price on Friday morning.

Allpool on toodud neli kõige tõenäolisemat stsenaariumit, mis arvestavad praeguste hinnatasemetega. Tasakaalustamatus, mis soodustab mõlemat poolt, kujutab endast potentsiaalset kasumit kehtivusaja lõppemisest.

The data shows how many contracts will be available on Friday, depending on the expiry price.

- Vahemikus 40,000 41,000 kuni XNUMX XNUMX dollarit: 110 calli vs 4,470 putitamist. Puhastulemus on 175 miljonit dollarit, mis eelistab kaitsevahendeid.

- Vahemikus 41,000 43,000 kuni XNUMX XNUMX dollarit: 640 calls vs. 4,000 puts. The net result continues to favor bears by $140 million.

- Vahemikus 43,000 45,000 kuni XNUMX XNUMX dollarit: 1,780 kõnet vs 2,070 put. Tulemus on karude ja pullide vahel tasakaalus.

- Üle 45,000 XNUMX dollari: 2,530 calls vs. 1,090 puts. The net result shifts in favor of bulls by $65 million.

This crude estimate considers call (buy) options used in bullish strategies and put (sell) options exclusively in neutral-to-bearish trades. Unfortunately, real life is not that simple because it’s possible that more complex investment strategies are being deployed.

For example, a trader could have sold a put option, effectively gaining a positive exposure to Bitcoin above a specific price. Consequently, there’s no easy way to estimate this effect, so the simple analysis above is a good guess.

As things currently stand, bears have absolute control of the Oct. 1 expiry and they have a few good reasons to keep pressuring the price below $43,000.

Unless some unexpected buying pressure comes out over the next 12 hours, the amount of capital required for bulls to force the market above the $45,000 threshold seems immense and unjustified.

On the other hand, bears need a 5% negative price swing that takes BTC below $41,000 to increase their lead by $35 million. So this move also shows little return for the amount of effort required.

The bull’s only hope resides in some surprise positive newsflow for Bitcoin price ahead of Oct. 1 at 8:00 am UTC. If any sensible action is bound to occur, it will likely take place during the weekend, when there’s less active flow.

Siin väljendatud vaated ja arvamused on üksnes autor ega kajasta tingimata Cointelegraphi seisukohti. Iga investeerimis- ja kauplemiskäik hõlmab riski. Otsuse tegemisel peaksite läbi viima ise uuringud.

- 000

- 7

- absoluutne

- tegevus

- aktiivne

- Materjal: BPA ja flataatide vaba plastik

- Altcoiinid

- analüüs

- keeld

- Pank

- Hiina Pank

- ebaviisakas

- Karud

- Miljard

- Bitcoin

- Bitcoin Hind

- BTC

- Bullish

- Bullid

- ostma

- Ostmine

- California

- helistama

- kapital

- püütud

- põhjustatud

- tegevjuht

- Hiina

- kood

- coinbase

- Cointelegraph

- Ettevõtted

- Konverents

- arvab

- pidev

- lepingud

- krüpto

- Krüptovahetused

- krüpteeritud kauplemine

- cryptocurrency

- Praegune

- andmed

- hävitama

- langes

- Elon Musk

- ethereum

- Vahetused

- finants-

- voog

- Reede

- hea

- Valitsused

- siin

- Kuidas

- HTTPS

- Suurendama

- huvi

- investeering

- IT

- Juuli

- viima

- Likvideerimine

- peamine

- Tegemine

- Turg

- miljon

- Kaevandamine

- Kaevanduspallid

- liikuma

- neto

- uudised

- avatud

- Arvamused

- valik

- Valikud

- Muu

- Muster

- PBOC

- Inimesed

- Basseinid

- surve

- hind

- Kasum

- Kaitsev

- põhjustel

- teadustöö

- Oht

- müüma

- müüa bitcoini

- tunne

- Teenused

- lihtne

- So

- müüdud

- üllatus

- Teslal

- test

- kaupleja

- Ettevõtjad

- kaupleb

- Kauplemine

- Tehingud

- USD

- väärtus

- nädalavahetus

- iga nädal