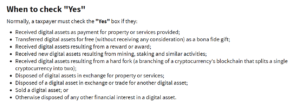

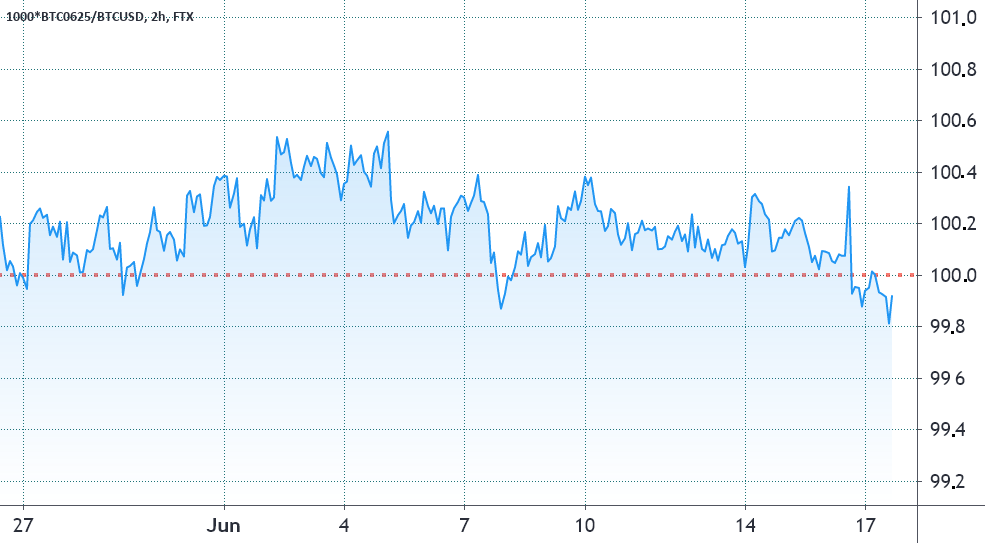

An unusual phenomenon called ‘backwardation’ is taking place in Bitcoin (BTC) futures trading, mainly the June contract, which expires on June 25.

The fixed-month contracts usually trade at a slight premium, indicating that sellers request more money to withhold settlement longer. Futures should also trade at a 5% to 15% annualized premium on healthy markets, in line with the stablecoin lending rate. This situation is known as contango and is not exclusive to crypto markets.

Whenever this indicator fades or turns negative, this is an alarming red flag. This situation is known as backwardation and indicates a bearish sentiment.

As displayed above, a healthy 0.1% to 0.5% premium took place for most of the previous three weeks. This is equivalent to a 2% to 9% annualized rate, therefore oscillating between slightly bearish and neutral.

When short sellers use excessive leverage, the indicator will turn negative, which has been the case on June 17. However, considering there is only one week left for the June expiry, traders should use longer-term contracts to confirm this scenario. As the contract approaches its final trading date, traders are forced to roll over their positions, thus causing exaggerated movements.

The September futures have displayed a 1.7% or higher premium versus spot markets, a 7% annualized basis. This indicates a lack of appetite from longs, but far enough from backwardation.

Seotud: Siit saate teada, kuidas proffid turvaliselt Bitcoini kauplevad, kui see ulatub 40 XNUMX dollarini

What’s really going on?

The final piece of the puzzle is the funding rate on perpetual contracts, which are retail traders’ preferred instrument. Unlike monthly contracts, perpetual futures prices (inverse swaps) trade at a very similar price to regular spot exchanges.

This condition makes retail traders’ lives a lot easier as they no longer need to calculate the futures premium or manually roll over positions nearing expiry.

The funding rate is automatically charged every eight hours from longs (buyers) when demanding more leverage. However, when the situation is reversed, and shorts (sellers) are over-leveraged, the funding rate turns negative and they become the ones paying the fee.

Since May 24, the funding rate has been oscillating between positive 0.03% and negative 0.05% per 8-hour. Thus, on the most “bearish” moments, shorts were paying 1% per week to maintain their positions.

In comparison, on April 13, longs were paying 0.12% per 8-hour, which is equivalent to 2.5% per week.

While many traders point to backwardation as a bearish signal, there is currently no sign of excessive leverage from shorts. As a result, the absence of buyers’ interest for the June contract does not accurately reflect the overall market sentiment. If traders had effectively been bearish, both the longer-term futures and perpetual contracts would be displaying this trend.

Siin väljendatud vaated ja arvamused on üksnes autor ega kajasta tingimata Cointelegraphi seisukohti. Iga investeerimis- ja kauplemiskäik hõlmab riski. Otsuse tegemisel peaksite läbi viima ise uuringud.

- söögiisu

- Aprill

- ebaviisakas

- Bitcoin

- Bitcoini futuurid

- BTC

- laetud

- coinbase

- Cointelegraph

- kontango

- leping

- lepingud

- krüpto

- Krüpto turud

- Vahetused

- Eksklusiivne

- rahastamise

- Futuurid

- siin

- Kuidas

- HTTPS

- huvi

- investeering

- IT

- laenud

- Finantsvõimendus

- joon

- Tegemine

- Turg

- turud

- raha

- liikuma

- Lähedal

- Arvamused

- preemia

- hind

- valik

- teadustöö

- jaemüük

- Oht

- Rull

- Otsing

- Sellers

- tunne

- arveldamine

- Lühike

- lühikesed püksid

- Kaubandus-

- stabiotsiin

- kaubelda

- Ettevõtjad

- kaupleb

- Kauplemine

- USD

- Versus

- nädal