Offering Latest Push in Revival of Crypto Lending

Ettevõte Compound Treasury, mis lihtsustab institutsionaalsete klientide nimel juurdepääsu Compound DeFi laenuprotokollile, teatas uuest laenuteenus Kolmapäev.

Riigikassa kliendid saavad nüüd laenata USA dollareid või dollariga seotud USDC stabiilset münti fikseeritud 6% krediidi kulukuse määraga, kasutades tagatisena krüptoraha.

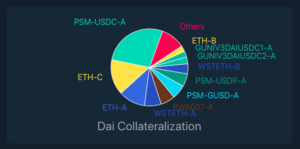

Compoundi protokoll on DeFis üks suurimaid, mille koguväärtus on The Defiant Terminali andmetel lukustatud rohkem kui 2 miljardit dollarit. Laenuprotokollidest on suuremad vaid Aave ja Maker.

Tegija TVL + Liit TVL + Aave TVL, Allikas: Defiant Terminal

Ületagatisega laenud

Liitlaenud peavad olema ületagatisega ja kasutajad saavad laenata ainult dollareid või USDC-d kuni 90% ulatuses oma tagatise väärtusest.

"Institutsioonid seisavad jätkuvalt silmitsi väljakutsetega, usaldades läbipaistmatuid CeFi tooteid või suhtlevad otse DeFi protokollidega oma bilansi haldamiseks," kirjutas Compound Treasury asepresident Reid Cuming ajaveebipostituses, milles kuulutati laenuteenust. „Lihtsa ja usaldusväärse laenulahendusega saab nüüd likviidsusnõudlust rahuldada.

Liitkassa käivitatud pakkus eelmisel aastal asutustele USA dollarites hoiustelt fikseeritud 4% tootlust, konverteerides need USDC-ks ja deponeerides need liitprotokolli.

Between 30 and 40 investment banks, hedge funds, fintech companies and other businesses use Compound Treasury, Cuming told The Defiant Wednesday – businesses that want to take advantage of the high yields DeFi offers without assuming the industry’s risks, such as variable interest rates and the automatic liquidation of collateral that declines in value.

Trusted Counterparty

“What our counterparties tell us – and this goes both ways, borrowers and those that earn – is that yes, they could go directly to a protocol,” Reid said. “However, they wouldn’t have someone trusted that they could call, or an agreement. With us, they have a compliant and transparent counterparty that really shields them from those risks and absorbs the risk on their behalf. And that’s really where the value is.”

At its peak, Compound Treasury had more than $260M in assets under management, Reid said, though that figure has fallen to the “mid-eight figures” in the wake of the June crash prompted by the implosion of crypto hedge fund Three Arrows Capital.

Selle aasta alguses sai Compound Treasuryst esimene DeFi toode, mis sai kolme suure reitinguagentuuri krediidireitingu. S&P Global Ratings andis Compound Treasury a rämpsu hinnang, viidates muude probleemide hulgas ka regulatiivsele ebakindlusele.

At the time, the yield for lending USDC on Compound was less than 1%, meaning there was a negative margin that Compound Treasury needed to supplement to meet its 4% commitment to depositors. Compound Labs, the company set up to support the Compound protocol, paid the difference, CEO Robert Leshner told The Defiant at the time.

The institutional lending service, with its 6% APR, will allow Compound Treasury to “more consistently control and ensure we can meet our obligations to our customers without having to rely solely on the Compound protocol,” he said.

Ühenduse juhtimismärk COMP oli uudisest häiritud. See on sel kuul kasvanud 13%.

COMP Hind, Allikas: Defiant Terminal

- Bitcoin

- blockchain

- plokiahela vastavus

- blockchain konverents

- coinbase

- coingenius

- üksmeel

- krüptokonverents

- krüpto mineerimine

- cryptocurrency

- Detsentraliseeritud

- Defi

- Digitaalsed varad

- ethereum

- masinõpe

- mitte vahetatav märk

- Platon

- plato ai

- Platoni andmete intelligentsus

- Platvormplokk

- PlatoData

- platogaming

- hulknurk

- tõend osaluse kohta

- Trotslik

- W3

- sephyrnet