After recording heavy outflows at the start of 2022, cryptocurrency investment funds have seen a gradual uptick in investor demand over the past two weeks, offering cautious optimism that the worst of the market downturn had passed.

Digital asset investment products saw $19 million worth of cumulative inflows last week, according to CoinShares. Bitcoin (BTC) and multi-asset funds led the gains with $22 million and $32 million worth of inflows, respectively.

The news wasn’t all positive, as Ether (ETH) continued to suffer from negative sentiment with outflows totaling $27 million. That marked eight consecutive weekly outflows for ETH-focused funds. Solana (SOL), Täpp (DOT) ja Cardano (ADA) products also registered outflows for the week.

Digital asset products have seen heavy outflows since December, as institutional investors took profits and reduced their positions amid extreme selloffs in the market. So far this year, Bitcoin funds have seen a net $131.8 million worth of outflows, according to CoinShares data. Ether ) funds have seen $111.2 million worth of drawdowns.

Bitcoin’s price rose to as high as $38,778 on Monday, according to Cointelegraph Markets Pro ja TradingView. However, the flagship cryptocurrency is down over 20% in January, marking its worst start to the year since 2018.

Seotud: Bitcoini hind on 20. aastal pärast halvimat jaanuari alates 2022. aastast langenud 2018%.

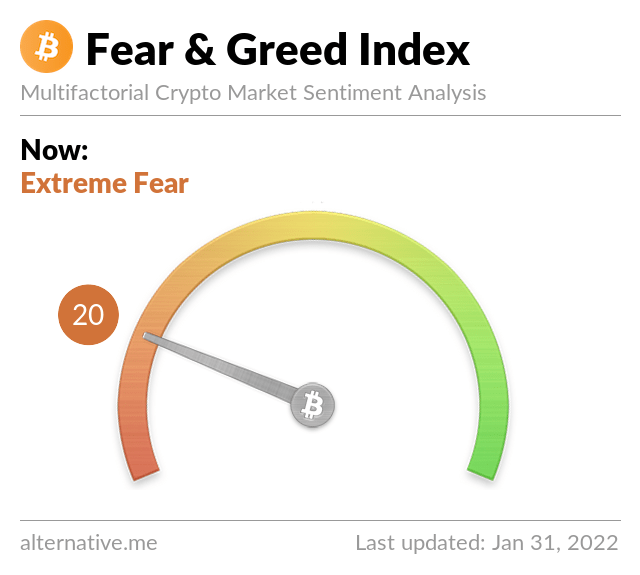

The Crypto Fear & Greed Index, which monitors market sentiment using several sources, jäänused in a state of “extreme fear” with a reading of 20. The index, which sides along a scale of 1 to 100, plunged as low as 13 last week.

Nevertheless, net inflows into Bitcoin and multi-coin funds suggest that institutional money is slowly returning to the market. While traders remain at odds over whether the market has actually bottomed, long-term investors posit that a sub-$40,000 Bitcoin is an attractive buy opportunity.

- &

- 000

- 100

- 2022

- Vastavalt

- Materjal: BPA ja flataatide vaba plastik

- eelis

- Bitcoin

- ostma

- Cardano

- CoinShares

- Cointelegraph

- krüpto

- cryptocurrency

- andmed

- Nõudlus

- alla

- Eeter

- raha

- Suur

- HTTPS

- indeks

- Institutsionaalne

- institutsionaalsetele investoritele

- investeering

- investor

- Investorid

- Jaanuar

- Led

- Turg

- turud

- miljon

- Esmaspäev

- raha

- mitme varaga

- neto

- uudised

- pakkumine

- Võimalus

- Polkadot

- hind

- Toodet

- kasum

- Lugemine

- rekord

- registreeritud

- Skaala

- tunne

- So

- Solana

- algus

- riik

- Ettevõtjad

- nädal

- iga nädal

- väärt

- aasta