سلب مسئولیت: یافته های تحلیل زیر تنها نظرات نویسنده است و نباید به عنوان توصیه سرمایه گذاری در نظر گرفته شود

Ethereum’s rally was somewhat of a breath of fresh air in the crypto-market. Led by Bitcoin’s flat-like movement, most cryptos have followed either consolidation patterns or gradual downtrends, except for a few alts that have ignored the wider market trend.

Ethereum is now back among the market’s gainers, forming an integral part of trend-defying alts. Its weekly gains may not be the highest among the top 10 just yet, but a crucial development on its chart is expected to have some huge upside.

At the time of writing, Ethereum was valued at $3546, up by 7% over the last 24 hours.

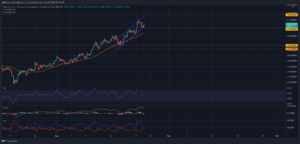

نمودار روزانه اتریوم

Ethereum bulls have had to work hard during the fag end of August. Buying at regular intervals prevented ETH from breaking below its lower trendline – Something which would have brought $2,700 into play. The market was especially vulnerable to this decline on 26 August when ETH closed below its 20-SMA (red) for the first time in nearly a month.

However, an immediate bullish response allowed the price to climb back towards its upper trendline. At press time, ETH seemed to be eyeing the $3,600-mark.

Break-Up Breakout؟

While ETH did challenge the upper trendline at press time, a few more criteria need to be met for a successful breakout. Firstly, volumes observed over the past few days have been consistently dropping. In case ETH sustains itself above $3,600, the breakout needs to be preceded by stronger volumes.

Now, the 24-hour trading volumes did note a 30% hike. However, the same needs to hike further in order to topple levels seen over the past few days. Secondly, the ADX registered a reading of 22. Any reading below 25 signifies a weak market trend, even though the price can sometimes rise to higher levels.

استدلال

Meanwhile, buying pressure did register on both the Awesome Oscillator and the RSI. The latter even eyed the overbought region but more importantly, the index found support at 55.

In an uptrend, the RSI usually finds support anywhere above 40. This is used to ascertain whether an asset would continue its northbound push or follow a bearish trend switch.

Finally, the MACD’s fast-moving line eyed a move above the Signal line. A bullish crossover often functions as a buy signal in the market.

نتیجه

While ETH’s indicators did present further upside, a weak ADX reading and relatively low volumes did not point to an upwards breakout just yet. If the price does climb past $3,600 but volumes continue to trend lower each day, expect a sharp retracement as traders cash out on ETH’s impulsive swing.

On the other hand, a throwback to $3,600 followed by a surge in trading volumes would have the capacity to push ETH towards the $4k price level.

کجا سرمایه گذاری کنیم؟

مشترک شدن در خبرنامه ما

Source: https://ambcrypto.com/ethereum-to-4000-will-depend-on-these-conditions-being-met-first/

- 000

- 7

- در میان

- تحلیل

- دارایی

- اوت

- بی تربیت

- برک آوت

- سرسخت کله شق

- بولز

- خرید

- خریداری کردن

- ظرفیت

- پول دادن و سكس - پول دادن و كس كردن

- به چالش

- بسته

- تثبیت

- ظرف

- ادامه دادن

- روز

- پروژه

- DID

- ETH

- ETH / USD

- ethereum

- پیدا می کند

- نام خانوادگی

- بار اول

- به دنبال

- تازه

- HTTPS

- بزرگ

- شاخص

- سرمایه گذاری

- رهبری

- سطح

- لاین

- بازار

- حرکت

- دیدگاه ها

- سفارش

- دیگر

- در حال حاضر

- فشار

- فشار

- قیمت

- گرد

- مطالعه

- پاسخ

- موفق

- پشتیبانی

- افزایش

- گزینه

- زمان

- بالا

- معامله گران

- تجارت

- ارزش

- آسیب پذیر

- هفتگی

- مهاجرت کاری

- نویسنده

- نوشته