TL ؛ خرابی DR

- Uniswap price is expected to rise to $28

- نزدیکترین سطح پشتیبانی 27.50 دلار است

- Uniswap price is facing resistance at the $28

Uniswap has gone above the $22 mark and strong bullish momentum has carried the price to challenge the $28 mark. Uniswap price records an over 26 percent price hike across the last seven days showing extremely strong bullish dominance. However, the sharp bullish activity leaves room for a volatile price movement.

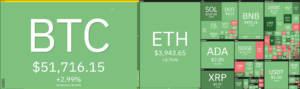

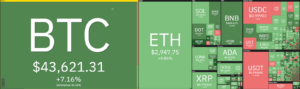

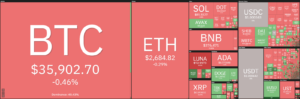

Across the broader cryptocurrency market, the last 24 hours have observed a net bullish movement, with most major cryptocurrencies recording a profit across the time frame. Major players include BNB and ADA that record a 0.22 and a 0.78 percent increase respectively. Meanwhile بیت کوین و Ethereum ثبت 2.73 و 0.42 درصد افزایش.

Technical indicators for UNI/USDT

Across the technical indicators, the MACD shows a declining bullish momentum. While the histogram is still green at the time of writing and has been green since the 4TH of August, the histogram’s size has decreased significantly as the price is struggling to climb back above the 1.40 mark. While the 12-EMA still trades above the 26-EMA, the difference between the two is negligible and they may show a reversal at any time.

The RSI broke out of the neutral region on August 6th but has since dropped back into the neutral zone. The indicator currently trades just below the 68.00 mark and moves upwards suggesting a bullish presence at the current price level. Moreover, the RSI trades with a steep slope suggesting low bearish momentum as the buyers appear to be fighting back.

The Bollinger bands at press time are wide and as the last few candlesticks are green the bands will expand further in the immediate future. As the bulls take charge of the market momentum, it will cause the volatility of the Uniswap price to increase in the short term. Moreover, as the price is consolidating closer to the upper limit rather than the band’s mean line, the bands will be leaning upwards for the next few candlesticks.

به طور کلی تحلیل تکنیکال 4 ساعته یک سیگنال خرید با 15 نشانگر از مجموع 26 شاخص فنی اصلی نشان می دهد که حمایت آنها از یک حرکت صعودی را نشان می دهد. از سوی دیگر، تنها یک اندیکاتور سیگنالهای فروش را صادر میکند که حاکی از بازگشت نزولی است. در همین حال، ده اندیکاتور روی حصار نشسته اند و هیچ حمایتی برای هیچ یک از طرفین بازار ندارند.

The 24-hour technical analysis shares this sentiment and also issues a buy signal with 14 of the 26 indicators suggesting a bullish movement against only seven indicators suggest a bearish retracement. Meanwhile, five indicators remain neutral and do not issue any signals at the time of writing.

What to expect from Uniswap price?

Uniswap price at press time is facing resistance at $28 mark but the market is showing strong bullish sentiment .The short term technical indicators support the bulls heavily, while the midterm technical indicators also give a bullish indicator and show high potential for a sharp upward movement.As such traders should expect the price to break above the $28 mark resistance level soon . Traders can even expect an upward breakthrough where the Uniswap price might be able to challenge the $29 mark again if the current momentum continues.Moreover, if the bears take hold of the market the price will not go lower than the $25 علامت

سلب مسئولیت. اطلاعات ارائه شده مشاوره تجاری نیست. Cryptopolitan.com هیچگونه مسئولیتی در قبال هرگونه سرمایه گذاری انجام شده بر اساس اطلاعات ارائه شده در این صفحه ندارد. ما اکیداً قبل از تصمیم گیری در مورد سرمایه گذاری ، تحقیقات مستقل و / یا مشاوره با یک متخصص واجد شرایط را توصیه می کنیم. منبع: https://www.cryptopolitan.com/uniswap-price-analysis-2021-08-08/

- ADA

- نصیحت

- تحلیل

- اوت

- بی تربیت

- حرکت نزولی

- خرس

- bnb

- سرسخت کله شق

- بولز

- خرید

- علت

- به چالش

- بار

- نزدیک

- ادامه

- ارز رمزنگاری

- کریپتو کارنسی (رمز ارزها )

- بازار کریستوگرام

- جاری

- کاهش یافته است

- گسترش

- نما

- آینده

- سبز

- زیاد

- نگه داشتن

- HTTPS

- افزایش

- اطلاعات

- سرمایه گذاری

- سرمایه گذاری

- مسائل

- IT

- سطح

- بدهی

- لاین

- عمده

- ساخت

- علامت

- بازار

- حرکت

- خالص

- دیگر

- فشار

- قیمت

- تجزیه و تحلیل قیمت

- سود

- سوابق

- تحقیق

- فروش

- احساس

- سهام

- کوتاه

- اندازه

- پشتیبانی

- سطح پشتیبانی

- فنی

- تجزیه و تحلیل فنی

- زمان

- معامله گران

- معاملات

- تجارت

- لغو کردن

- نوسانات

- نوشته