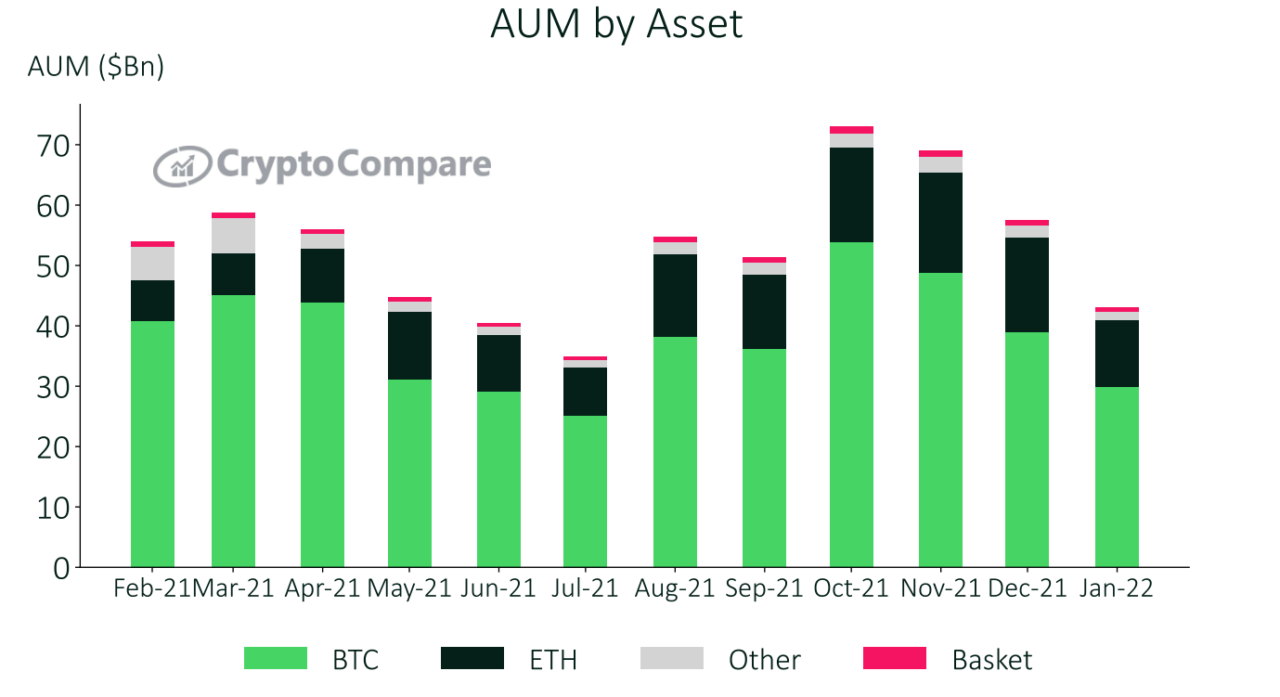

In January, the price of most cryptocurrencies tumbled, with BTC dropping over 20% and ETH over 30% in a continued decline from all-time highs seen in November of last year. Over the decline, Bitcoin’s share of total assets held in cryptocurrency investment products rose to 69.5%.

مطابق با آخرین بررسی مدیریت دارایی دیجیتال CryptoCompare, macro sentiment around risk-assets has been the leading narrative in the markets, as following a record 7% CPI inflation figure coming out from the U.S. in December 2021 investors expect significant tapering of quantitative easing from central banks.

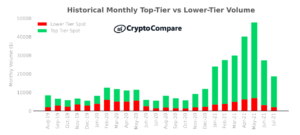

The report details that assets under management for cryptocurrency investment products tumbled 25.1% from $58.6 billion to $43.9 billion, while average daily trading volumes fell 14.5% to $481 million. It adds that Bitcoin-based products saw their assets under management drop 23.3% to $29.9 billion, while Ethereum products and products backed by other assets saw more significant declines of 29.2% and 29.9% respectively.

As a result, BTC products gained market share, going from 67.8% to 69.5% in January.

According to the Digital Asset Management report, the third week of December was the first week since August where digital asset products saw outflows, with the trend carrying on into January. Bitcoin products have experienced the largest outflows with a weekly average of $49.3 million.

Notably, some products saw inflows. Solana-based products, the report notes, saw inflows of $2.4 million a week on average. Similarly, most products saw their trading volumes tumble, although physically-backed BTC products saw their volumes grow.

As CryptoGlobe reported, analysts at JPMorgan led by Nikolaos Panigirtzoglou have revealed they see Ethereum, the second-largest cryptocurrency by market capitalization, از دست دادن سهم بازار به رقبایی مانند سولانا وقتی صحبت از توکن های غیر قابل تعویض (NFT) می شود.

In a note shared with clients, the analysts wrote that Ethereum’s volume share of non-fungible token trading fell from 95% at the start of 2021 to 80% as a result of the high transaction fees seen on the cryptocurrency’s network.

As for Bitcoin, analysts at JPMorgan have also recently هدف بلند مدت قیمت بیت کوین خود را کاهش دادند 150,000 دلار تا 38,000 دلار پس از کاهش قیمت این ارز دیجیتال پرچمدار از 67,000 دلار بالاترین قیمت به 34,000 دلار قبل از بهبودی.

سلب مسئولیت

نظرات و نظرات بیان شده توسط نویسنده یا افراد ذکر شده در این مقاله صرفاً جهت اطلاع رسانی است و به منزله مشاوره مالی، سرمایه گذاری یا سایر موارد نیست. سرمایه گذاری یا معامله در دارایی های رمزنگاری شده با خطر زیان مالی همراه است.

قرض IMAGE

عکس های ویژه از طریق Pixabay

- 000

- 67

- 9

- آگهی

- نصیحت

- معرفی

- هر چند

- دور و بر

- مقاله

- دارایی

- مدیریت دارایی

- دارایی

- اوت

- میانگین

- بانک

- بیلیون

- بیت کوین

- قیمت بیت کوین

- BTC

- سرمایه گذاری

- حمل

- بانک های مرکزی

- آینده

- عضو سازمانهای سری ومخفی

- CryptoCompare

- ارز رمزنگاری

- کریپتو کارنسی (رمز ارزها )

- دیجیتال

- دارایی دیجیتال

- قطره

- کاهش یافته است

- تسکین دهنده

- ETH

- ethereum

- هزینه

- شکل

- مالی

- نام خانوادگی

- رفتن

- شدن

- زیاد

- HTTPS

- تصویر

- افزایش

- تورم

- سرمایه گذاری

- سرمایه گذاری

- سرمایه گذاران

- IT

- ژانویه

- جی پی مورگان

- آخرین

- برجسته

- رهبری

- درشت دستور

- مدیریت

- بازار

- سرمایه گذاری در بازار

- بازارها

- میلیون

- اکثر

- شبکه

- NFT

- غیر قابل مبادله

- نشانه غیر قارچ

- نشانه های غیر قارچی

- یادداشت

- دیدگاه ها

- دیگر

- مردم

- قیمت

- محصولات

- اهداف

- کمی

- کاهش کمی

- رکورد

- گزارش

- نشان داد

- خطر

- پرده

- احساس

- اشتراک گذاری

- به اشتراک گذاشته شده

- قابل توجه

- شروع

- رمز

- نشانه

- تجارت

- معامله

- ما

- حجم

- هفته

- هفتگی

- سال