There was good news on the UK inflation front, as the November data pointed to a drop in inflation. CPI fell to 10.7% y/y, down from 11.1% in October and below the consensus of 10.9%. Core CPI eased to 6.3% y/y, down from 6.5% a month earlier, which was also the consensus. Even with the welcome drop in inflation, it still remains in double digits and is more than five times the Bank of England’s target of 2%.

The British pound is almost unchanged today, despite the drop in inflation. This is in sharp contrast to the reaction on Tuesday to the drop in US inflation, which fell to 7.3% and was softer than expected. The US dollar was about 1% lower against the majors, as once again a soft inflation report raised hopes that the end of the Fed’s tightening cycle is not far off.

همه نگاه ها به فدرال رزرو است

The Fed will announce the benchmark rate later today, after Tuesday’s dramatic CPI report. Inflation fell to 7.1%, down from 7.7% and below the consensus of 7.3%. This hasn’t changed the pricing of an 80% likelihood that the Fed will deliver a 50-basis point hike. The markets will be listening carefully to the tone of Jerome Powell’s rate statement and follow-up remarks, hoping for clues about the next meeting in February. There is a strong chance that the Fed will hike by 25 bp in February and then end the current rate-hike cycle at a terminal rate of 4.75%, on the lower side of the 4.75% to 5.25% range that is considered most likely.

BoE rate decision next

The BoE meets on Thursday and is expected to deliver a 50-basis point hike, which would raise the benchmark rate to 3.50%. This week’s employment and inflation numbers were within market expectations, and a stronger pound has also helped lower the need for a more aggressive 75-bp move. We could see some disagreement among MPC members in today’s vote, which could shed some light on where the BoE goes from here.

Thursday’s rate decision is the final one of the year, with the next meeting not until February 2nd. The most likely scenarios are for a hike of either 25 or 50 points. There is speculation that the February meeting could mark the end of the current tightening cycle, but I am sceptical unless inflation has fallen dramatically by then.

.

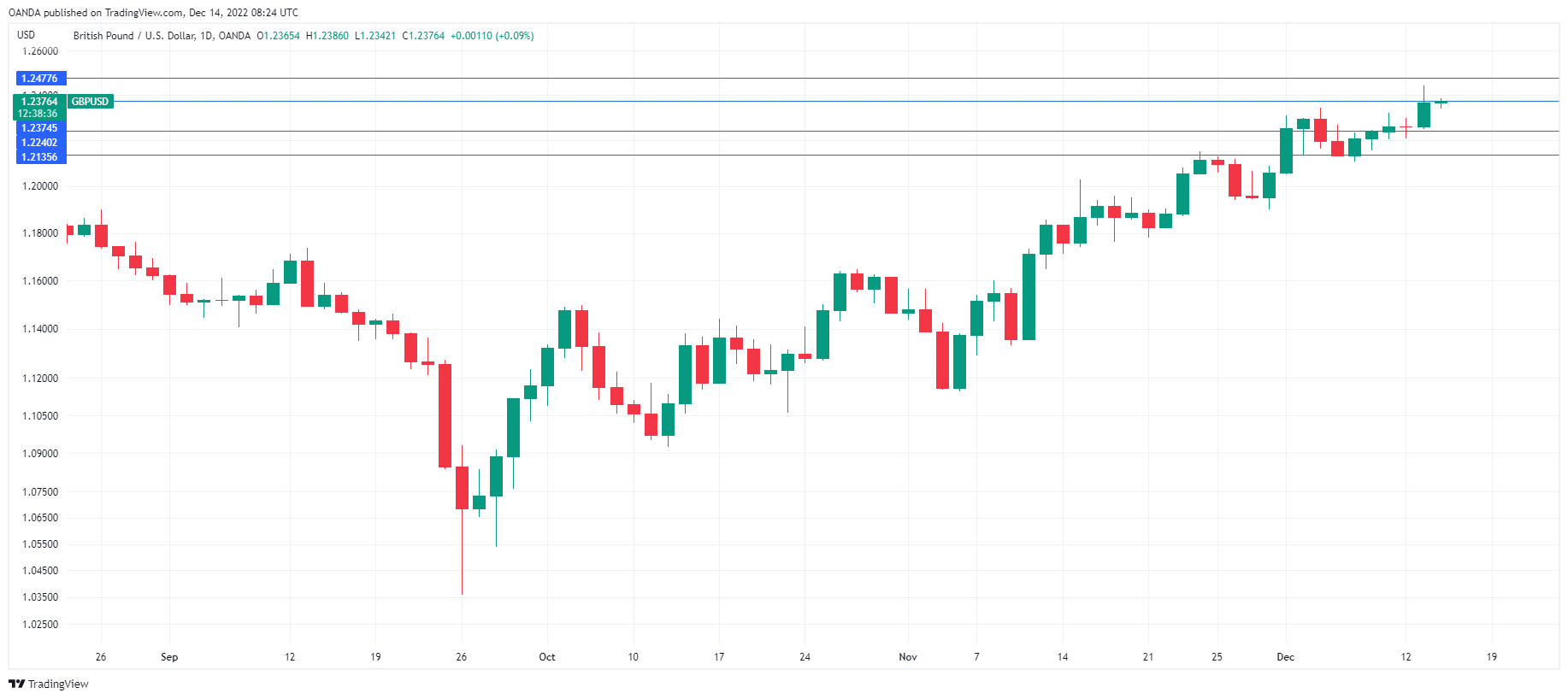

GBP / USD فنی

- 1.2240 و 1.2136 سطوح پشتیبانی بعدی هستند

- GBP/USD در حال تست مقاومت 1.2374 است. در مرحله بعد، مقاومت 1.2478 وجود دارد

این مقاله تنها به منظور اطلاعات عمومی می باشد. این توصیه سرمایه گذاری یا راه حلی برای خرید یا فروش اوراق بهادار نیست. نظرات نویسندگان هستند. نه لزوما شرکت OANDA یا هر یک از شرکت های وابسته، شرکت های تابعه، افسران یا مدیران آن. معاملات اهرمی ریسک بالایی دارد و برای همه مناسب نیست. ممکن است تمام وجوه سپرده شده خود را از دست بدهید.

- بیت کوین

- بلاکچین

- انطباق با بلاک چین

- کنفرانس بلاکچین

- تصمیم نرخ BOE

- بانک های مرکزی

- coinbase

- coingenius

- اجماع

- کنفرانس رمزنگاری

- معدنکاری رمز گشایی

- کریپتو کارنسی (رمز ارزها )

- غیر متمرکز

- DEFI

- دارایی های دیجیتال

- ethereum

- نشست نرخ بهره فدرال رزرو

- FX

- GBP

- GBP / USD

- فراگیری ماشین

- MarketPulse

- خبرها و رویدادها

- خبرخوان

- رمز غیر قابل شستشو

- افلاطون

- افلاطون آی

- هوش داده افلاطون

- پلاتوبلاک چین

- PlatoData

- بازی پلاتو

- چند ضلعی

- اثبات سهام

- CPI اصلی انگلستان

- UK CPI

- CPI ایالات متحده

- دلار آمریکا

- W3

- زفیرنت