USD/JPY Technical: Retesting the 20-day moving average support with bearish momentum

- Key technical elements have turned bearish for USD/JPY ex-post suspected BoJ’s invention.

- USD/JPY bulls’ first defence line at the 20-day moving average acting as a 148.25 support looks vulnerable.

- The next immediate support to watch will be at 146.10/146.00

Il s'agit d'une analyse de suivi de notre rapport précédent, “USD/JPY rallied to an 11-month high despite a rosy Q3 Tankan report and verbal interventions” publié le 2 octobre 2023. Cliquez ici pour un récapitulatif.

Le USD / JPY has shaped the expected push-up and hit the key resistance zone of 150.00/150.30 as it printed an intraday high of 150.16 on Tuesday, 3 October during the first half of the US session upon the release of the better-than-expected US JOLTs jobs numbers for August.

Thereafter within just 5 minutes, the USD/JPY tumbled by close to three big figures to print an intraday low of 147.34 on suspected Bank of Japan (BoJ) intervention under the instructions of Japan’s Ministry of Finance.

The odds have increased for a broad-based USD strength pull-back scenario

Yesterday’s movement in the broad-based FX market has started to show signs of a potential multi-week US dollar strength pull-back scenario as the US Dollar Index’s daily RSI indicator, a gauge on momentum has exhibited a bearish divergence condition at its overbought zone (its first occurrence since its medium-term uptrend kickstarted on 14 July 2023).

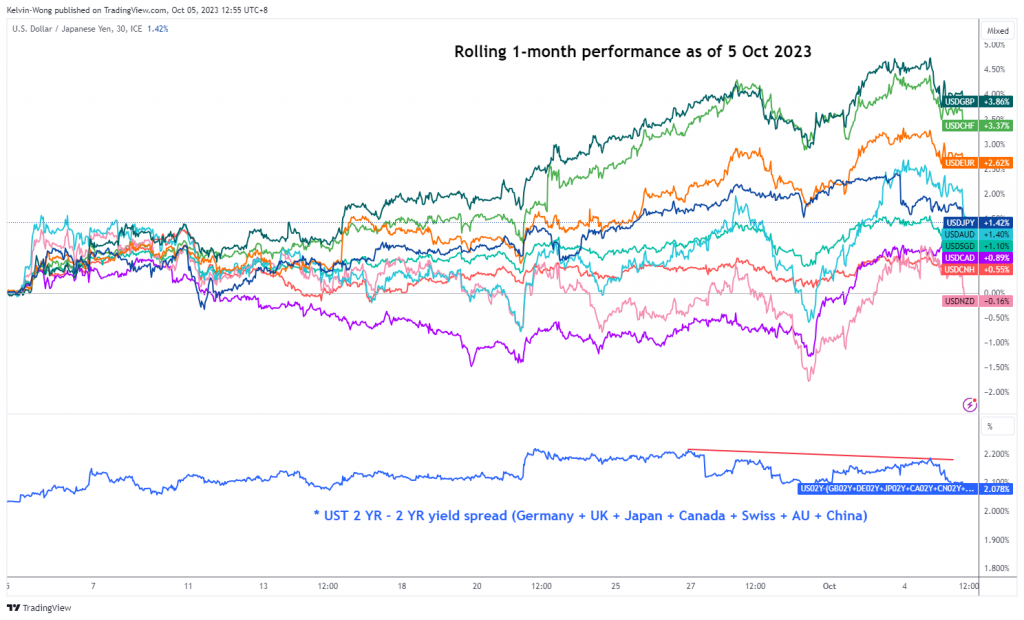

Fig 1: Rolling one-month US dollar performance with 2-year US Treasury yield premium spread as of 5 Oct 2023 (Source: TradingView, click to enlarge chart)

Also, the rolling one-month performances as of 5 October 2023 of the prior weakest currencies against the dollar (GBP, EUR, CHF) have started to display mean reversion movements from 27 September 2023 to cover the prior gaps with the other “lesser weaker” currencies (AUD, NZD, CAD, CNH, SGD) as measured against the US dollar.

In addition, the 2-year US Treasury yield premium over an equal-weighted average of the 2-year sovereign yields of Germany, the UK, Japan, Canada, Switzerland, Australia, and China has started to shrink over the same period.

These latest observations support a potential broad-based multi-week US dollar strength pull-back scenario which in turn reinforces another round of further potential weakness in the USD/JPY where the earlier unconfirmed BoJ’s intervention to halt a multi-month JPY down move is likely to have created a fear element in the mindset of short-term speculators that have a persistent bullish view on the USD/JPY.

Impending medium-term momentum bearish breakdown on USD/JPY

Fig 2: USD/JPY medium-term trend as of 5 Oct 2023 (Source: TradingView, click to enlarge chart)

The daily RSI of the USD/JPY has shaped an impending “Double Top” bearish reversal configuration around its overbought zone and right now, it is attempting to stage a bearish breakdown below a parallel support at the 56 level.

This key technical element suggests that the medium-term downside momentum of the USD/JPY has started to build up which may jeopardize the ongoing short to medium-term uptrend phases of the USD/JPY.

The 20-day moving average support on the USD/JPY looks vulnerable

Fig 3: USD/JPY minor short-term trend as of 5 Oct 2023 (Source: TradingView, click to enlarge chart)

The bulls of the USD/JPY have managed to hold the defence line at the upward-sloping 20-day moving during Tuesday’s suspected BoJ’s intervention. The price actions of the USD/JPY have been trading at and above the 20-day moving average since 28 July 2023.

The 20-day moving average is now acting as support at around 148.25 where price actions retested it again in today’s Asian morning session and staged a minor bounce of 29 pips at this time of the writing.

However, other short-term technical elements have turned bearish where the price actions of the USD/JPY have staged a bearish breakdown from the lower boundary of its minor ascending channel from 1 September low now acting as a near-term pull-back resistance at 149.40.

Watch the 150.30 pivotal resistance and a breakdown below 148.25 may trigger the start of a potential short-term downtrend phase to expose the next support at 146.10/146.00 in the first step.

However, a clearance above 150.30 invalidates the bearish tone for a squeeze up towards the next major resistances of 150.90 and 151.95 (21 Oct 2022 swing high).

Le contenu est uniquement à des fins d'information générale. Il ne s'agit pas d'un conseil en investissement ni d'une solution d'achat ou de vente de titres. Les opinions sont les auteurs; pas nécessairement celui d'OANDA Business Information & Services, Inc. ou de l'un de ses affiliés, filiales, dirigeants ou administrateurs. Si vous souhaitez reproduire ou redistribuer tout contenu trouvé sur MarketPulse, un service primé d'analyse et d'actualités sur le forex, les matières premières et les indices mondiaux produit par OANDA Business Information & Services, Inc., veuillez accéder au flux RSS ou contactez-nous à info@marketpulse.com. Visiter https://www.marketpulse.com/ pour en savoir plus sur le rythme des marchés mondiaux. © 2023 OANDA Business Information & Services Inc.

- Contenu propulsé par le référencement et distribution de relations publiques. Soyez amplifié aujourd'hui.

- PlatoData.Network Ai générative verticale. Autonomisez-vous. Accéder ici.

- PlatoAiStream. Intelligence Web3. Connaissance Amplifiée. Accéder ici.

- PlatonESG. Carbone, Technologie propre, Énergie, Environnement, Solaire, La gestion des déchets. Accéder ici.

- PlatoHealth. Veille biotechnologique et essais cliniques. Accéder ici.

- La source: https://www.marketpulse.com/forex/usd-jpy-technical-retesting-the-20-day-moving-average-support-with-bearish-momentum/kwong

- :possède

- :est

- :ne pas

- :où

- $UP

- 1

- 14

- 15 ans

- 15%

- 150

- 16

- 2022

- 2023

- 25

- 27

- 28

- 29

- 30

- 40

- 7

- 700

- a

- A Propos

- au dessus de

- accès

- intérim

- actes

- ajout

- conseils

- Affiliés

- encore

- à opposer à

- an

- Analyses

- selon une analyse de l’Université de Princeton

- et les

- Une autre

- tous

- SONT

- autour

- AS

- asiatique

- At

- tenter

- AUD

- Août

- Australie

- auteur

- auteurs

- Avatar

- moyen

- prix

- Banque

- banque du japon

- Banque du Japon (BoJ)

- BE

- baissier

- divergence baissière

- Moment baissier

- était

- ci-dessous

- Big

- boj

- Rebondir

- limite

- Box

- Breakdown

- large

- construire

- Haussier

- Bulls

- la performance des entreprises

- acheter

- by

- CAD

- Canada

- Développement

- Graphique

- chf

- Chine

- dégagement

- cliquez

- Fermer

- COM

- combinaison

- Matières premières

- condition

- menée

- configuration

- Connecter les

- contact

- contenu

- cours

- couverture

- créée

- devises

- Tous les jours

- la défense

- Malgré

- Administration

- Commande

- Divergence

- Dollar

- down

- inconvénient

- tendance baissière

- pendant

- Plus tôt

- élément

- éléments

- Elliott

- agrandir

- EUR

- échange

- attendu

- d'experience

- expert

- peur

- Figures

- finance

- la traduction de documents financiers

- Trouvez

- Prénom

- flux

- Pour

- étranger

- change

- forex

- trouvé

- De

- fund

- fondamental

- plus

- FX

- lacunes

- jauge

- GBP

- Général

- Allemagne

- Global

- les marchés mondiaux

- Half

- Vous avez

- Haute

- Frappé

- appuyez en continu

- HTTPS

- if

- Immédiat

- imminent

- in

- Inc

- increased

- Indicateur

- Indices

- d'information

- Des instructions

- intervention

- Invention

- un investissement

- IT

- SES

- Japon

- Japon

- Compromettre

- Emplois

- JPY

- Juillet

- juste

- Kelvin

- ACTIVITES

- résistance clé

- kickstarted

- Nom

- Nouveautés

- Niveau

- niveaux

- comme

- Probable

- Gamme

- LOOKS

- Faible

- baisser

- Macro

- majeur

- gérés

- Marché

- perspectives du marché

- Étude de marché

- MarketPulse

- Marchés

- largeur maximale

- Mai..

- signifier

- Réversion moyenne

- Mindset

- ministère

- mineur

- Minutes

- Élan

- PLUS

- Matin

- Bougez

- mouvement

- mouvements

- en mouvement

- moyenne mobile

- nécessairement

- nouvelles

- next

- maintenant

- numéros

- nombreux

- NZD

- événement

- OCT

- octobre

- Chances

- of

- les officiers

- on

- un mois

- en cours

- uniquement

- Avis

- or

- Autre

- nos

- ande

- Outlook

- plus de

- Parallèle

- passionné

- performant

- performances

- période

- perspectives

- phase

- photo

- pivot

- Platon

- Intelligence des données Platon

- PlatonDonnées

- veuillez cliquer

- positionnement

- Poteaux

- défaillances

- Premium

- prix

- Imprimé

- Avant

- Produit

- aportando

- publié

- des fins

- Q3

- résumer

- renforce

- libérer

- rapport

- un article

- Résistance

- détail

- Renversement

- bon

- Roulant

- rosé

- Round

- rsi

- rss

- même

- scénario

- titres

- vendre

- supérieur

- Septembre

- service

- Services

- Session

- SGD

- en forme de

- partage

- Shorts

- assistance technique à court terme

- montrer

- Signes

- depuis

- Singapour

- site

- sur mesure

- Identifier

- souverain

- spécialisation

- propagation

- La technique “squeeze”

- Étape

- Commencer

- j'ai commencé

- étapes

- stock

- Marchés boursiers

- Stratège

- force

- Suggère

- Support

- Swing

- Suisse

- Technique

- Analyse technique

- Dix

- qui

- Le

- au Royaume-Uni

- this

- milliers

- trois

- fiable

- à

- aujourd'hui

- TON

- vers

- Les commerçants

- Commerce

- TradingView

- Formation

- Trésorerie

- Trend

- déclencher

- Mardi

- TOUR

- Tourné

- Uk

- sous

- expérience unique et authentique

- sur

- tendance haussière

- us

- Dollars américain

- Trésor américain

- USD

- USD / JPY

- en utilisant

- v1

- Voir

- Visiter

- Vulnérable

- Montres

- Vague

- faiblesse

- WELL

- qui

- sera

- une équipe qui gagne ?

- comprenant

- dans les

- wong

- pourra

- écriture

- années

- Rendement

- rendements

- Vous n'avez

- zéphyrnet