Bitcoin fell below US$24,000 in a mixed morning for the top 10 non-stablecoin cryptocurrencies by market capitalization on Monday in Asia. Solana posted the most gains in that list while leading memecoin Dogecoin dropped the most.

Lásd a kapcsolódó cikket: Japán áprilisban indít digitális jen kísérleti programot

Gyors tények

- Bitcoin fell 2.76% in the last 24 hours to trade at US$23,927 as of 9:15 a.m. in Hong Kong, but was still up 11.9% over the past week, szerint a CoinMarketCap. Ethereum lost 0.97% to US$1,661, and has gained 11.2% over the past seven days.

- Solana was up 4.6% to US$24.62, a weekly gain of 15.6%. The network has been holding its “Build through the Bear” hackathon this month, which invites community members to build on the blockchain, offering US$50,000 in USDC for the top prize. The hackathon ends on March 14.

- Dogecoin fell 2% to US$0.087, but was still trading up 6.6% over the past seven days. XRP slipped 1.7% to US$0.38, though was still trading 3% higher for the past week.

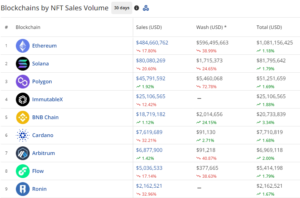

- The total crypto market capitalization reached US$1.13 trillion overnight, the highest since August 2022, before falling to US$1.12 trillion at 9:15 a.m. in Hong Kong. The total trading volume over the past 24 hours was up by 14.4% to US$54.9 billion.

- U.S. equities had a mixed day of trading on Friday. The Dow Jones Industrial Average rose 0.4%, but the S&P 500 Index fell 0.3%, and the Nasdaq Composite Index closed the day down 0.6%. Wall Street will be closed on Monday for Presidents’ Day.

- Many major U.S. retailers are slated to release their holiday season earnings this week, starting with Walmart Inc. and Home Depot Inc. on Tuesday.

- The earning reports are set to come amid growing recessionary concerns in the U.S., as the Federal Reserve has raised interest rates from near zero to 4.5% to 4.75% to tamp down on inflation. While some have criticized the Fed for raising rates too sharply, the central bank maintains it will be able to achieve a “sima landolás” to bring down inflation without triggering a recession.

- A fogyasztói árindex legfrissebb adatai szerint az infláció januárban 6.4%-kal haladta meg az egy évvel korábbit, szemben a decemberi 6.5%-kal és a novemberi 7.1%-kal.

- Elemzők a CME Group predict an 85% chance that the Fed will raise rates by another 25 basis points next month.

Lásd a kapcsolódó cikket: Wemade WEMIX tokenje megugrott, miután újra jegyezték a dél-koreai Coinone tőzsdén

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://forkast.news/headlines/markets-bitcoin-24000-trading-week-asia/

- 000

- 1

- 10

- 11

- 2%

- 2022

- 7

- 9

- a

- am

- Képes

- Szerint

- Elérése

- Után

- Között

- és a

- Másik

- cikkben

- Ázsia

- Augusztus

- átlagos

- Bank

- alap

- előtt

- lent

- Billió

- Bitcoin

- blockchain

- Bloomberg

- hoz

- épít

- tőkésítés

- központi

- Központi Bank

- esély

- zárt

- CM kiterjesztés

- CME Group

- CNBC

- Coinone

- hogyan

- közösség

- aggodalmak

- fogyasztó

- fogyasztói árindex

- crypto

- Crypto Market

- cryptocurrencies

- dátum

- nap

- Nap

- december

- digitális

- digitális jen

- Dogecoin

- dow

- Dow Jones

- Dow Jones Industrial Average

- le-

- csökkent

- bevételt hozó

- Kereset

- vége

- Részvények

- Ethereum

- Eső

- Fed

- Szövetségi

- Federal Reserve

- Péntek

- ból ből

- Nyereség

- Nyereség

- Csoport

- Növekvő

- hackathon

- <p></p>

- legnagyobb

- holding

- Ünnep

- Kezdőlap

- otthoni raktár

- Hong

- Hong Kong

- NYITVATARTÁS

- HTML

- HTTPS

- in

- Inc.

- index

- ipari

- infláció

- kamat

- Kamat-

- meghívja

- IT

- január

- Kong

- Koreai

- keresztnév

- legutolsó

- indít

- vezető

- Lista

- fenntartja

- fontos

- március

- piacára

- Piac tőkésítés

- piacok

- Partnerek

- memecoin

- vegyes

- hétfő

- Hónap

- Reggel

- a legtöbb

- Nasdaq

- Közel

- hálózat

- következő

- nem stabil érme

- november

- felajánlás

- éjszakai

- múlt

- pilóta

- Plató

- Platón adatintelligencia

- PlatoData

- pont

- kiküldött

- ár

- díj

- program

- emel

- emelt

- emelés

- Az árak

- elérte

- recesszió

- összefüggő

- engedje

- Jelentések

- Tartalék

- kiskereskedők

- ROSE

- S&P

- S&P 500

- készlet

- hét

- óta

- Solana

- néhány

- Dél

- kezdet

- Kezdve

- Még mindig

- utca

- túlfeszültség

- A

- a Fed

- azok

- Keresztül

- nak nek

- jelképes

- is

- felső

- Top 10

- Végösszeg

- kereskedelem

- Kereskedés

- kereskedési volumen

- kioldás

- Trillió

- Kedd

- nekünk

- USDC

- kötet

- Wall Street

- Walmart

- hét

- heti

- ami

- míg

- lesz

- nélkül

- XRP

- év

- Jen

- zephyrnet

- nulla