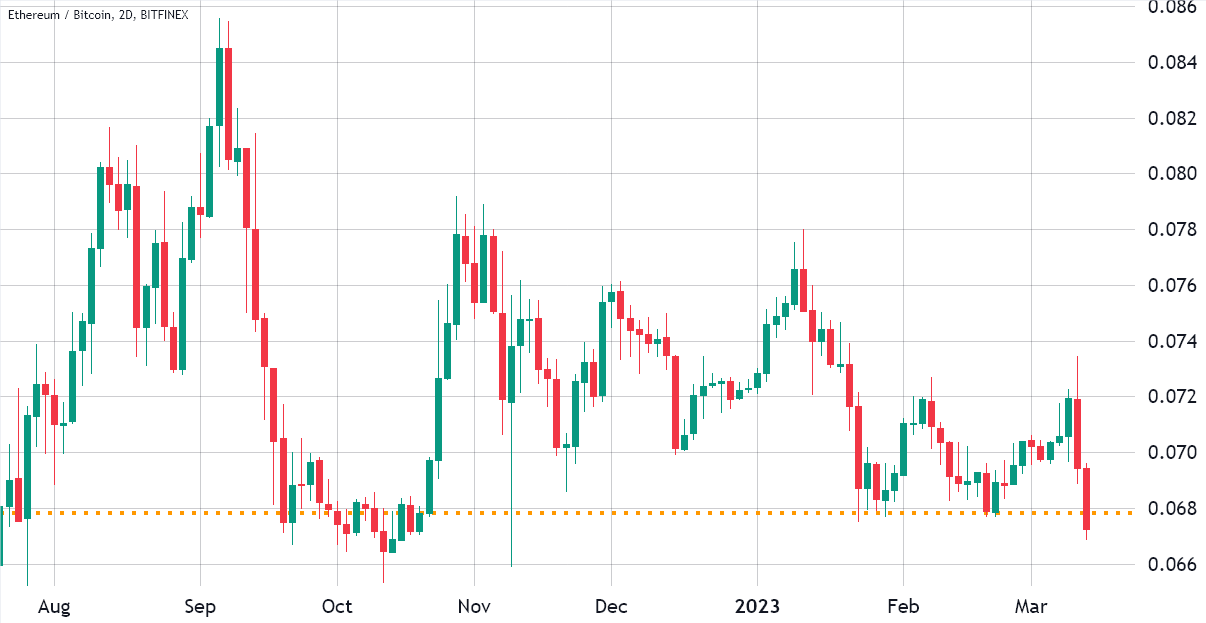

The previous six months should have been extremely beneficial to Ether’s (ETH) price, especially after the project’s most significant upgrade ever in September 2022. However, the reality was the opposite: between September 15, 2022, and March 15, 2023, Ether underperformed Bitcoin (BTC) 10% -kal.

The price ratio of 0.068 ETH/BTC had been holding since October 2022, a support that was broken on March 15. Whatever the reason for the underperformance, traders currently have little confidence in placing leverage bets, according to ETH futures and options data.

But first, one should consider why Ether’s price was expected to rise in the previous six months. On September 15, 2022, the Merge, a hard fork that switched the network to a proof-of-stake consensus mechanism, occurred. It enabled a much lower, even negative, coin issuing rate. But, more importantly, the change paved the way for parallel processing that aimed to bring scalability and lower transaction costs to the Ethereum network.

The Shapella hard fork, expected to take effect on the mainnet in April, is the next step in the Ethereum network upgrade. The change will allow validators who previously deposited 32 ETH to enter the staking mechanism to withdraw in part or in full. While this development is generally positive because it gives validators more flexibility, the potential 1.76 million ETH unlock is a negative consequence.

However, there is a cap on the number of validators that can exit; therefore, the maximum daily unstake is 70,000 ETH. Moreover, after exiting the validation process, one may choose between Lido, Rocket Pool, or a decentralized finance (DeFi) application for yield mechanisms. These coins will not necessarily be sold at the market.

Nézzük Éter származékok data to understand if the recent drop below the 0.068 ETH/BTC ratio has affected investors’ sentiment.

Az ETH határidős ügyletek felépültek a pánik állapotából

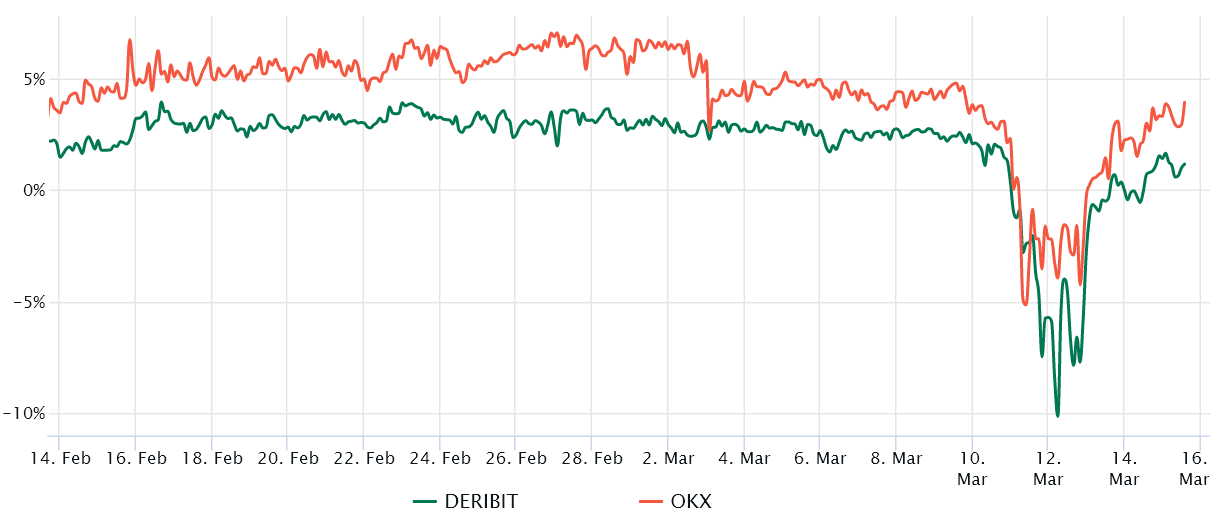

In healthy markets, the annualized three-month futures premium should trade between 5% and 10% to cover associated costs and risks. However, when the contract trades at a discount (backwardation) relative to traditional spot markets, it indicates traders’ lack of confidence and is regarded as a bearish indicator.

A származékos kereskedők kényelmetlenül érezték magukat a tőkeáttételi hosszú (bull) pozíciók tartásában, mivel az Ether határidős prémium március 11-én nulla alá süllyedt a mindössze két nappal korábbi 3.5%-ról. Ennél is fontosabb, hogy a jelenlegi 2.5%-os prémium továbbra is szerény, és távol áll az 5%-os semlegestől a bullish-ig terjedő küszöbtől.

Nonetheless, declining demand for leverage longs (bulls) does not necessarily imply an expectation of negative price action. As a result, traders should examine Az Ether opciós piacai to understand how whales and market makers price the likelihood of future price movements.

Kapcsolódó: Lark Davis a közösségi média viharai elleni küzdelemről, és arról, hogy miért ETH bika – Lángcsarnok

Az ETH opciók megerősítik a kockázati étvágy hiányát

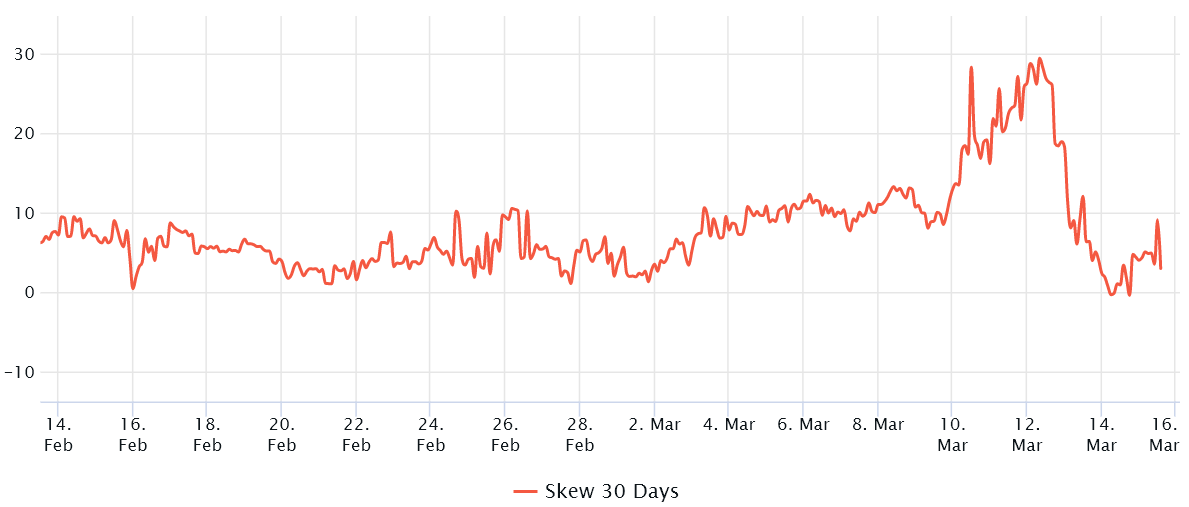

The 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection. In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 8%. On the other hand, bullish markets tend to drive the skew metric below -8%, meaning the bearish put options are in less demand.

Március 3-án a delta ferdeség átlépte a bearish 8%-os küszöböt, jelezve a stresszt a professzionális kereskedők körében. A félelem szintje március 10-én tetőzött, amikor az Ether ára 1,370 dollárra zuhant, ami az elmúlt 56 nap legalacsonyabb szintje, bár az ETH ára március 1,480-én 12 dollár fölé szökött.

Surprisingly, on March 12, the 25% delta skew metric continued to rise, reaching its highest level of skepticism since November 2022. That happened just hours before Ether’s price rose 20% in 48 hours. That explains why ETH traders shorting futures contracts faced $507 million in felszámolások.

The 3% delta skew metric currently signals a balanced demand for ETH call and put options. When combined with the neutral stance on ETH futures premium, the derivatives market indicates that professional traders are hesitant to place either bullish or bearish bets. Unfortunately, ETH derivatives metrics do not favor traders expecting Ether to reclaim the 0.068 level against Bitcoin in the near term.

Az itt kifejtett nézetek, gondolatok és vélemények önmagában a szerzők, és nem feltétlenül tükrözik, vagy képviselik a Cointelegraph nézeteit és véleményét.

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://cointelegraph.com/news/ethereum-price-reaches-lowest-level-relative-to-bitcoin-in-5-months

- :is

- 000

- 1

- 10

- 11

- 2022

- 2023

- 32 ETH

- 70

- a

- felett

- Szerint

- Akció

- Után

- ellen

- kizárólag

- Bár

- között

- és a

- évesített

- Alkalmazás

- arbitrázs

- VANNAK

- AS

- társult

- At

- BE

- Viselik

- medvepiacok

- esetlen

- mert

- előtt

- lent

- előnyös

- fogadás

- között

- Bitcoin

- Bitfinex

- hoz

- Törött

- bika

- Bullish

- Bulls

- by

- hívás

- TUD

- sapka

- okozó

- változik

- A pop-art design, négy időzóna kijelzése egyszerre és méretének arányai azok az érvek, amelyek a NeXtime Time Zones-t kiváló választássá teszik. Válassza a

- Érme

- érmék

- Cointelegraph

- kombinált

- bizalom

- megerősít

- megegyezés

- Fontolja

- tovább

- szerződés

- szerződések

- kiadások

- terjed

- Crossed

- Jelenlegi

- Jelenleg

- napi

- dátum

- Davis

- Nap

- decentralizált

- Decentralizált pénzügy

- decentralizált pénzügy (DeFi)

- Hanyatló

- Defi

- Delta

- Kereslet

- letétbe

- Származékok

- Íróasztalok

- Fejlesztés

- Kedvezmény

- le-

- hátránya

- hajtás

- Csepp

- kiírása

- hatás

- bármelyik

- engedélyezve

- belép

- különösen

- ETH

- Éter

- éter határidős

- Ethereum

- ethereum hálózat

- Ethereum ár

- Még

- EVER

- Kilépés

- Kilépés

- várakozás

- várható

- vár

- Elmagyarázza

- kifejezve

- rendkívüli módon

- szembe

- kedvez

- félelem

- harcoló

- finanszíroz

- vezetéknév

- Rugalmasság

- A

- hozamért

- villa

- ból ből

- Tele

- jövő

- Jövő ára

- Futures

- általában

- Ad

- ad

- Csarnok

- kéz

- történt

- Kemény

- kemény villa

- Legyen

- egészséges

- itt

- Habozó

- <p></p>

- legnagyobb

- holding

- NYITVATARTÁS

- Hogyan

- azonban

- HTTPS

- in

- jelzi

- Mutató

- Befektetők

- kibocsátó

- IT

- ITS

- hiány

- szint

- szintek

- Tőkeáttétel

- STRANDFÜRDŐ

- kis

- Hosszú

- néz

- legalacsonyabb szint

- mainnet

- Makers

- március

- piacára

- piaci döntéshozók

- piacok

- maximális

- jelenti

- mechanizmus

- Média

- megy

- metrikus

- Metrics

- millió

- hónap

- több

- Ráadásul

- a legtöbb

- mozgások

- Közel

- szükségszerűen

- negatív

- hálózat

- Semleges

- következő

- november

- szám

- történt

- október

- Esély

- of

- on

- ONE

- Vélemények

- szemben

- Opciók

- Más

- Párhuzamos

- rész

- Hely

- forgalomba

- Plató

- Platón adatintelligencia

- PlatoData

- medence

- pozíciók

- pozitív

- potenciális

- prémium

- előző

- korábban

- ár

- ÁRJEGYZÉK

- Előzetes

- folyamat

- feldolgozás

- szakmai

- program

- Proof-of-Tét

- védelem

- tesz

- Arány

- hányados

- Elér

- elérése

- Valóság

- ok

- új

- tükröznie

- maradványok

- képvisel

- eredményez

- Emelkedik

- Kockázat

- kockázatok

- Rakéta

- Rakéta medence

- ROSE

- s

- skálázhatóság

- érzés

- szeptember

- rövidzárlat

- kellene

- <p></p>

- jelek

- jelentős

- óta

- SIX

- Hat hónap

- Szkepticizmus

- ferdeség

- Közösség

- Közösségi média

- eladott

- forrás

- Spot

- kockára

- Állami

- Lépés

- viharok

- feszültség

- támogatás

- hogy

- A

- Az egyesítés

- ebből adódóan

- Ezek

- küszöb

- nak nek

- kereskedelem

- Kereskedők

- szakmák

- hagyományos

- tranzakció

- tranzakciós költségek

- megért

- kinyit

- frissítés

- fejjel

- érvényesítés

- érvényesítő

- nézetek

- Út..

- bálnák

- míg

- WHO

- lesz

- val vel

- visszavonul

- Hozam

- zephyrnet

- nulla

![Legfrissebb frissítés – Sam Bankman-Fried, az FTX korábbi vezérigazgatója tárgyalása [3. nap] Legfrissebb frissítés – Sam Bankman-Fried, az FTX korábbi vezérigazgatója tárgyalása [3. nap]](https://platoblockchain.com/wp-content/uploads/2023/10/latest-update-former-ftx-ceo-sam-bankman-fried-trial-day-3-225x300.jpg)