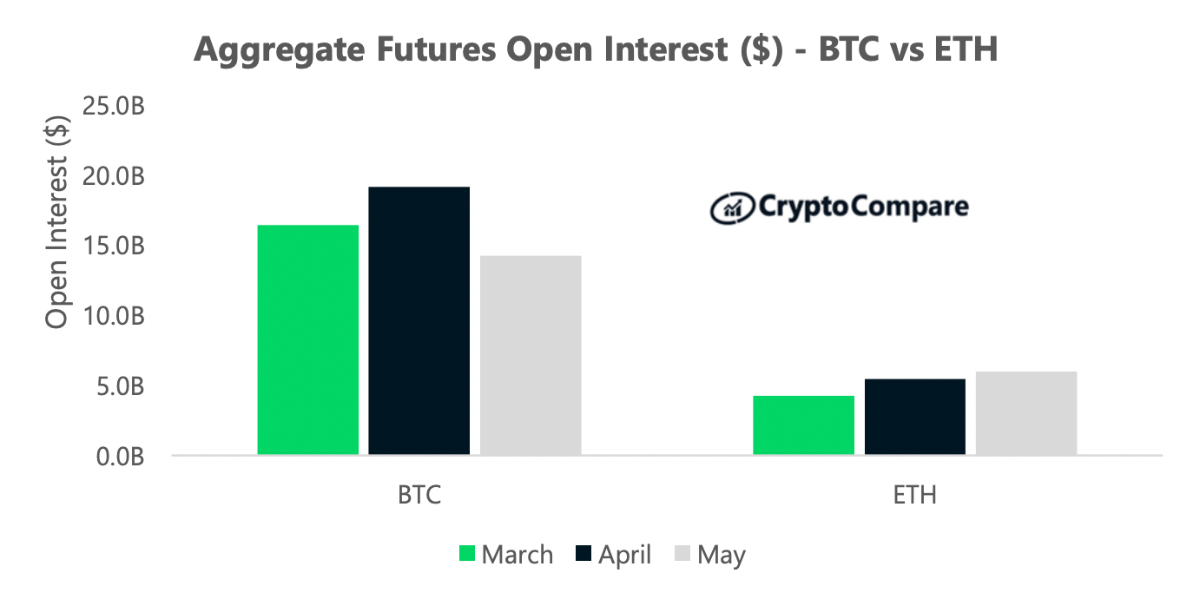

Following the recent cryptocurrency market crash that saw the price of bitcoin plunge from a near $64,000 all-time high to $29,900 before it recovered to $36,000, open interest for bitcoin has dropped significantly, while for Ethereum it surged.

Szerint A CryptoCompare 2021. májusi tőzsdei áttekintése, Ethereum’s priced ended the month of May down just 2.5%; however, Ethereum gained market share in the derivatives market, as open interest on the second-largest cryptocurrency by market capitalization rose 9.9% to $6 billion.

Open interest on BTC products dropped by 25.8% during the same period, during a period in which open interest across all derivatives products fell by 14.5% to $27.8 billion, with Binance being the exchange with the highest open interest in the space, followed by Huobi and OKEx.

A Binance volt a legmagasabb nyitott kamata az ETH perpetual futures kontraktusoknál 1.5 milliárd dollárral, ezt követi a Bybit, a Huobi és az OKEx. A szabályozott határidős tőzsde CME-vel rendelkezett a legmagasabb ETH határidős nyitott kamata 489 millió dollárral, ezt követi az OKEx 481 millió dolláros kamata.

Open interest for BTC futures on the CME exchange decreased by 22.9% last month to $2 billion, while ETH open interest averaged $489 million after rising 146% compared to April.

The figures come as total spot volume across the cryptocurrency space surged 26.5% to $4.8 trillion, and total derivatives trading volumes increased 40.4% to $5.5 trillion. Volumes surged, according to the report, as investors reacted to higher volatility on the market. Binance, Huobi Global, and OKEx were the largest spot exchanges, while for derivatives, Huobi was replaced by Bybit on the podium.

Ether open interest surging while BTC drops is significant as talks of a “Flippening” have been increasing on social media. The Flippening is a scenario in which Ethereum surpasses bitcoin and becomes the number one cryptocurrency by market capitalization.

A találmány egy set up to track the Flippening, Ethereum mining rewards are already superior to BTC mining rewards, as is ETH’s transactions volume, transaction count, transaction fees, and trading volume.

Bitcoin’s market capitalization isn’t the only thing setting it apart, however, as Google search interest for BTC is still far above interest for ETH, as is BTC’s node count and the number of active addresses on the Bitcoin network.

Data shows that earlier this year Ethereum’s market capitalization was around 19% that of BTC, but recent price action saw the second-largest cryptocurrency’s market cap half that of BTC for a short period.

It’s worth noting the Flippening first set the cryptocurrency community abuzz back in 2017, when Ethereum’s market capitalization represented 83% of bitcoin’s market capitalization. Bitcoin’s share of the cryptocurrency markets – its dominance – is now at 41%, while Ethereum’s is at 18.8%. In 2017, BTC’s dominance was 38% while ETH’s was 33%.

NYILATKOZAT

A szerző, vagy a cikkben említett személyek által kifejtett nézetek és vélemények csak tájékoztató jellegűek, és nem jelentenek pénzügyi, befektetési vagy egyéb tanácsokat. A kriptokészletekbe történő befektetés vagy kereskedés pénzügyi veszteség kockázatával jár.

IMAGE CREDIT

Kiemelt kép a pixabay

- 000

- 9

- Akció

- aktív

- hirdetések

- tanács

- Minden termék

- április

- körül

- cikkben

- auto

- Billió

- binance

- Bitcoin

- BTC

- CM kiterjesztés

- közösség

- szerződések

- Crash

- cryptocurrency

- cryptocurrency piacon

- Származékok

- származékos termékek kereskedelme

- csökkent

- ETH

- Ethereum

- csere

- Feltételek

- díjak

- pénzügyi

- vezetéknév

- Futures

- Globális

- Google keresés

- Magas

- HTTPS

- Huobi

- Globális Huobi

- kép

- kamat

- befektetés

- beruházás

- Befektetők

- IT

- piacára

- Piaci sapka

- Piac tőkésítés

- piacok

- Média

- millió

- Bányászati

- Közel

- hálózat

- OKEx

- nyitva

- Vélemények

- Más

- Emberek (People)

- pódium

- ár

- Termékek

- jelentést

- Jutalmak

- Kockázat

- Keresés

- készlet

- beállítás

- Megosztás

- rövid

- Közösség

- Közösségi média

- Hely

- Spot

- Talks

- vágány

- Kereskedés

- tranzakció

- Tranzakciók

- Illékonyság

- kötet

- érdemes

- év