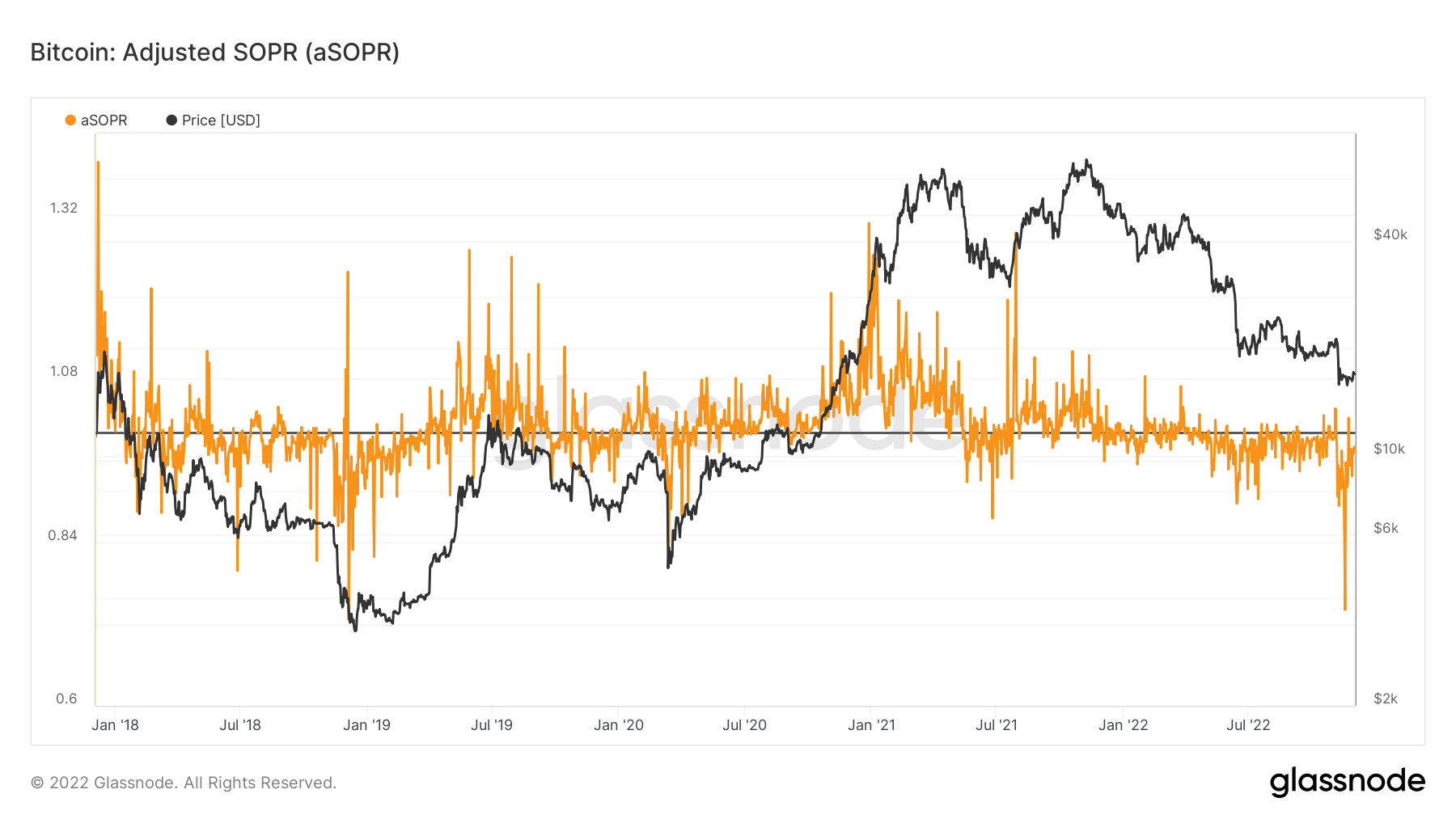

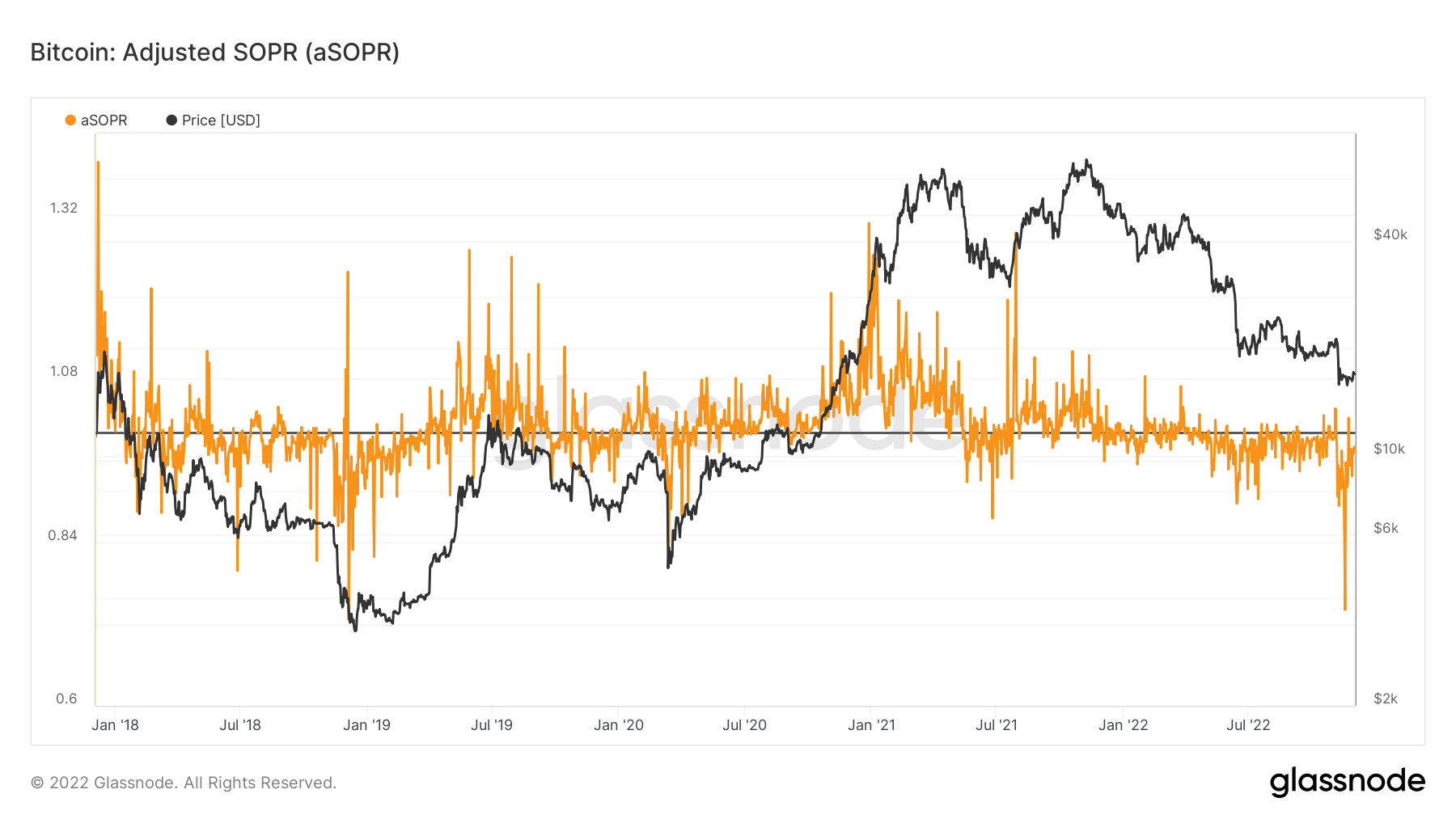

The Adjusted Spent Output Profit Ratio (aSOPR), a metric that indicates whether holders are selling at a profit or loss, recorded a downward trajectory below the 1-level, which suggests investors are selling their positions at massive losses.

Szerint CryptoSlate elemzés, the aSOPR provided by Glassnode usually signals the transition to a bull market when investors realize high losses during the bear market. Holders give up with current conditions at this point, and the capitulation deepens. Therefore ushering buy-the-dip opportunists, who are driving substantial accumulation, despite the BTC market witnessing one of the most significant capitulation events in 4 years.

As depicted in the graph below, the trend in Bitcoin’s aSOPR shows a recent downward trajectory below 1. As a result, the indicator’s value presently lies at a level last witnessed in 2018 when the bearish cycle reached its bottom.

Fluctuating aSOPR levels suggest break-even traders, and the indicator trending upwards above 1 indicates profit-taking, which usually takes place before a bear market. For example, the $21K Bitcoin price level was an interesting zone for profit-taking in October, as was indicated by that time’s aSOPR.

A novemberi, az FTX ütközőfűrész-tartók további árcsökkenése azonban továbbra is a veszteséges eladási tendenciát követi.

Ahogy az FTX fizetésképtelensége tovább pusztította a piacokat, és további zűrzavart okozott a már egyéves bearish ciklusban, a tulajdonosok továbbra is több veszteséget realizáltak, így az aSOPR-t úgy módosították, hogy jelezze a széles körű BTC kapitulációt.

Additionally, the aSOPR shifted to historical lows last seen before the 2018 bear market transitioned to bullish, which could signify the current cycle is approaching a bottom.

The only difference right now is the 2018 bottom featured lower lows compared to the current bottom. Therefore it is still uncertain whether the market has finally reached a transition point.

- elemzés

- asopr

- Bitcoin

- Bitcoin onchain data

- blockchain

- blokklánc megfelelőség

- blockchain konferencia

- coinbase

- coingenius

- megegyezés

- kriptokonferencia

- kriptikus bányászat

- cryptocurrency

- CryptoSlate

- decentralizált

- Defi

- Digitális eszközök

- Ethereum

- Üvegcsomó

- gépi tanulás

- nem helyettesíthető token

- Plató

- plato ai

- Platón adatintelligencia

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- a tét igazolása

- W3

- zephyrnet