Crossover investor giant Kabát has significantly cut down on funding deals as the venture sector continues to see a pullback after a record-shattering 2021.

After taking part in 56 funding deals in the fourth quarter of last year, the New York-based firm took part in only 16 such deals in the just-completed second quarter of this year, a Crunchbase adatai szerint.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t] .process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement("script");o.async=1,o.id=n,o.src= ”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

In addition, whereas the rounds the firm participated in in the fourth quarter totaled more than $14 billion, the rounds in the second quarter came out to only $1.6 billion, according to Crunchbase.

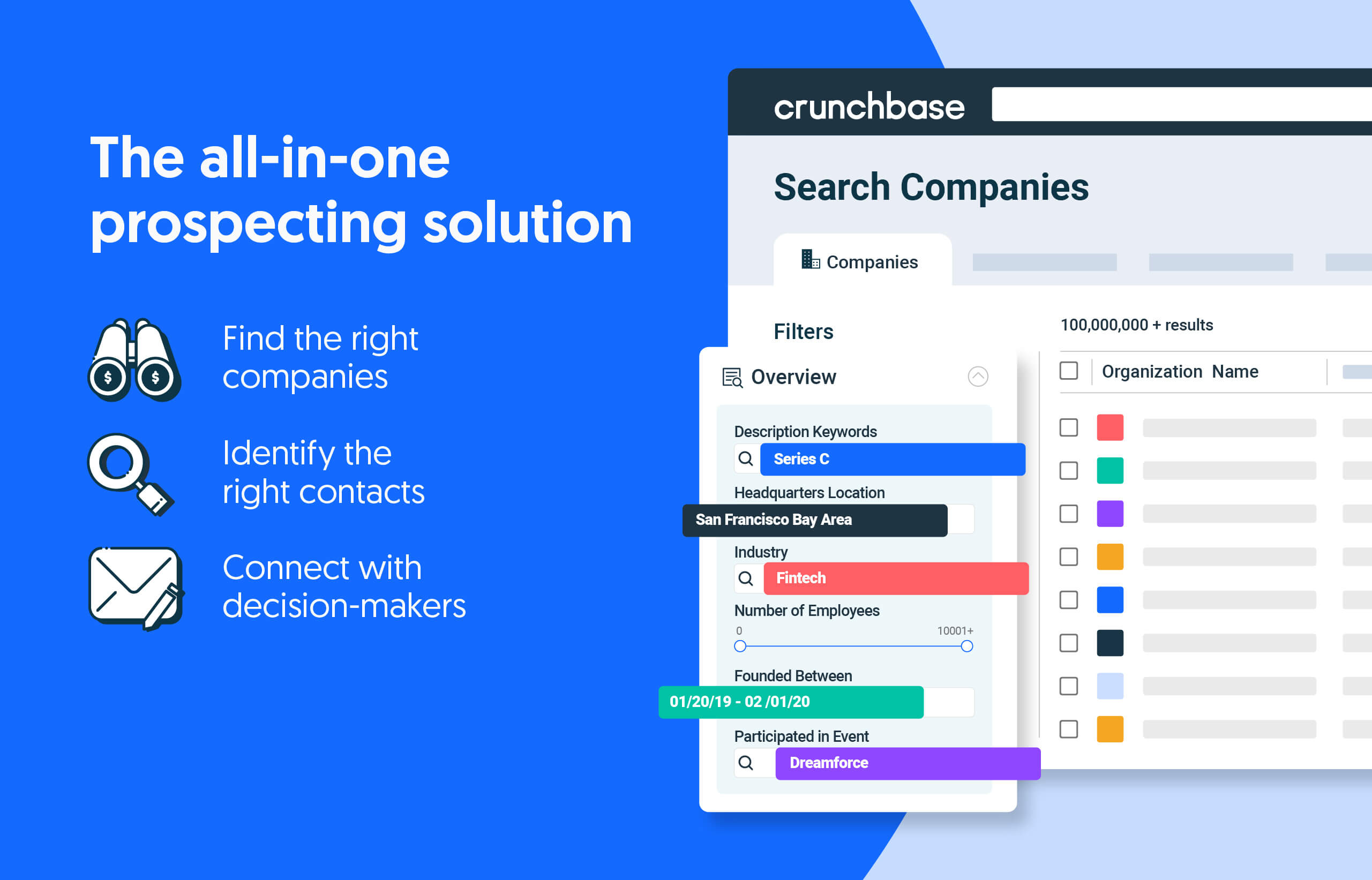

Keressen kevesebbet. Többet bezárni.

Növelje bevételét a magánvállalati adatok piacvezető piacán működő, mindent az egyben potenciális ügyfélszolgálati megoldásokkal.

In fact, only one round this calendar year makes the firm’s list of the 10 largest since the beginning of 2021—a $1 billion round to London-based e-commerce startup Checkout.com januárban.

The pullback

It is unclear exactly how much money Coatue invested itself as specific stakes in a round are not usually divulged. But the numbers seem to indicate the venture pullback of 2022 is very real as valuations get slashed and the search for funding gets harder for startups.

Crossover investors like Coatue also face the added pressure of the public markets. As a hedge fund, the firm—which focuses on the technology, media and telecommunications industries—holds public stock in tech companies, many of which have taken a beating as the market has spiraled downward into bear territory. As those public holdings drop in value, a hedge fund can become overexposed to the private market, with its portfolio weighted too heavily to its more illiquid private assets.

The decline in share prices also gives a firm less access to capital for the private markets.

Last year, Coatue participated in several large rounds worth well over $1 billion. Those rounds included:

- Participating in both of electric carmaker Riviáné $2.5 billion and $2.65 billion funding rounds last year.

- An $18 billion round for Cambridge, Massachusetts-based Commonwealth Fusion.

- Leading a $1.4 billion round in Louisville, Kentucky-based commercial space company Sierra Űr.

This year, however, has posed quite a different story for the large investment firm.

Coatue did not respond to a request for comment.

Kapcsolódó olvasmány:

- Accel’s Deal Size Shrinks As Venture Market Pullback Continues

- A SoftBank Vision Fund ügyletei lassuló ütemet, kisebb köröket mutatnak

- Even A16z Is Slowing Its Investing Pace

Ábra: Dom Guzman

- "

- 1 milliárd $

- 10

- 2021

- 2022

- a

- Abszolút

- hozzáférés

- Szerint

- hozzáadott

- mellett

- Eszközök

- válik

- Kezdet

- hogy

- Billió

- Naptár

- Cambridge

- tőke

- kereskedelmi

- Companies

- vállalat

- tovább

- terjed

- CrunchBase

- dátum

- üzlet

- Ajánlatok

- DID

- különböző

- le-

- Csepp

- e-commerce

- elektromos

- pontosan

- Arc

- Cég

- vezetéknév

- koncentrál

- Startupoknak

- alap

- finanszírozás

- finanszírozási ügyletek

- Arany

- súlyosan

- Holdings

- Hogyan

- azonban

- HTTPS

- beleértve

- jelez

- interaktív

- befektetett

- befektetés

- beruházás

- Beruházások

- befektető

- Befektetők

- maga

- január

- július

- nagy

- legnagyobb

- vezető

- Lista

- KÉSZÍT

- piacára

- piacok

- Média

- pénz

- több

- New York-i székhelyű

- számok

- rész

- portfolió

- powered

- nyomás

- magán

- magánpiacok

- nyilvános

- Negyed

- Olvasás

- kérni

- jövedelem

- körül

- fordulóban

- Keresés

- szektor

- számos

- Megosztás

- előadás

- jelentős

- óta

- Méret

- lassuló

- Megoldások

- Hely

- különleges

- indítás

- Startups

- készlet

- Történet

- bevétel

- tech

- Technológia

- távközlés

- A

- rendszerint

- értékbecslés

- érték

- vállalkozás

- látomás

- érdemes

- év

- A te