Here on the Clarus blog, we anticipated that LIBOR cessation in GBP, JPY and CHF would usher in simpler markets and “easier” trading this year. Less indices, less basis, fewer restructuring requests. Heaven forbid, fewer blogs even!

However, 2022 has seen two big market themes step up that have provided plenty to write about – namely activity in Credit markets (and the new data from SBSDRView) És Infláció.

In light of Jackson Hole and the “unconditional” messaging to “keep at” the inflation fight from all of the central banks, today sees an update to our Inflation blogs of 2022. If you have missed any of the previous blogs, please see below:

- G3 INFLATION SWAP VOLUMES ARE ON THE UP

- BIG VOLUMES IN CREDIT AND INFLATION PLUS EUROPEAN EQUIVALENCE

- ARE INFLATION EXPECTATIONS BECOMING ENTRENCHED? THE DATA

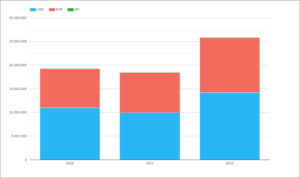

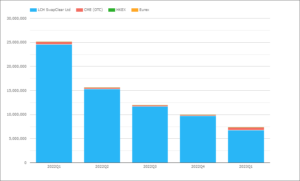

Monthly Cleared Inflation Swap Volumes

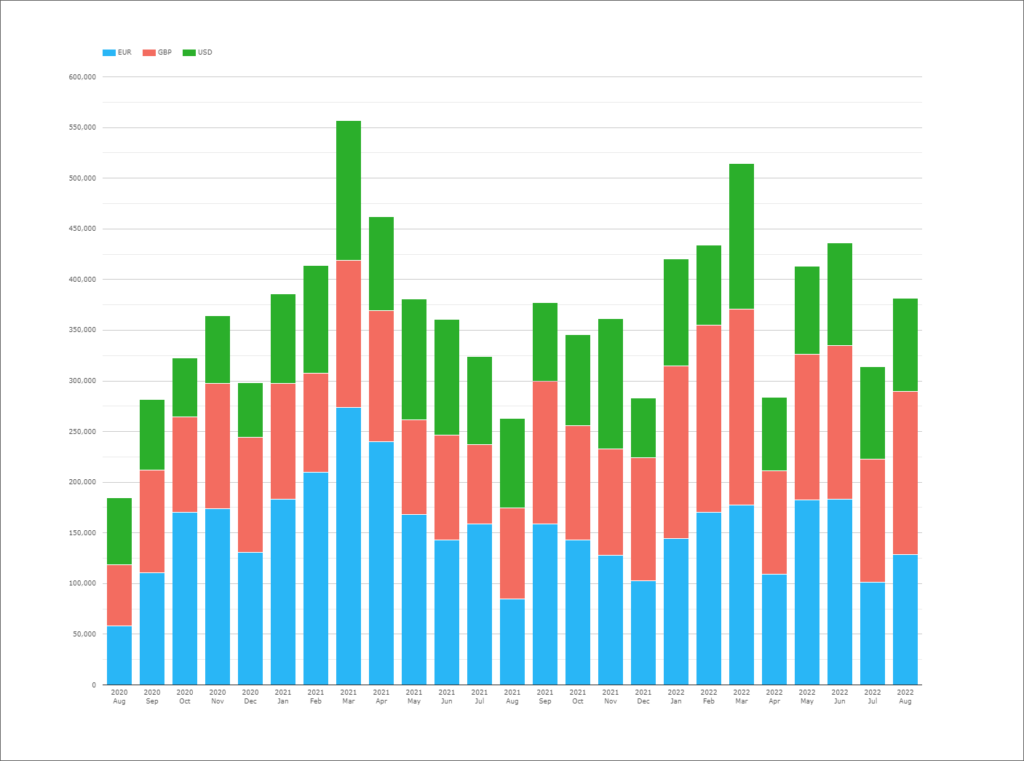

Monthly volumes of cleared inflation swaps topped $500 Billion for the first time in 2021. március. That was basically double the monthly volumes that traded in 2020. With a couple of trading days left in August 2022, it is very likely that traded volumes will top $400bn this month – not bad during the “Nyári Lull"

Megjelenítés;

- Cleared volumes in EUR, GBP and USD inflation swaps per month. Volumes are shown in USD notional equivalents.

- A kontextushoz, február 2020 ez volt az első hónap, amikor a globális elszámolt mennyiségek meghaladták a 300 milliárd dollárt.

- Now, the 2022 monthly average volume is $400bn, with even August looking likely to break that barrier.

Microservices to Monitor Inflation Data

This blog is largely an update to an earlier article on the Clarus website:

Revisiting the data analysis, I quickly realised that it was well suited to using our Microservices. Using a single line of code, I can analyse Inflation traded volumes:

Here is the simple python script:

import clarus

response = clarus.ccp.volume(startdate='2020-08-01', enddate='2022-08-26',producttype='Inflation', currency='USD', group='month,tenor')

print (response)And here it is translated via our Excel add-in:

This simple line of code made updating the blog super simple below. Let’s see what has been happening in Inflation trading.

EUR Inflációs Swap elszámolás

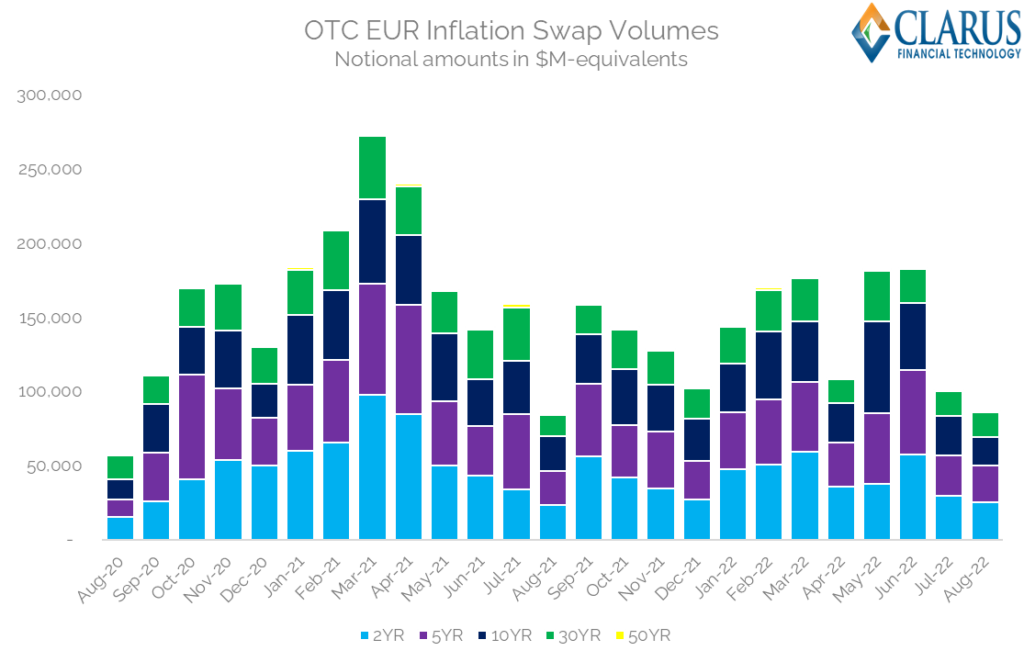

First up, the EUR Inflation swaps market:

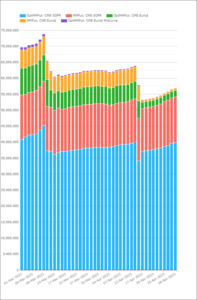

The chart shows:

- Average monthly volumes so far in 2022 sit at ~$150bn.

- In 2022, cleared EUR Inflation Volumes tend to account for about 40% of total global volumes. It is still the largest Inflation market by notional volume.

- August (with two trading days remaining) is likely to be the lowest volume month of the year.

- June 2022 was the largest volume month so far this year, just beating May 2022.

- Whilst May saw a huge amount of activity in 10Y, June was a more balanced month. Volumes in all tenors have reduced since.

- YTD volumes are now 21% lower than at this point in 2021 – surprising given our előző frissítés!

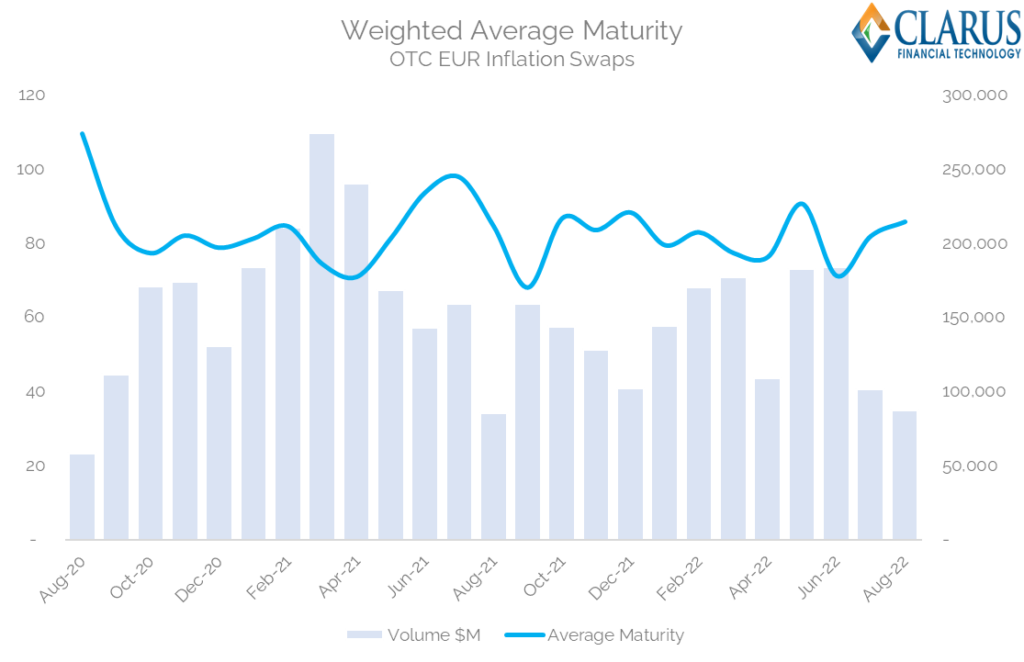

The tenor data from CCPView and the microservices allow us to monitor the average maturity traded each month:

Megjelenítés;

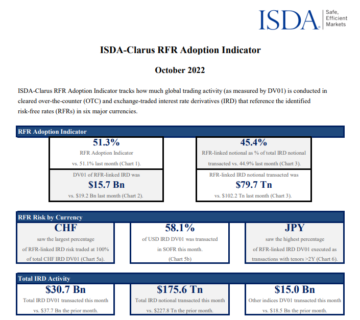

- Weighted average life of cleared EUR Inflation Swaps. This is calculated as (Tenor in Months * Notional) / Total notional. This is very similar to some of the methodology we use in the RFR átvételi mutató.

- August 2020 saw trading activity with the longest average maturity, at 110 months (9 years).

- However, that was a very low volume month (typical of summer trading conditions).

- Similarly, August 2022 has shown an uptick in the average maturity of trading activity, hitting 86 months – up from the 71 months recorded in June.

- But volumes in August 2022 are likely to be lower than other months in 2022, so we need to be cautious in interpreting anything from this data point.

Assuming volumes rebound again in September, it is going to be interesting to see where market participants centre their activity.

GBP Inflációs Swap elszámolás

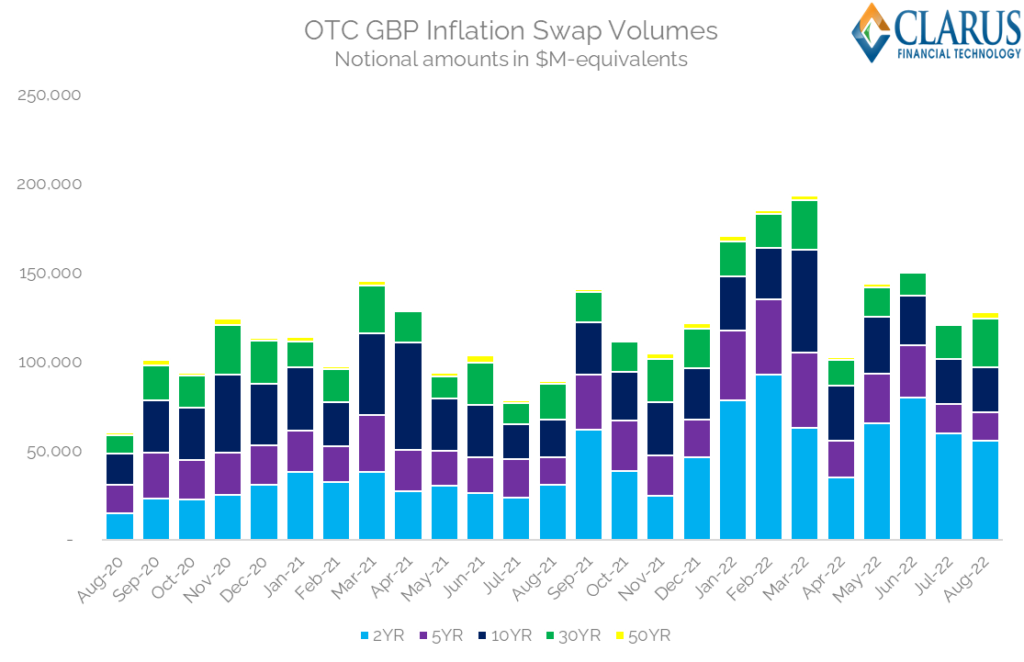

Figyelmünket a GBP piacokra irányítjuk;

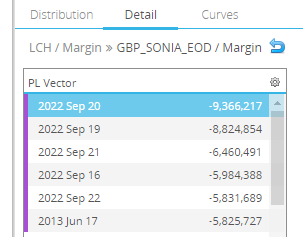

Megjelenítés;

- Elszámolt mennyiségek futamidő szerint GBP-ben Inflációs swapügyletek. Minden kötet az LCH SwapClear oldalon található.

- With the three largest volume months all occurring in Q1 2022 , we shouldn’t be surprised that volumes have stayed elevated in August 2022 as well.

- YTD volumes are now 41% higher than 2021.

- GBP Inflation trading is extremely active right now.

There is therefore one sign that inflation expectations are becoming entrenched in GBP markets – there is much more activity than we have ever seen before. Are the trades also getting longer?

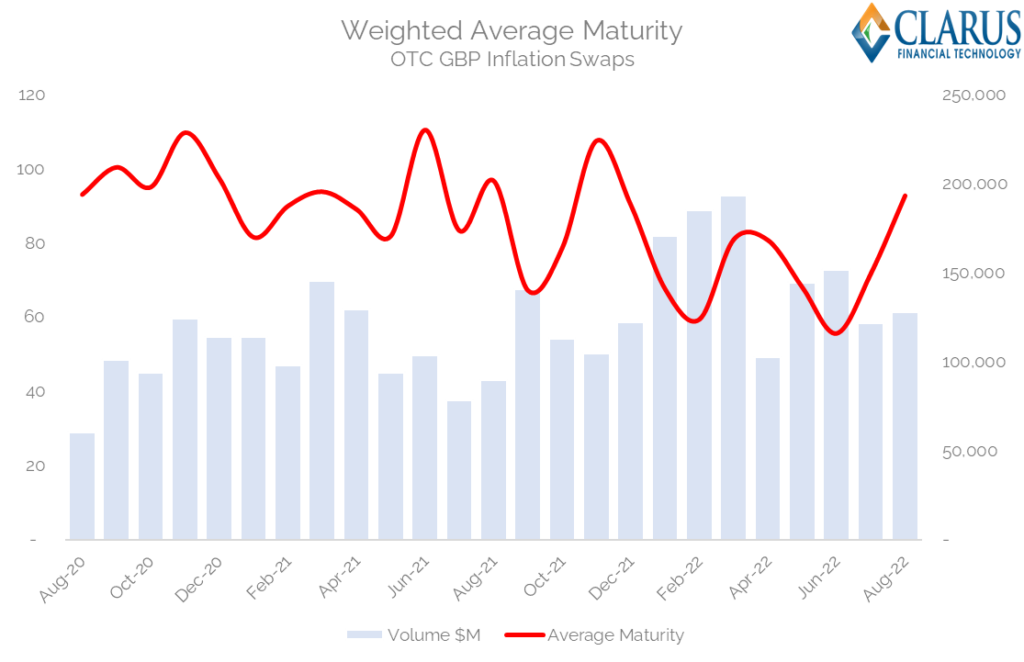

The chart shows:

- Weighted average life of cleared GBP Inflation Swaps.

- August 2022 has seen a sharp increase in the weighted average maturity of activity, to nearly 8 years.

- Previously, 2022 trading activity had all been about shorter and shorter trades.

- August has bucked that trend, with an average maturity more in line with 2021 trading patterns.

- Is this a blot associated with summer trading or is activity moving further out the curve now?

- Monitor the data to find out.

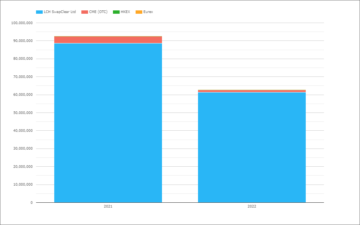

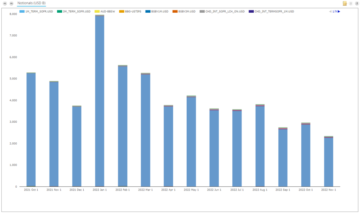

USD Inflációs Swap elszámolás

Finally, are inflation expectations becoming entrenched in US markets?

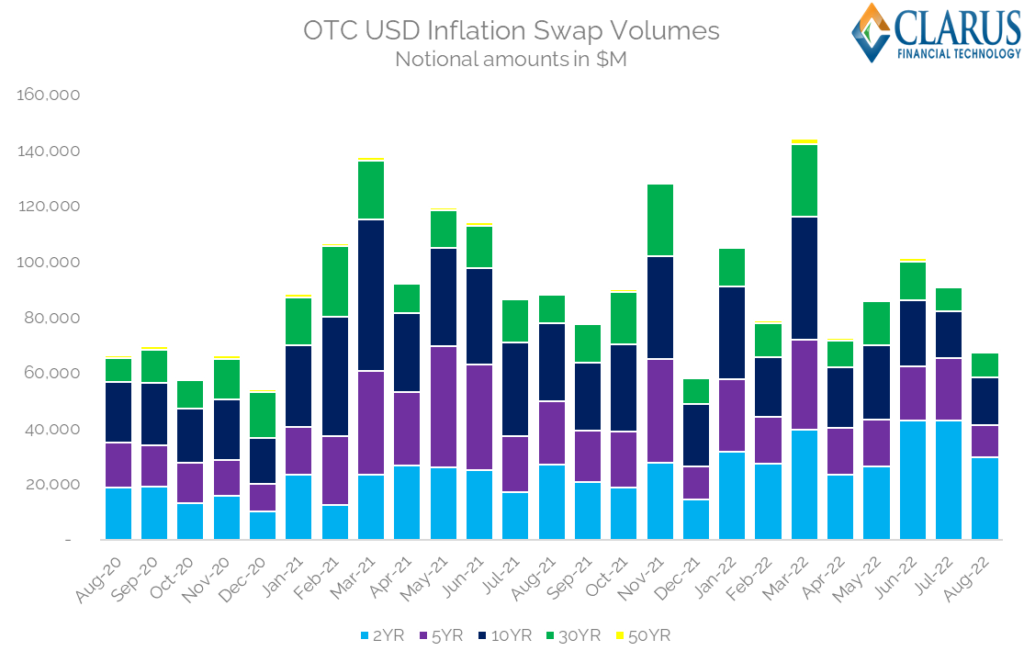

Megjelenítés;

- Even allowing for any spike in activity on Friday after Jackson Hole (our data runs to the close of business on Friday 26th August), activity has been pretty low in August 2022.

- August is looking like the lowest volume month since December last year.

- Between Jan 2021 and Nov 2021, every month saw over $75bn in notional activity.

- Despite a record volume month in 2022, we’ve now seen 3 months with activity below $75bn.

- Volumes remain really volatile in USD inflation trading.

- YTD volumes in USD inflation swaps are now actually lower than at the same point in 2021 (-10%).

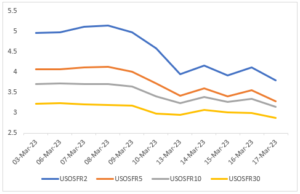

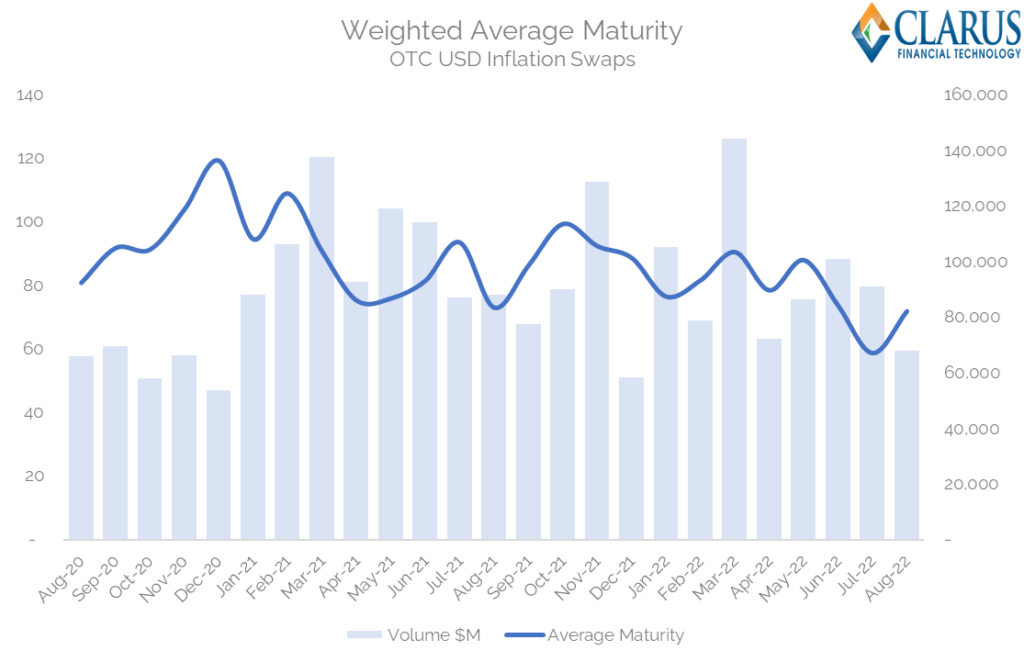

Looking now at the Weighted Average Life in USD Inflation Swaps:

- Weighted average life of cleared USD Inflation Swaps.

- December 2020 saw the longest average activity, at nearly 10 years.

- However, July 2022 saw the shortest average life, at just 59 months – the only month that dips below 5 years in our history above.

- This means that for 2022 the average life stands at 6.4 years, compared to 7.4 years in 2021.

- Like in GBP markets, August 2022 has seen an increase in the average maturity traded. USD markets extended their average maturity from 59 to 72 months (6 years).

Összefoglalva

- We look for signals that inflation expectations are becoming entrenched.

- We suggest that elevated trading volumes and longer average maturities point to entrenched inflation expectations.

- The data shows that inflation swap notional traded YTD is almost identical to the same point in 2021.

- However, this varies hugely by market.

- GBP markets are the most active, recording an increase of 41% in trading activity.

- USD (-10%) and EUR (-21%) tell a different story.

- There is no clear signal in any market that trades are getting longer.

- hangya pénzügyi

- blockchain

- blockchain konferencia fintech

- harangjáték fintech

- clarus

- coinbase

- coingenius

- kripto konferencia fintech

- Származékok

- FINTECH

- fintech alkalmazás

- fintech innováció

- Nyílt tenger

- PayPal

- paytech

- fizetési mód

- Plató

- plato ai

- Platón adatintelligencia

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- csík

- tencent fintech

- Xero

- zephyrnet