Bitcoin (BTC) has made a remarkable comeback in 2023, achieving its best quarterly gain in two years with a 72% increase so far this year, as per the latest update. At the time of writing, the value of BTC is $28,398, raising the cryptocurrency’s market capitalization to $542 billion, pushing it ahead of other competing assets, including the world’s largest altcoin Ethereum (ETH), Gold, and Nasdaq.

Motivi del rally BTC

The recent uptrend can be attributed to speculation that central banks, led by the Federal Reserve, will abandon their aggressive rate increases in response to recession signals. This has fueled an increase in leveraged risk in BTC in the derivatives market. Furthermore, the funding rates for Bitcoin reveal a spike, indicating a positive sentiment among market participants.

Analisi Tecnica

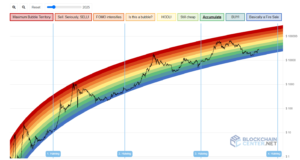

Secondo l'analisi tecnica, il re delle criptovalute ha un ulteriore potenziale di rialzo. BTC è attualmente in una tendenza al rialzo, senza deviazioni significative nel suo Relative Strength Index (RSI). Il prezzo è anche al di sopra di due medie mobili esponenziali (EMA) chiave, che dovrebbero fungere da supporto in caso di calo del prezzo.

I livelli di resistenza per BTC sono visti a $ 28,784, un livello chiave, e il massimo settimanale a $ 29,380, che coincide con il livello di ritracciamento di Fibonacci del 38.2%.

Once BTC price crosses these levels, it could continue its climb towards the target of $30,040, a level that previously acted as support for Bitcoin during mid-2022. Support levels for BTC are seen at $26,888, followed by the monthly high at $25,270 and low at $21,376 in the event of a decline in the asset.

I commercianti anticipano la stampa dei dati macroeconomici degli Stati Uniti

Traders are anticipating the macroeconomic data print from the United States on March 31, preparing for potential buying opportunities should the downside enter again. Meanwhile, BTC price action has effectively erased any trace of losses engendered by the news that the largest crypto exchange, Binance, was being targeted by US regulators. Let’s see how it performs after the Fed meeting.

- Distribuzione di contenuti basati su SEO e PR. Ricevi amplificazione oggi.

- Platoblockchain. Web3 Metaverse Intelligence. Conoscenza amplificata. Accedi qui.

- Fonte: https://coinpedia.org/altcoin/bitcoin-records-72-gain-in-2023-btc-price-surpasses-eth-gold-nasdaq/

- :È

- 2%

- 2023

- a

- sopra

- il raggiungimento

- Action

- Dopo shavasana, sedersi in silenzio; saluti;

- aggressivo

- avanti

- Altcoin

- tra

- .

- ed

- anticipare

- anticipando

- SONO

- AS

- attività

- Attività

- At

- Banche

- BE

- essendo

- MIGLIORE

- Miliardo

- Bitcoin

- BTC

- prezzo BTC

- Acquisto

- by

- Materiale

- capitalizzazione

- centrale

- Banche centrali

- salire

- Coinpedia

- Ritorno

- concorrenti

- continua

- potuto

- crypto

- Scambio criptato

- cryptocurrencies

- dati

- Rifiuta

- Derivati

- deviazione

- svantaggio

- durante

- in maniera efficace

- entrare

- ETH

- Evento

- exchange

- previsto

- esponenziale

- Federale

- incontro nutrito

- Fibonacci

- seguito

- Nel

- da

- finanziamento

- tassi di finanziamento

- ulteriormente

- Inoltre

- Guadagno

- Oro

- Alta

- Come

- http

- HTTPS

- in

- Compreso

- Aumento

- Aumenta

- Index

- IT

- SUO

- Le

- King

- maggiore

- Cripto più grande

- con i più recenti

- Guidato

- Livello

- livelli

- perdite

- Basso

- macroeconomico

- fatto

- Marzo

- Rappresentanza

- Capitalizzazione di mercato

- Nel frattempo

- incontro

- mensile

- massimo mensile

- in movimento

- medie mobili

- Nasdaq

- notizie

- of

- on

- Opportunità

- Altro

- partecipanti

- esegue

- Platone

- Platone Data Intelligence

- PlatoneDati

- positivo

- potenziale

- preparazione

- in precedenza

- prezzo

- AZIONE PREZZI

- Stampa

- spingendo

- raccolta

- tasso

- recente

- recessione

- record

- Regolatori

- indice di forza relativa

- notevole

- risposta

- ritracciamento

- rivelare

- Rischio

- rsi

- sentimento

- servire

- dovrebbero

- Segnali

- significativa

- So

- finora

- speculazione

- spuntone

- stati

- forza

- supporto

- livelli di supporto

- Target

- mirata

- Consulenza

- Analisi Tecnica

- che

- Il

- la Fed

- Il settimanale

- loro

- Strumenti Bowman per analizzare le seguenti finiture:

- quest'anno

- tempo

- a

- verso

- Traccia

- Unito

- Stati Uniti

- Aggiornanento

- upside

- uptrend

- us

- Regolatori statunitensi

- APPREZZIAMO

- settimanale

- quale

- volere

- con

- Il mondo di

- scrittura

- anno

- anni

- zefiro