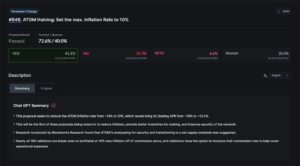

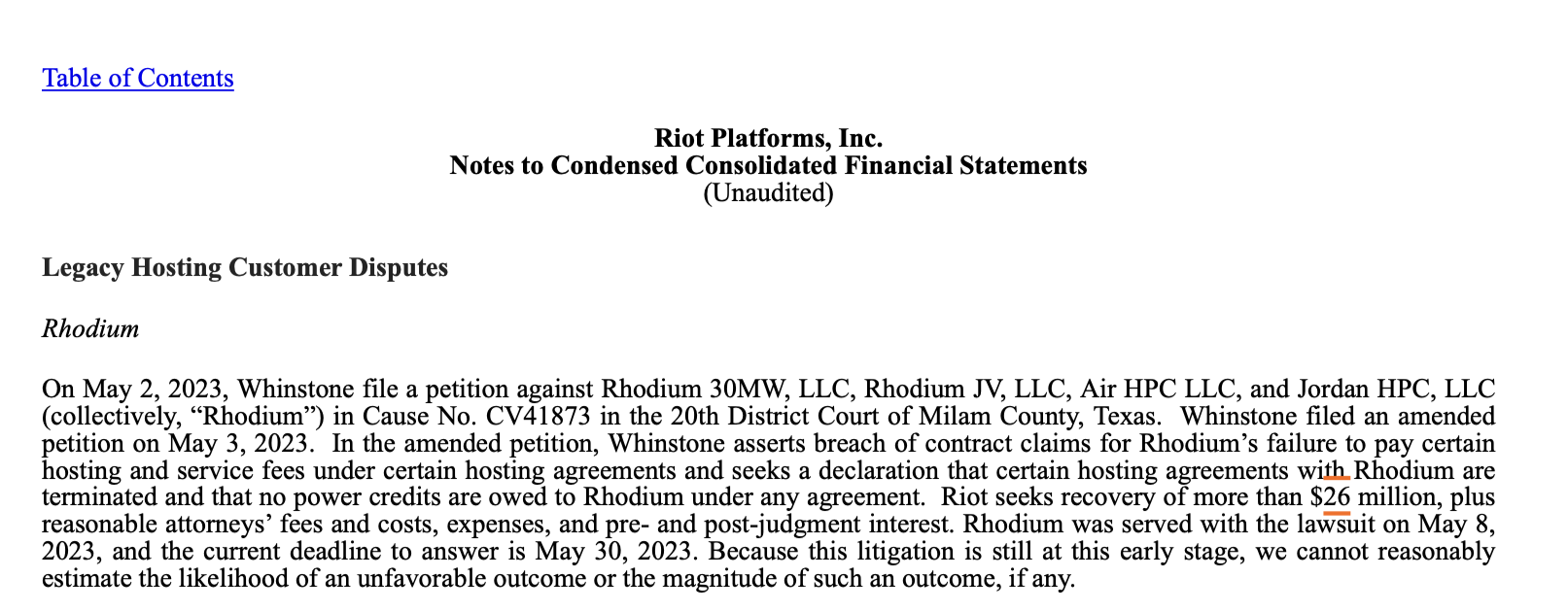

Crypto mining firm Riot Platforms – formerly Riot Blockchain – has taken legal action against Texas-based Bitcoin (BTC) miner, Rhodium Enterprises, in an effort to recover “more than $26 million” in alleged unpaid mining facility fees.

According to Riot Platform’s Q1 2023 financial raport published on May 10, Rhodium Enterprises allegedly breached its contract with Riot by failing to pay hosting and service fees associated with the use of Whinstone’s Bitcoin mining facilities, a wholly owned subsidiary of Riot.

A petition was filed against Rhodium Enterprises on May 2 in the District Court of Milam County in Texas, seeking to recover “more than $26 million,” as well as reimbursement for legal fees incurred during the legal proceedings.

Riot zażądał ponadto rozwiązania „niektórych umów hostingowych” i zaproponował zwolnienie ze spłaty wszelkich zaległych kredytów na energię na rzecz Rhodium.

It was acknowledged that estimating “the likelihood” of recovering the unpaid fees at this stage is uncertain. It noted:

„Ponieważ ten spór jest wciąż na tak wczesnym etapie, nie możemy rozsądnie oszacować prawdopodobieństwa niekorzystnego wyniku ani skali takiego wyniku, jeśli w ogóle”.

Rhodium was served on May 8, and have a deadline to respond by May 30, according to the report.

Związane z: Skarga złożona przeciwko Compass Mining za utratę maszyn do wydobywania BTC napotyka na przeszkody

Meanwhile, Riot stated that it had mined “2,115 Bitcoins” in Q1 2023, an increase of 50.5% compared to Q1 2022.

It was further noted that Riot did not have any affiliations with the banks that have experienced collapses in recent times. It noted:

„Nie mieliśmy żadnych relacji bankowych z Silicon Valley Bank, Silvergate Bank ani First Republic Bank, a obecnie przechowujemy nasze środki pieniężne i ich ekwiwalenty w wielu instytucjach bankowych.

Riot anticipates that crypto mining companies will continue to experience challenges in 2023 due to the “significant price decline of Bitcoin” and “other national and global macroeconomic factors.”

It was stated that Riot’s “relative position” in the industry, as well as its “liquidity and absence of long-term debt,” makes it well positioned to “benefit from such consolidation.”

Magazine: 3AC gotuje burzę, koparka bitcoinów rośnie o 360%, nurkowanie Bruce'a Lee NFT: Asia Express

- Dystrybucja treści i PR oparta na SEO. Uzyskaj wzmocnienie już dziś.

- PlatoAiStream. Analiza danych Web3. Wiedza wzmocniona. Dostęp tutaj.

- Wybijanie przyszłości w Adryenn Ashley. Dostęp tutaj.

- Kupuj i sprzedawaj akcje spółek PRE-IPO z PREIPO®. Dostęp tutaj.

- Źródło: https://cointelegraph.com/news/btc-miner-rhodium-lawsuit-alleged-26-m-in-unpaid-fees

- :ma

- :Jest

- :nie

- $W GÓRĘ

- 10

- 2022

- 2023

- 30

- 50

- 7

- 8

- a

- Stosownie

- przyznał

- Działania

- powiązania

- przed

- rzekomy

- rzekomo

- an

- i

- każdy

- SĄ

- AS

- Azja

- powiązany

- At

- Bank

- Bankowość

- Banki

- Bitcoin

- Bitcoin Miner

- Wydobywanie Bitcoina

- Bitcoins

- blockchain

- Bruce

- Bruce Lee

- BTC

- Górnik BTC

- wydobycie btc

- by

- nie może

- Gotówka

- wyzwania

- Cointelegraph

- upada

- Firmy

- w porównaniu

- Kompas

- wydobycie kompasu

- konsolidacja

- kontynuować

- umowa

- hrabstwo

- Boisko

- Kredyty

- Crypto

- wydobycie kryptograficzne

- Obecnie

- ostateczny termin

- Dług

- upadek

- ZROBIŁ

- dzielnica

- Sąd rejonowy

- z powodu

- podczas

- Wcześnie

- wczesna faza

- wysiłek

- przedsiębiorstwa

- odpowiedniki

- oszacowanie

- zwolniony

- doświadczenie

- doświadczony

- twarze

- udogodnienia

- Łatwość

- Czynniki

- nie

- Opłaty

- Firma

- i terminów, a

- W razie zamówieenia projektu

- dawniej

- od

- dalej

- Globalne

- miał

- Have

- Odsłon

- przytrzymaj

- Hosting

- HTTPS

- if

- in

- Zwiększać

- przemysł

- instytucje

- IT

- JEGO

- proces sądowy

- Lee

- Regulamin

- Działania prawne

- postępowanie sądowe

- Spór

- długoterminowy

- utraty

- maszyny

- Makroekonomiczne

- WYKONUJE

- March

- Może..

- milion

- zaminowany

- górnik

- Górnictwo

- Firmy wydobywcze

- obiekty górnicze

- maszyny górnicze

- wielokrotność

- narodowy

- NFT

- zauważyć

- of

- on

- or

- ludzkiej,

- Wynik

- wybitny

- koniec

- własność

- Zapłacić

- okres

- Platforma

- Platformy

- plato

- Analiza danych Platona

- PlatoDane

- position

- ustawione

- power

- Cena

- Obrady

- zaproponowane

- opublikowany

- Q1

- niedawny

- Recover

- odzyskiwanie

- Relacje

- raport

- Republika

- Odpowiadać

- Rod

- Zamieszki

- Riot Blockchain

- s

- SEK

- poszukuje

- usługa

- znaczący

- Krzem

- Silicon Valley

- Bank Doliny Krzemowej

- Silvergate

- BANK SILVERGATE

- Źródło

- STAGE

- stwierdził,

- Nadal

- burza

- subsydiarny

- taki

- Udary

- texas

- niż

- że

- Połączenia

- to

- czasy

- do

- Niepewny

- posługiwać się

- Dolina

- była

- we

- DOBRZE

- całkowicie

- będzie

- w

- zefirnet