Posted April 12, 2024 at 1:02 pm EST.

Ethereum on Friday reached its one-year Shapella upgrade anniversary, which transitioned the blockchain from a proof-of-work validation system to the more energy-efficient proof-of-stake.

The upgrade occurred on April 12, 2023, which allowed stakers to withdraw ether (ETH) that had been securing and validating the second-largest blockchain network.

One year later, Ethereum has changed in several ways, from fluctuations in staked ETH to the number of validators in its ecosystem. Here are five charts to illustrate how Ethereum has progressed since Shapella:

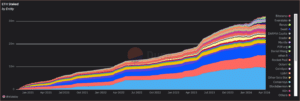

1. Total Staked ETH Securing Ethereum

Staked ether has grown considerably in the past year to 32.2 million ETH, up from 20 million, Nansen data shows.

Despite the slight decrease in staked ETH from centralized exchanges initiating withdrawals following the rollout of Shapella, staked ETH has since ballooned 61%, marking a $42 billion influx into Ethereum’s staking infrastructure, based on recent pricing.

Before Shapella, would-be validators had one option: depositing ETH into Ethereum’s staking contract. Withdrawing assets was not possible.

“Based on how the total amount of ETH staked on Ethereum grew dramatically since the Shanghai [or the Shapella] upgrade, it’s clear that the activation of staked ETH withdrawals on the network was a major de-risking event for the activity of staking,” said Christine Kim, Galaxy’s vice president of research, in an email.

Shapella helped de-risk Ethereum, because stakers gained an exit window — without suffering slashing penalties for ditching duties. As of publication, staked ETH represented 26.94% of the 120 million total supply.

Mike Neuder of the Ethereum Foundation outlined in a March blog factors set to fuel demand for staked ETH. Those include ETH appreciation, increased demand for restaking, lower interest rates that may lead institutions to look for alternative yield, the popularity of liquid staking and the potential of exchange-traded fund providers pushing for staked ETH.

Ethereum developers, however, are concerned regarding increased demand causing staked ETH supply to rise “too much and too quickly,” Kim noted.

Read More: Why the Ethereum Community Is Up in Arms Against a Proposal to Change the Monetary Policy

2. Number of Validators

Validators have grown substantially since Shapella, easing “some fear in the Ethereum community that the ability to withdraw ETH from the Beacon Chain would lead to a mass exodus of validators,” Austin Blackerby, EVM analytics manager at Flipside Crypto, told Unchained via Telegram.

Nearly 563,000 validators secured Ethereum as of April 12, 2023. The figure has since jumped over 74% to roughly 981,000 validators.

“Additionally, interest to join the active validator set has shown a thorough increase over the past 30 days, with the current queue time for new validators sitting over 9 days,” Blackerby said. “Conversely, there is practically no queue to exit the validator set. This means there is a lot more demand to be a validator than there is demand to leave the network.”

Continued validator growth has raised additional concerns among protocol developers and researchers. Galaxy’s Kim noted two main reasons in a September 2023 report.

“First, a large validator set size creates strains on peer-to-peer networking and messaging that may cause node failures from high computational load and bandwidth requirements,” Kim wrote. A large validator set also makes future upgrades “harder and riskier to achieve,” she added.

The next upgrade, “Electra,” is expected to address the rising validator set. Electra includes EIP-7251, an improvement proposal to reduce validators by increasing the maximum ETH a validator can stake. EIP-7251 aims to allow validators a maximum of 2,048 staked ETH, instead of the current limit of 32 ETH.

Read More: What is EIP-7251 (MaxEB) in Ethereum? A Beginner’s Guide

3. Total Value Locked (TVL)

Ethereum’s TVL surged after withdrawal activations. On April 12, 2023, users locked $54.69 billion on decentralized finance (DeFi) applications, with 54% from liquid staking. Since, TVL has grown over 131% to $126.75 billion, with liquid staking comprising about 42%.

Ethereum maintains its top TVL position, followed by Tron, Binance Smart Chain, and Solana, according to DefiLlama. One factor driving growth is ETH appreciation, which surged 79% from $1,920 during the Shapella rollout to about $3,440 as of publication.

4. Lido Leading the Pack

ETH holders have two ways to stake: solo home staking or using a third party.

Smart contract protocol Lido, widely known for its liquid staking techniques, commands nearly 9.4 million staked ETH, representing about $33 billion — or 29% of all staked ETH.

Liquid staking refers to staking ETH and receiving a “receipt” token, which represents a principal deposit, as well as rewards. While the ETH is locked, a staker can use their “receipt” token as liquidity on DeFi applications.

Lido led the pack in terms of staked ETH at the time of Shapella, boasting a lead of 2.97 million ETH over Coinbase. Lido has grown its lead over the past year. At publication, Lido’s staked ETH stood at almost 9.4 million.

Liquid staking competition has been heating up. Consider that protocols Renzo, Stader, Mantle and Ether.Fi did not have any ETH staked when ETH withdrawals went live, but are now responsible for 2.16 million staked ETH.

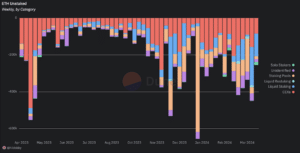

5. Unstaked ETH

While staking withdrawals haven’t exceeded deposits, withdrawal patterns have changed since Shapella.

Centralized exchanges were the primary withdrawers of staked ETH in the 2023 aftermath of Shapella. Exchanges that week withdrew 138,912 ETH that had secured the blockchain, dwarfing the collective 72,792 ETH withdrawn from all other categories, per the Dune dashboard.

A year later, staked ETH withdrawals were largely activated by liquid staking protocols. Since Monday, centralized exchanges withdrew 84,128 staked ETH, while liquid staking protocols were responsible for 121,472 staked ETH withdrawals. Lido, which withdrew staked ETH Thursday, has seen its staked ETH decrease 1% in the past week and 4% over the past month.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/5-charts-that-highlight-how-ethereum-has-changed-one-year-after-shapella/

- :has

- :is

- :not

- $3

- $UP

- 000

- 09

- 1

- 12

- 121

- 13

- 15%

- 16

- 19

- 20

- 202

- 2023

- 2024

- 26%

- 30

- 32

- 32 ETH

- 440

- 72

- 75

- 84

- 9

- 97

- a

- ability

- About

- According

- Achieve

- Activation

- activations

- active

- activity

- added

- Additional

- address

- After

- aftermath

- against

- aims

- All

- allow

- allowed

- almost

- also

- alternative

- among

- amount

- amounts

- an

- analytics

- and

- Anniversary

- any

- applications

- appreciation

- April

- ARE

- arms

- AS

- Assets

- At

- austin

- Bandwidth

- bar

- based

- BE

- beacon

- beacon chain

- because

- been

- Billion

- binance

- Binance Smart Chain

- blockchain

- Blockchain network

- boasting

- Boosted

- but

- by

- CAN

- categories

- Cause

- causing

- centralized

- Centralized Exchanges

- chain

- change

- changed

- Chart

- Charts

- Christine

- clear

- coinbase

- Collective

- community

- competition

- comprising

- computational

- concerned

- Concerns

- Consider

- contract

- creates

- crypto

- Current

- daily

- data

- Days

- decentralized

- Decentralized Finance

- decrease

- DeFi

- Demand

- deposit

- deposits

- developers

- DID

- different

- dominant

- dramatically

- driving

- during

- easing

- ecosystem

- ETH

- Ether

- Ether (ETH)

- ethereum

- Ethereum blockchain

- ethereum foundation

- Ethereum's

- Event

- EVM

- exceeded

- exchange-traded

- Exchanges

- Exit

- Exodus

- expected

- facilitating

- factor

- factors

- failures

- fear

- Figure

- finance

- five

- flipside

- FLIPSIDE CRYPTO

- fluctuated

- fluctuations

- followed

- following

- For

- Foundation

- Friday

- from

- Fuel

- fund

- future

- gained

- Galaxy

- grew

- grown

- Growth

- had

- Have

- helped

- here

- High

- Highlight

- holders

- Home

- How

- However

- HTTPS

- illustrate

- improvement

- in

- include

- includes

- Increase

- increased

- increasing

- influx

- Infrastructure

- instead

- institutions

- interest

- Interest Rates

- into

- ITS

- join

- Jumped

- Kim

- known

- large

- largely

- later

- lead

- leading

- Leave

- Led

- LIDO

- LIMIT

- Liquid

- liquid staking

- Liquidity

- live

- load

- locked

- Look

- Lot

- lower

- Main

- maintains

- major

- MAKES

- manager

- marking

- Mass

- max-width

- maximum

- May..

- means

- messaging

- million

- Monday

- Monetary

- Month

- more

- much

- Nansen

- nearly

- network

- networking

- New

- next

- no

- node

- noted

- now

- number

- occurred

- of

- on

- ONE

- Option

- or

- Other

- out

- outlined

- over

- Pack

- party

- past

- patterns

- peer to peer

- penalties

- per

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- player

- pm

- popularity

- position

- possible

- posted

- potential

- practically

- president

- price

- pricing

- primary

- Principal

- progressed

- Proof-of-Stake

- Proof-of-Work

- proposal

- protocol

- protocols

- providers

- Publication

- Pushing

- quickly

- raised

- Rates

- reached

- reasons

- receiving

- recent

- reduce

- refers

- regarding

- remains

- represented

- representing

- represents

- Requirements

- research

- researchers

- responsible

- Rewards

- Rise

- rising

- riskier

- Rolled

- rollout

- roughly

- Said

- second-largest

- Secured

- securing

- seen

- September

- set

- several

- shanghai

- she

- showing

- shown

- Shows

- since

- Sitting

- Size

- slashing

- smart

- Smart Chain

- Solana

- solo

- stake

- Staked

- Staked ETH

- stakers

- Staking

- stood

- Strains

- substantially

- suffering

- supply

- Surged

- system

- techniques

- Telegram

- terms

- than

- that

- The

- The Ethereum Foundation

- their

- There.

- Third

- this

- thorough

- those

- thursday

- time

- to

- token

- told

- too

- top

- Total

- total value locked

- transitioned

- TRON

- TVL

- two

- Unchained

- upgrade

- upgrades

- use

- users

- using

- validating

- validation

- Validator

- validators

- value

- venues

- via

- vice

- Vice President

- was

- ways

- week

- WELL

- went

- were

- when

- which

- while

- widely

- window

- with

- withdraw

- withdrawal

- Withdrawals

- withdrawing

- without

- would

- wrote

- year

- Yield

- zephyrnet