October has brought in a new surge in the bullish sentiment, in a couple of days, Bitcoin has returned to the $50,000. This signals the beginning of a new up-only season but could spell caution for the most experienced operators.

Related Reading | Bitcoin Hash Rate Might Make New ATH Soon, What Does It Mean For The Price?

At the time of writing, Bitcoin trades at $49,968 with a 4.4% profit in the daily chart. The first cryptocurrency by market cap was rejected north of the $50,000 and could trend lower before resuming its bullish momentum.

In a recent report by Arcane Research, the firm believes the $46,000 to $48,000 will act as support and a potential consolidation range.

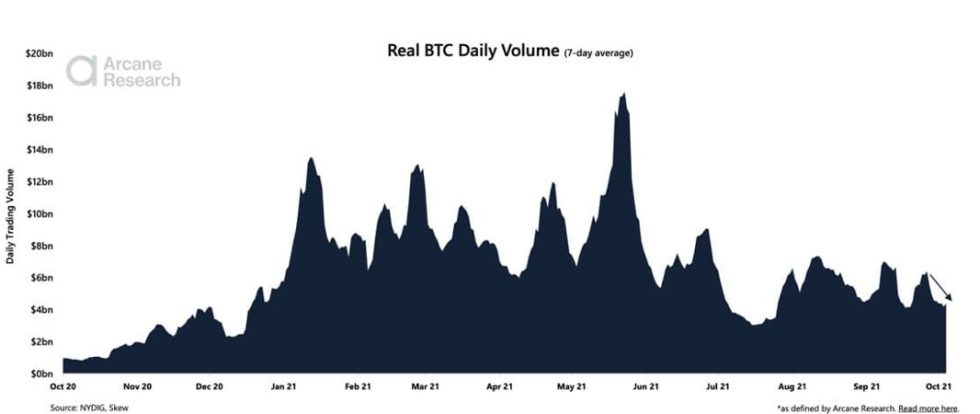

Despite the retest of the $50,000 level, BTC trading volume appears to be on the decline. This suggests a lack of demand that would sustain a rally deep into previous highs, as seen below.

However, Arcane Research believes that the Bitcoin trading volume will be higher during October and could potentially be similar to September 2021 with a 7-day average standing at $4.3 billion.

In order for Bitcoin to have a shot at retaking previous highs, bulls will most likely need to increase their activity and break the current trading volume. At the same time, this could potentially be tracked down into on-chain activity.

Related Reading | $47,000,000 In Bitcoin Shorts Liquidate In An Hour As BTC Climbs To $47.5k

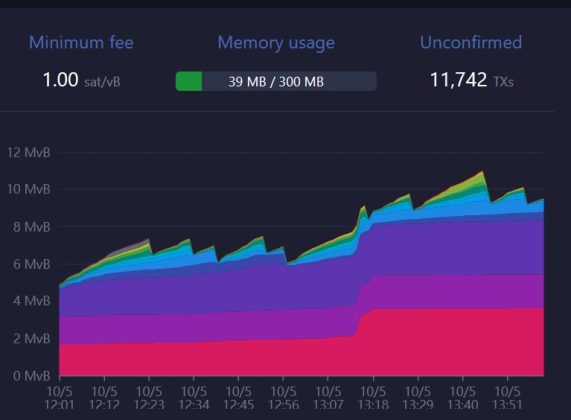

Ever since BTC experienced its first capitulation event, the on-chain activity seems to be on the decline with not a lot of demand for block space, as seen below. Transaction fees on the network are well below those recorded when BTC moved into uncharted territory.

Bitcoin To The Moon, Just A Matter Of Time?

In a separate report, Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone is highly bullish on Bitcoin and Ethereum.

The analyst expects more appreciation into Q4, 2021 after Bitcoin managed to turn previous short-term factors into bullish long-term factors. These include the crypto ban in China and the Great Miners migration out of that country.

Related Reading | Bitcoin Loses Steam As Institutional Investors Shift Focus To Ethereum

The two main factors that have been driven BTC’s price rally since March 2020 are still relevant: increase demand, decrease supply. In Q4, 2021, $40,000 could become the new $30,000, McGlone said:

Our graphic depicts Bitcoin in a quarterly bull-flag consolidation pattern, unable to breach $30,000 support and knocking on the door of $50,000 resistance. If the benchmark crypto catches up a bit to the Bloomberg Galaxy Crypto Index (BGCI), Bitcoin would be closer to $70,000.

- 000

- 2020

- 420

- Action

- analyst

- Arcane Research

- Ban

- Benchmark

- Billion

- Bit

- Bitcoin

- Bitcoin BTC

- bitcoin trading

- Bloomberg

- breach

- BTC

- btc trading

- BTCUSD

- Bullish

- Bulls

- China

- closer

- commodity

- consolidation

- Couple

- crypto

- cryptocurrency

- Current

- Demand

- driven

- ethereum

- Event

- expects

- Fees

- Firm

- First

- Focus

- great

- hash

- hash rate

- HTTPS

- Increase

- index

- Institutional

- institutional investors

- Intelligence

- Investors

- IT

- Level

- March

- march 2020

- Market

- Market Cap

- Mempool

- Miners

- Momentum

- Moon

- network

- North

- order

- Pattern

- price

- price rally

- Profit

- rally

- range

- Reading

- report

- research

- sentiment

- shift

- shorts

- Space

- Steam

- supply

- support

- surge

- time

- trades

- Trading

- transaction

- volume

- writing