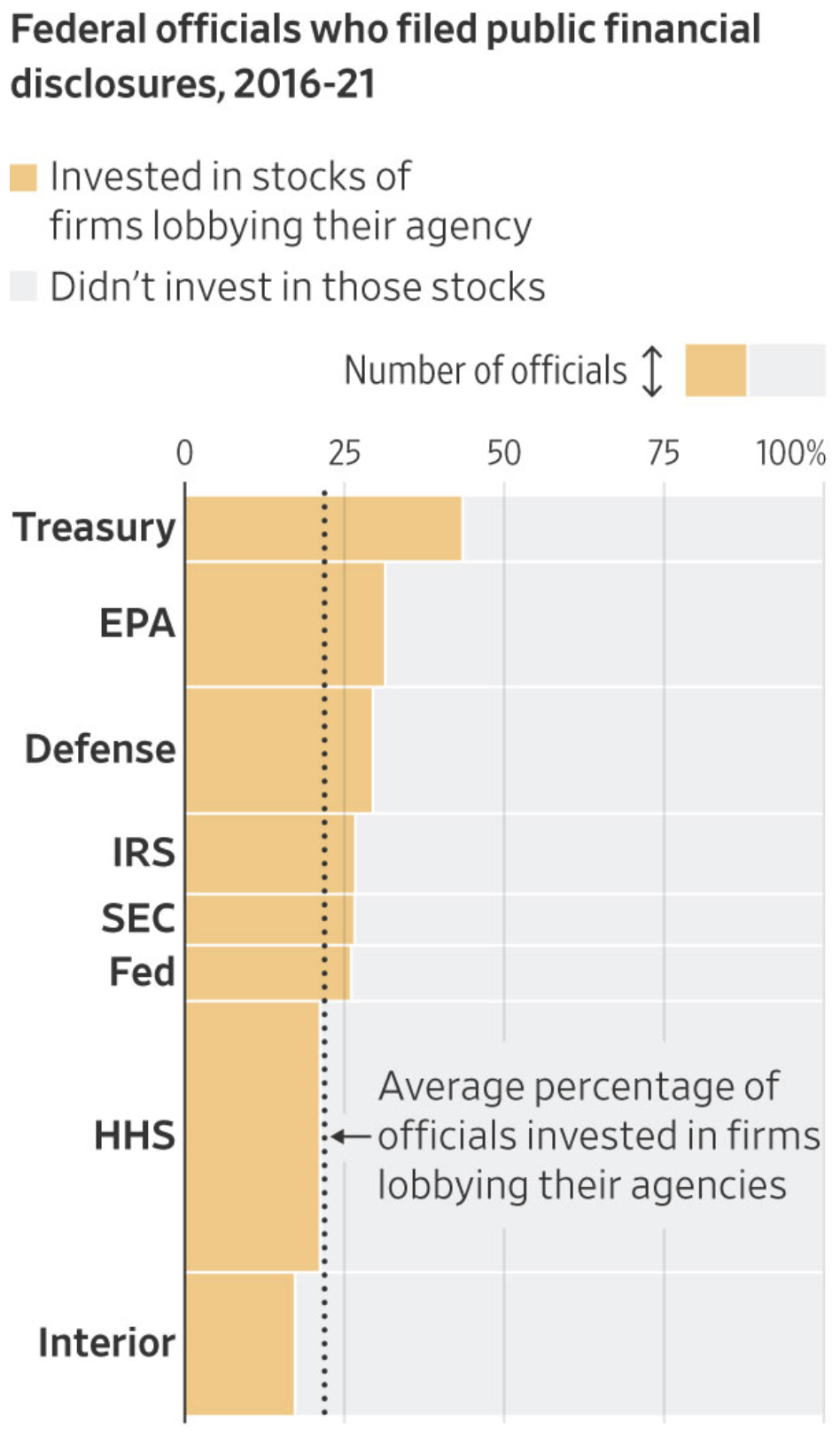

More than 25% of the employees at the Securities and Exchanges Commission (SEC) have invested in stocks of firms that were lobbying their agency.

That’s one of the many findings of an extensive investigation of financial disclosures by employees in federal agencies.

To compile the findings in this arcane disclosure system where most of the filings are not publicly online, WSJ had to spend ten months, including numerous requests through the Freedom of Information Act, and even the involvement of lawyers.

One of their most striking finding is direct insider trading at five federal agencies with WSJ stating:

“More than five dozen officials at five agencies, including the Federal Trade Commission and the Justice Department, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.”

We asked for the other three departments to be named, and will update once a response is received.

This investigation, which compiled 12,000 financial disclosures that are mostly offline, also found that close to half of all officials at the Treasury are invested in companies lobbying them.

For SEC, IRS and Fed it stands at around 25%, with the data including the employees themself as well as their immediate family members.

At the Commodities Futures and Exchanges Commission (CFTC), the investigation found that one employee shorted a stock even though that is banned at this agency.

At the SEC, WSJ finds that ethics officers rarely investigate conflicts when clearing trades, and even when referred to the Justice Department, “prosecutors in most cases have declined to open an investigation.”

A leaked email last year revealed that SEC has no rules against holding bitcoin, eth or XRP, or against trading the cryptos.

That has led to some speculation SEC employees can freely engage in insider trading regarding bitcoin and eth, with some evidence provided in 2018 when bitcoin’s price fell before SEC’s decision to deny a bitcoin ETF was published.

That was the first time SEC made such decision, making it a significant market moving event with SEC having prior information.

Besides the two mentioned agencies where employees engage in stock trading before enforcement actions, there aren’t that many federal agencies that through their decisions can move markets.

SEC however is certainly one of them with it unclear whether WSJ will now make public these invaluable reports so that they can be analyzed more widely, not least because they should be publicly accessible in a digital form in any event considering the significant position of trust and to increase transparency while minimizing abuse.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- featured

- machine learning

- Markets

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- politics

- Polygon

- proof of stake

- Trustnodes

- W3

- zephyrnet